Personal budgeting empowers you to manage income, expenses, and savings effectively, helping you reach your financial goals and build stability for the future.

What is personal budgeting?

Personal budgeting is all about knowing where your money goes and making conscious choices to save and spend based on your financial goals. It’s the backbone of effective money management, giving you financial stability and helping you make confident financial decisions. With a solid personal budget, you’ll feel empowered to take the next steps toward reaching your goals.

How does a personal budget work?

A personal budget works by tracking your income and expenses, allowing you to make informed decisions about how to allocate your money. By understanding what’s coming in and going out, you can set realistic limits, prioritise spending, and plan for both expected and unexpected expenses. A well-maintained budget helps reduce financial stress and keeps you in control of your money.

Why is personal budgeting important for financial stability?

Personal budgeting gives you a complete view of your finances, empowering you to make smart choices, fast-track long-term goals, and reduce the stress that can come with financial uncertainty.

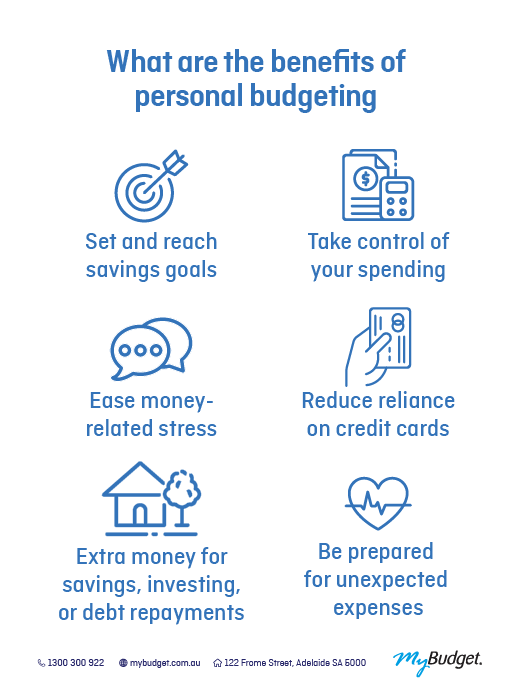

What are the benefits of personal budgeting?

Personal budgeting brings a host of benefits that extend beyond your bank balance. Here’s a snapshot of what budgeting can help you achieve:

- set and reach savings goals

- take control of your spending

- free up extra money for savings, debt repayment, or investing

- reduce reliance on credit cards and loans

- be prepared for unexpected expenses like medical bills or loss of income

- ease money-related stress in relationships.

What does a realistic personal budget include?

A realistic personal budget covers essential and discretionary expenses, and it’s best to plan it out over an entire year. Here’s what to consider:

- Essential expenses: these are must-pay costs like rent or mortgage, utilities, groceries, insurance (health, life, home, car), and loan repayments.

- Discretionary expenses: these are more flexible costs that can adjust based on lifestyle, like dining out, gym memberships, and hobbies.

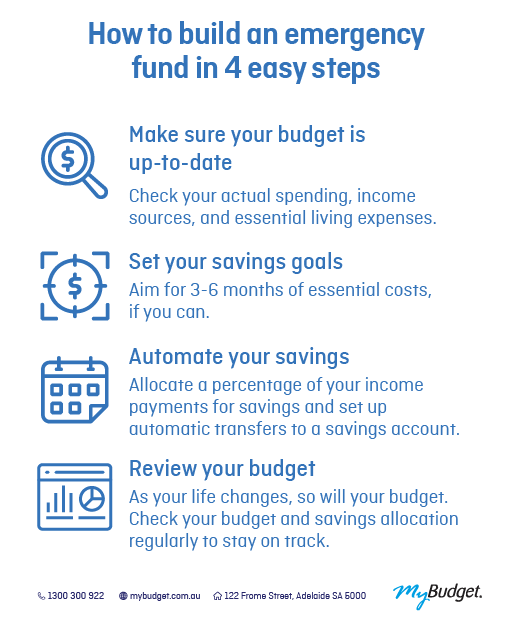

Do I need an emergency fund?

Every personal budget should include an emergency fund. We recommend starting with $1,000 to $1,200, with a goal of contributing at least $100 per month. Once established, focus on building enough to cover three months of essential expenses, protecting you from unexpected events like job loss or health setbacks.

Does budgeting help you save money?

Budgeting is one of the best ways to save money because it gives you a clear plan for managing income and expenses. By prioritising savings, you can work toward goals like an emergency fund, retirement savings, or paying off credit card debt. A well-structured budget allows you to set realistic goals, track every dollar, and consistently put money aside each month.

By covering essential expenses like rent, bills, and groceries first, you can then allocate remaining funds toward savings goals or even big purchases. Using a budgeting tool or spreadsheet keeps you organised and on track, so every dollar goes toward a meaningful goal; whether building savings, paying off debt, or planning for a major purchase like a home or holiday.

Why are financial goals important when creating a budget?

Setting clear financial goals gives your budget purpose and keeps you motivated. With specific goals; whether building an emergency fund, paying off debt, or saving for a holiday; you can measure progress and stay focused without feeling overwhelmed.

Download our free Personal Budget Template

How can MyBudget help with budget planning?

At MyBudget, we’ve helped over 130,000 Australians gain control of their personal finances through expert financial planning and budget management. We’re here to help you pay your bills on time, reduce debt, and grow your savings, so you can achieve your financial goals with confidence.

The best part? It all starts with a free, tailored budget plan that shows you exactly where your money is going and how to make it work harder for you. If you’re ready to take the next step toward financial freedom, MyBudget can guide you through creating a personal budget and provide ongoing support to keep you on track.

To get started, enquire online or call 1300 300 922 today.

Start with a FREE no obligation appointment