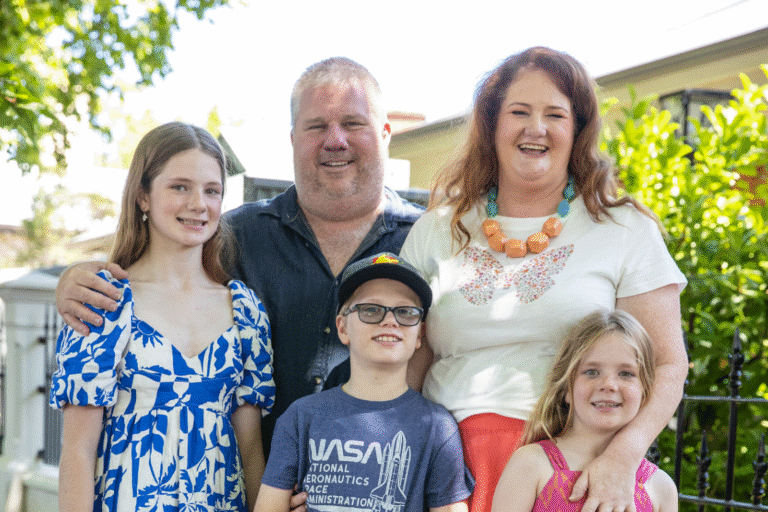

We’ve been using MyBudget for over 4 years now and this is our 3rd time back. The customer service team are polite and professional. We never feel alone and always supported. We are debt free and saving for a house deposit. If you feel the mountain is too high to climb alone, contact MyBudget. You won’t be disappointed!

Dani | MyBudget client