Wondering how to create a budget that lasts? This guide teaches you how to budget and save with MyBudget. It covers the best ways to manage money, cut expenses, reach savings goals, and succeed financially with expert tips and helpful money tools.

Budget and save for financial success

Budgeting puts you in control of your money and sets a clear road map for financial success. By tracking your income and expenses, you can decide how your money will work best for you. You can spot and cut unnecessary spending. You can also stay on track with your savings goals. A tailored budget plan is the best way to budget, save, reduce money stress, and achieve your financial goals all while building financial confidence. If you want to get out of debt, save for a house deposit, or handle the rising cost of living, learning to budget better can improve your long-term financial health.

Did you know?

38% of the wealthiest people say that budgeting helped them build their net wealth.

Finder, Building Wealth Report, 2024.

Quick steps to set up a budget, save, and manage money

- Set clear money goals to plan your spending and guide where your income should go, use our free Goal Setting Template to map them out and stay on track

- Track expenses and due dates so bills are always covered, and use our free Personal Budget Template to get started

- Review needs vs wants identify areas to cut back and adjust your money mindset, freeing up more funds for priorities, savings goals, and long-term financial success

- Start an emergency fund to prepare for unexpected expenses, and use our free Savings Calculator to see how quickly you can reach your target

- Seek help if you’re struggling. MyBudget can help you budget better, reduce money stress, and create a plan you can stick to. Book a free session with one of our Personal Budgeting Specialists.

MyBudget free money tools to help you budget better

We have a number of free money tools and resources to help you budget your way to financial success:

- Personal Budget Template: unlike traditional tools that track your past spending, MyBudget takes a future-focused approach, showing you where your money can take you over the next 12-months and beyond

- Savings Calculator: Plan how to budget and save for your goals faster by seeing exactly how much you need to set aside and how long it will take

- Mortgage Stress Calculator: Understand how much of your income is going to your mortgage and adjust your budget to reduce financial stress

- Essential Baby Checklist: Plan and budget for all the costs of welcoming a new baby so you can manage expenses without sacrificing your savings goals

- 10 steps to get out of debt eBook: Learn practical budgeting and debt relief strategies to manage money better, reduce debts, and work toward financial freedom.

How do you create a budget?

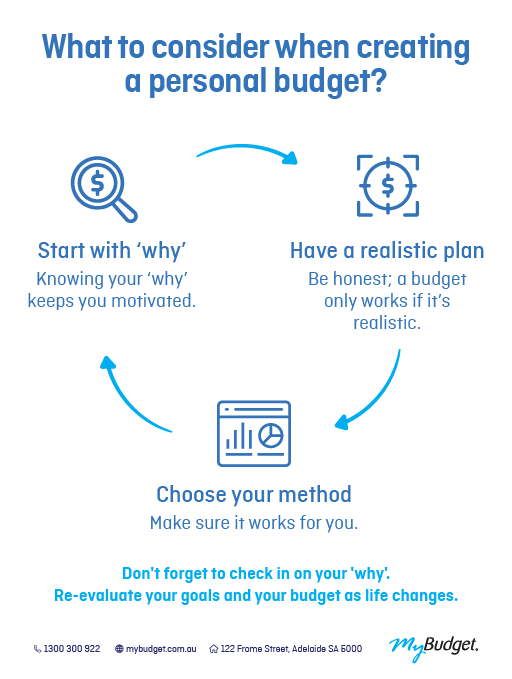

The first step to making a successful budget is to start by identifying your goals. As Tammy Barton says, “knowing your ‘why’ keeps you motivated.” Are you budgeting to save money fast, get help with debt, or prepare for a big life change like starting a family?

Set financial goals

- List your top 3-5 your financial goals, immediate, short-term and long-term

- Assess your financial situation, list your income, expenses and debt

- Set spending limits – and track spending against your weekly budget

- Cut overspending – small changes lead to big savings

- Prioritise debt repayments and savings – allocate money to priorities so you stay on track toward your goals

- Track and review your progress regularly.

Want to know more about setting and achieving money goals? Achieve your financial goals in 5 easy steps.

Record your income and expenses

Your budget should reflect your actual income and expenses. Use our free Personal Budget Template, pen and paper, or an excel budget planner spreadsheet. Start with a simple money check to control your cash flow: what’s coming in and what’s going out? Break it into these categories:

- Living expenses

- Required bills

- Debt repayments

- Discretionary spending.

If your expenses are piling up, or you’re dealing with high credit card debt, the MyBudget Debt Solutions Team can help you. They offer tailored debt relief solutions.

Did you know?

1 in 3 Australians don’t have a clear monthly budget.

WeMoney, Financial Wellness Report, 2024

Building an emergency fund

An emergency fund is money you intentionally set aside for unexpected expenses. These can include medical bills, urgent travel, or car repairs. This important financial buffer lets you manage costs without using credit cards, loans, or pay early apps. It helps you stick to your budget, protect your savings, and reach your financial goals.

How much do you need in an emergency fund

Aim to save enough to cover at least three months of essential expenses in your emergency fund. Even small, regular deposits over time can quickly build your emergency fund.

Quick tips to start an emergency fund:

- Open a separate high-interest savings account for your emergency fund

- Automate transfers from your main account each payday

- Grow your emergency fund with extra deposits like tax refunds or side hustle income.

Use our free Savings Calculator to set your savings goal and track your progress.

What’s the best way to pay off debt?

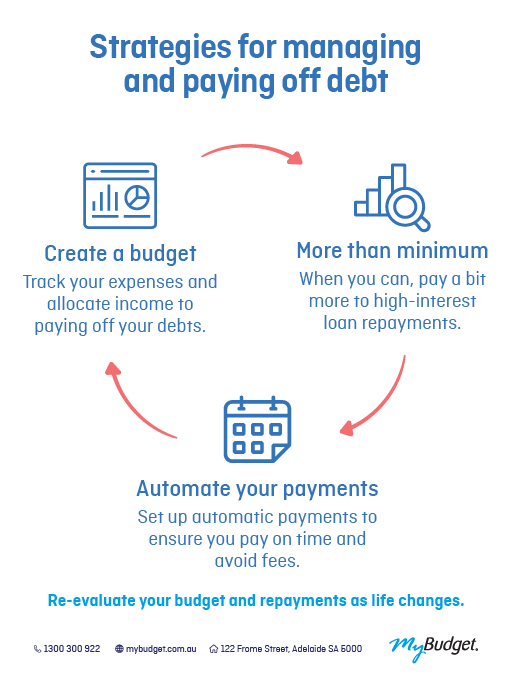

When paying off debt, the first step is to know exactly how much of your income can go toward extra repayments. A clear, realistic budget shows this straight away, as well as the savings you’ll make by paying debts off faster. With this plan in place, many people quickly see they can reduce credit card debt, clear loans, and move toward their financial goals sooner.

Quick tips to pay down debt fast:

- Budget for more than minimum repayments

- Use the avalanche or snowball method

- Automate payments

Need debt help? MyBudget can support you with consolidating debt, speaking with creditors, improving your credit score, and building savings while eliminating debt

Download our free 10 Steps to get out of debt eBook to start your debt-free journey today.

Did you know?

MyBudget have saved clients over $2 million in debt arrangements in 2024.

Debt Arrangement Team, MyBudget

Other budgeting FAQs

Budgeting mistakes to avoid

To make a budget work long-term, and avoid budgeting pitfalls that can derail your savings plan, look out for these common budgeting mistakes:

- Being too strict and unrealistic with your spending

- Forgetting irregular expenses like insurance premiums or health expenses

- Not tracking spending and overspending

- Not having an emergency fund

- Not regularly reviewing your budget.

Budgeting behaviours that lead to success

The latest research from Finder says: 84% of the most financially secure Australians have one thing in common: frugal habits. For example:

- 59% buy food on special

- 44% avoid dining out

- 34% compare and switch utility providers.

These small habits can make a big difference, especially when paired with a future-focused budget that’s tailored to your goals.

How do you stick to a budget?

To stick to a budget, it needs to feel realistic and flexible. A sustainable budget fits your lifestyle, reflects your real spending habits, and includes occasional costs.

How to budget with irregular income?

If your income fluctuates, base your budget on your lowest average monthly income. Separate fixed expenses from flexible ones and focus on building a buffer.

How often should you review your budget?

Review your budget monthly to adjust for changes in bills, income, or priorities, and schedule longer-term check-ins every 6 or 12 months, or after major life changes such as a separation or job loss.

If you need help getting started, download MyBudget’s free Personal Budget Template.

“Budgeting isn’t something you do, it’s something you live.”

Tammy Barton, MyBudget Founder & Director

Are you ready to set up a budget that reduces money stress?

If you want help to set up a budget you can stick to, reduce credit card debt, or find relief from money stress, MyBudget can guide you every step of the way.

We’ll help you:

- Create a tailored money-saving plan that fits your lifestyle and goals

- Use budgeting tools to manage money, save, and stay on track

- Consolidate debt, repay it faster, and work toward financial freedom.

Don’t wait. Phone us today on 1300 300 922 or enquire online. You will receive a completely free, no-obligation personal budget plan that is tailored to your unique financial situation.

Could a budget save your marriage? MyBudget clients, Michelle and Phil share their story.