Money management is all about putting your money to work, budgeting wisely, managing debt, saving for life goals, and setting up future you for a stress-free retirement.

What is money management?

Money management is all about being the boss of your own cash flow. It’s making sure your hard-earned dollars work for you; not the other way around. It’s about budgeting, managing debt, building savings, and setting yourself up for big life goals like buying a home or planning for retirement. Whether you’re thinking short-term (like an emergency fund) or long-term (hello, retirement), a good grip on money management keeps you on track.

10 money management strategies you’ll actually use

- Budget like a pro: your budget is your financial GPS. Focus your income on essentials like housing, groceries, and savings. And remember, the key to budgeting is consistency! Check out our Personal Budget Template to organise your finances like a pro.

- Build an emergency fund: save 3 to 6 months of living expenses as a safety net for life’s surprises. Automate your savings to grow this fund with minimal effort.

- Pay yourself first: stash 10% of your income into a savings plan before anything else. It’s a simple way to build long-term wealth and get closer to financial freedom.

- Manage debt smartly: the Avalanche Debt Method (paying off high-interest debts first) is a great way to reduce interest payments. If debt is overwhelming, our team of debt solutions experts can help with negotiating with creditors, or exploring debt consolidation options.

- Practise mindful spending: before splurging, ask yourself if a purchase aligns with your financial goals. Prioritise needs over wants to keep your spending purposeful.

- Start investing: get educated on investment options, from shares to property, and diversify your portfolio. A financial advisor can help tailor a strategy that suits you.

- Plan for retirement: superannuation contributions are essential for a secure retirement. If your employer offers matching, take it; it’s free money! Consider additional contributions to boost your retirement savings.

- Insure your future: protect your health, home, car, and life with adequate insurance. It’s about safeguarding your finances from unexpected events.

- Boost financial knowledge: financial literacy is key to long-term success. Books, online courses, and seminars will sharpen your money skills.

- Review your budget regularly: life changes, and so should your budget. Regular check-ins help ensure your finances align with your goals.

What is personal budgeting?

Personal budgeting is managing your money to meet your goals and cover your expenses. Think of it as your financial roadmap! By tracking your income, expenses, and savings with a budget planner, you can make sure your spending lines up with your priorities; and keeps your bank account in check.

Budgeting gives you a clear picture of your financial situation, helping you make smarter choices and work towards long-term goals. It’s not just about digging out of debt (though that’s a big win). A solid budget lets you manage regular payments, plan for irregular or once-off expenses, and still grow your savings.

Budgeting means practising mindful spending, regularly checking in, and tweaking as needed. With this approach, you stay firmly in control of your finances, ready for whatever life throws your way.

MyBudget’s personal budgeting services and tools

There’s no shortage of budgeting apps out there, but tracking expenses is just one part of the puzzle. MyBudget offers a complete money management service, helping you create a personalised budget plan, pay bills on time, and build savings.

If debt is weighing you down, our money coaches are here to help. We can work with creditors to negotiate better terms or explore MyBudget Loans for debt consolidation. We’re with you every step of the way, ensuring you feel supported as you take control of your financial wellbeing.

Creating an effective savings plan

Saving doesn’t have to be a drag; get creative with how you manage your money! Whether it’s tweaking your income, cutting down on expenses, or setting clear goals to secure your financial future, building solid savings habits is key. Trust us, saving with a purpose feels way more rewarding than just stashing cash for the sake of it.

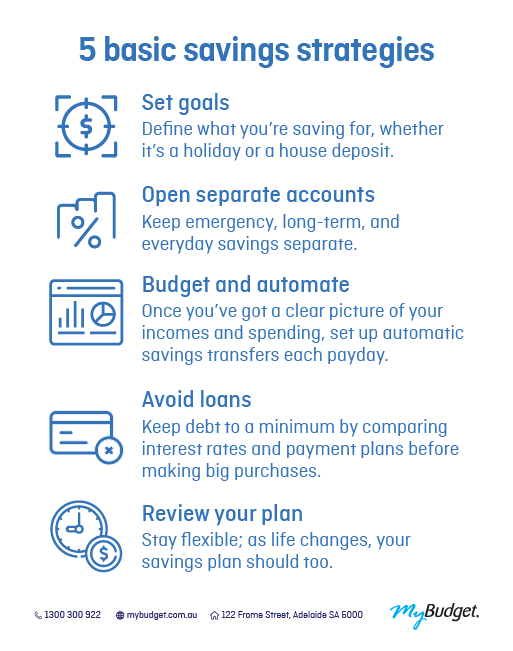

5 basic savings strategies

- Set goals: define what you’re saving for, whether it’s a holiday or a house deposit.

- Open separate accounts: keep emergency, long-term, and everyday savings separate.

- Automate savings: transfer funds to savings automatically each payday.

- Avoid loans: compare interest rates and payment plans before making big purchases.

- Review your plan: life changes, and so should your savings plan. Adjust as needed to stay on track.

Want to know exactly how long it’ll take to reach your savings goal? Use MyBudget’s Savings Calculator

What is debt management?

Debt management is about getting a handle on debt and moving towards a debt-free future. This includes prioritising payments, negotiating with creditors, and considering debt consolidation.

3 debt management strategies

- Debt Snowball Method: tackle the smallest debt first for quick wins.

- Debt Avalanche Method: focus on debts with the highest interest rates to save money long-term.

- Feel Good Method: pay off the debt that causes the most anxiety.

Debt help: seeking professional assistance

If debt feels like a treadmill, professional assistance can provide relief. Debt help services include credit counselling, debt negotiation, and management plans. At MyBudget, our expert money coaches can craft a debt relief plan to suit your situation, whether it’s debt consolidation or budgeting advice.

Debt relief options

- Budgeting: document income and expenses to prioritise debt repayment

- Debt consolidation: roll multiple debts into one loan at a lower rate

- Debt negotiation: work with creditors to secure manageable payments

- Bankruptcy: considered a last resort, bankruptcy offers a fresh start but impacts credit.

What is debt consolidation?

Debt consolidation is a way to round up all of your debts and turn them into one new loan. The idea is to slash those repayments by bundling everything together at a lower interest rate and have just one regular repayment and one single interest rate to manage, instead of a whole circus of bills.

Find out is debt consolidation right for you?

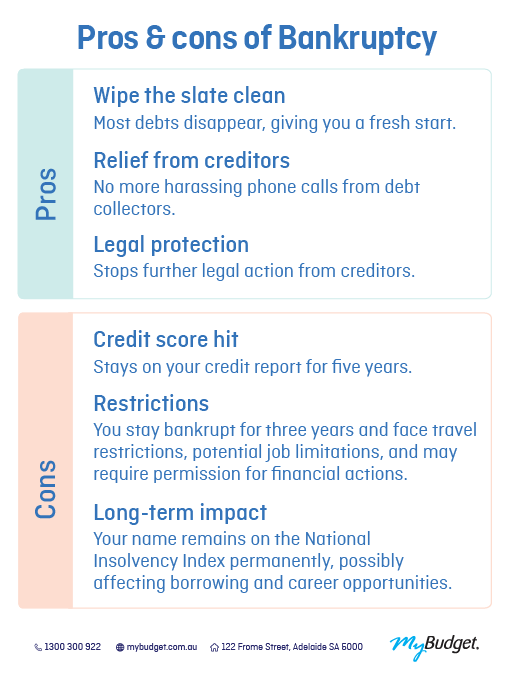

What is bankruptcy?

Bankruptcy can seem daunting, but sometimes it’s the reset you need. This legal process helps those who can’t repay debts get a fresh start, though it does come with long-term impacts.

Bankruptcy can affect your credit score and financial future. Always seek professional advice before making big decisions; or give MyBudget a call, and we’ll guide you through your options.

Pros of Bankruptcy:

- Fresh start: most debts are wiped clean

- Relief from creditors: no more debt collector calls

- Legal protection: stops further action from creditors.

Cons of Bankruptcy:

- Credit hit: appears on your credit report for five years

- Restrictions: includes three years of bankruptcy with travel and job limitations

- Long-term impact: listed on the National Insolvency Index, which may affect borrowing and career options.

Superannuation and retirement planning

Retirement planning isn’t just for “future you.” Superannuation contributions from your employer and your own voluntary contributions help build a post-retirement income. Planning involves setting clear goals, estimating how much you’ll need, and making the most of tax benefits to secure a comfy retirement.

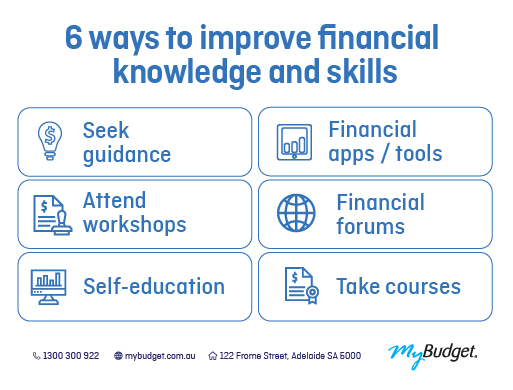

Financial literacy and education

Understanding money basics can change your life. Financial literacy helps you make informed decisions, build wealth, and secure your future.

6 ways to boost financial knowledge

- seek guidance from financial professionals

- attend workshops & seminars

- self-education

- use financial apps & tools

- join financial forums & communities

- take courses.

Ready to take control? Explore MyBudget’s financial tools and resources today!

How can MyBudget help with money management?

If you’re looking to take control of your finances, MyBudget is here to help. We offer personalised budgeting and money management services that help you manage debt, build savings, and achieve your financial goals. With over 25 years of experience, we’ve guided more than 130,000 Australians to a life free from money worries.

Ready to take the next step? Call us on 1300 300 922 or enquire online today. Let’s work together to get you on the road to financial freedom!

Start with a FREE no obligation appointment