How to buy a home in 2024: debunking myths and tips for success

So, you’re looking to enter the Australian property market in 2024? Bold move! But let’s be honest; things have changed drastically over the last 50 years. Sure, buying a home was always tough, but today’s prospective buyers are facing an entirely different game. If your parents or grandparents are reminiscing about battling high interest rates; bless them, but it’s time to acknowledge their struggles and focus on today’s reality. Homebuyers now are navigating a whole new level of difficulty. Whether you’re a first-home buyer, a couple, going solo, or a late entrant into the housing market, this guide will help you on your journey to securing the Australian dream of homeownership.

Debunking the baby boomer myth: high-interest rates vs. today’s challenges

Ah, the classic baby boomer line: “Back in my day, we dealt with 17% interest rates!” It’s often said with pride and a subtle hint that maybe, just maybe, you’re not trying hard enough. But let’s take a quick trip down memory lane. In the 1980s, your parents might’ve bought a house for what you’d now consider the price of a used car. The Australian property market was tough then, but today’s market is on a whole different level. Fast forward to 2024, and it feels like you need a small fortune just to afford a deposit in any capital city. The relentless rise in house prices has made saving for a home significantly harder than it was for previous generations.

from money worries

Start today with a FREE no obligation appointment

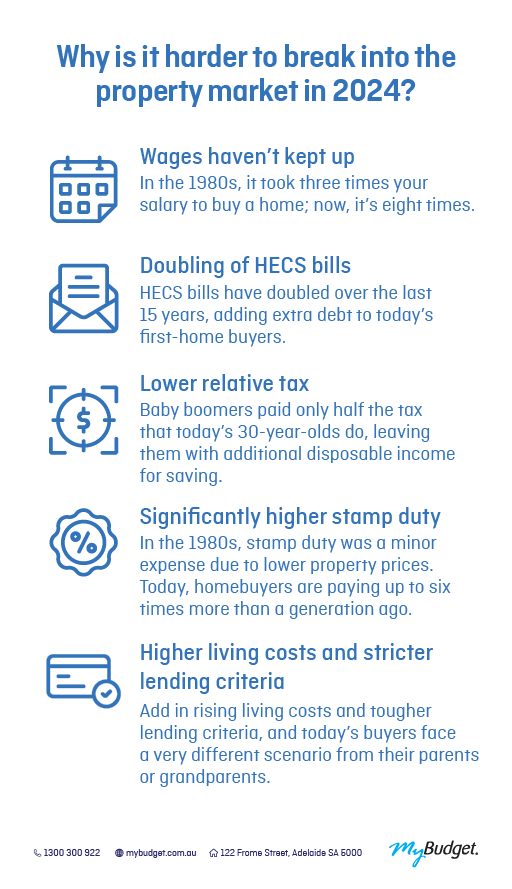

Why is it harder to break into the property market in 2024?

In 2024, the dream of homeownership feels more elusive than ever, and it’s not just rising property prices to blame. A tangled web of financial challenges has made it significantly tougher for today’s prospective buyers compared to previous generations. Let’s break down why getting into the property market can feel like an impossible feat.

Wages haven’t kept up: Back in the 1980s, it took three times your salary to buy a home; now, it’s eight times, according to the ABC’s Gruen. Today’s 30-year-olds are facing the toughest economic conditions in Australia’s history when it comes to homeownership.

Doubling of HECS bills: HECS bills have doubled over the last 15 years, adding extra debt to today’s first-home buyers. A burden that didn’t exist in the same way for earlier generations.

Lower relative tax for baby boomers: While they faced high-interest rates, baby boomers paid only half the tax that today’s 30-year-olds do. This lighter tax burden left them with more disposable income for saving and buying a home.

Significantly higher stamp duty: In the 1980s, stamp duty was a minor expense due to lower property prices. New data from realestate.com.au shows homebuyers are paying up to six times more than a generation ago. As property values soar, so does stamp duty, adding a hefty upfront cost that makes saving for a home even tougher.

Higher living costs and stricter lending criteria: In 2024, comparing the national average house price to median income is like comparing apples to gold-plated apples. Add in rising living costs and tougher lending criteria, and today’s buyers face a very different scenario from their parents or grandparents.

Should I Buy a House Now or Wait Until 2025?

The big question: buy now or wait for mortgage rates to drop? With property prices climbing, it’s easy to feel the pressure. But before making a move, consider these factors:

Buy when you’re ready and you can afford it

The best time to buy is when your finances are in good shape. Don’t stress about market predictions; property markets are cyclical, as Dr. Nicola Powell from Domain points out. If you’ve found a home you love and you’re financially ready, that’s your green light.

The pros and cons

You could wait for interest rate cuts, but that might also mean higher median house prices and more potential buyers to compete with. On the flip side, buying now locks in today’s housing prices and gets you into the market sooner, but with higher monthly payments to start with.

Bottom line

The best time to buy is when you’re financially ready and have found a place that ticks all your boxes. Waiting for lower interest rates, perfect house values or just procrastinating on making a financial decision could leave you waiting too long and missing a great opportunity.

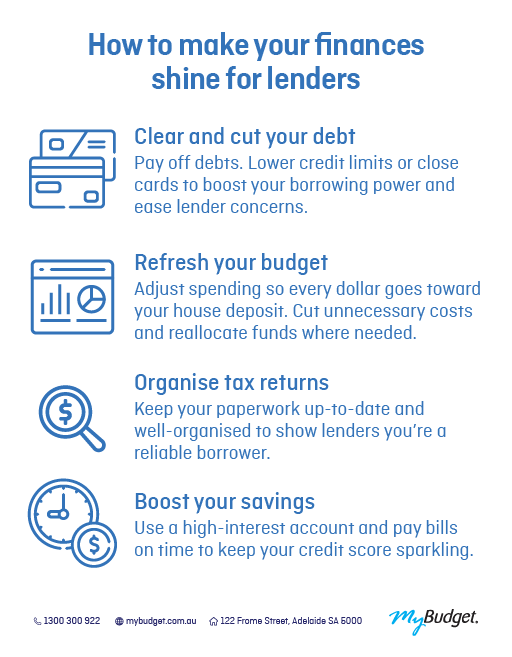

How to make your finances shine for lenders

Before diving into the real estate market, let’s get your finances in tip-top shape so you’re looking your best to all the financial institutions:

- Clear and cut your debt: Pay off debts. Lower credit limits or close cards to boost your borrowing power and ease lender concerns.

- Refresh your budget: Adjust spending so every dollar goes toward your house deposit. Cut unnecessary costs and reallocate funds where needed.

- Organise tax returns: Keep your paperwork up-to-date and well-organised to show lenders you’re a reliable borrower.

- Boost your savings: Use a high-interest account and pay bills on time to keep your credit score sparkling.

With these steps, you’ll be on your way to impressing the bank and securing your dream home. When you’re ready to explore financing options, MyBudget Loans can help. Our team can guide you through government schemes, find the right loan, and assist with your application. We’re here to provide expert advice on the best mortgage options, supporting you every step of the way.

Expert tips for every property buyer

For first homebuyers: It’s tough out there, but don’t lose hope. Government incentives are your best friend, so make sure you’re tapping into every available grant and scheme. If capital city areas are too steep, consider regional areas or start with a smaller, more affordable unit as your first step onto the property ladder.

For single parents: You’re already a superhero, so adding “homeowner” to your title is just another win. The government’s Family Home Guarantee can help you buy with just a 2% deposit. Explore this and other grants for single-income borrowers. Co-ownership or looking in outer suburbs or regional areas might offer more affordable prices.

For couples: Two incomes can work wonders. Combining savings can make all the difference, especially in pricey inner-city areas. Communicate openly about financial goals and consider living on one income while saving the other. This approach can help you manage potential rate hikes.

For retirees: It’s never too late to buy. Consider using your superannuation or other financing options to fund your property purchase. Explore government grants for older Australians and focus on affordable suburbs. Co-owning with an investor or family member can also ease the financial burden and help you enter the market with confidence.

Homeownership starts with a realistic budget

Before you start touring open houses, let’s tackle the most crucial part of your property purchase: your budget! (Maybe not the most exciting, but definitely essential.) A solid budget is the foundation of all your financial goals. Start by downloading MyBudget’s free personal budget template and follow our expert tips:

- Assess and cut back: Know what’s coming in and going out

- Set a savings goal for your house deposit: Break down your deposit goal into monthly targets

- Automate your savings: Set up a direct debit to a high-interest account each month

- Track and adjust your budget regularly: Check in on your budget regularly and adjust as needed.

And don’t forget, MyBudget is here to help every step of the way. We’ll work with you to create a tailored budget that aligns with your homeownership goals. Our experts can help you manage your finances, reduce debt, and build savings, so you’re ready to make your property dream a reality!

from money worries

Start today with a FREE no obligation appointment

What’s next for the property market?

So, what’s the crystal ball saying for the foreseeable future? In this current market, brace yourself for continued strong demand for housing in both capital city and regional markets. With strong population growth, limited housing supply, and upward pressure from increased demand, property prices are likely to stay elevated. While the market might cool slightly, don’t hold your breath for a major drop in prices. Stay savvy, be flexible with your expectations, and keep an eye on trends like rental demand and shifts in housing supply that could tip the scales in your favour.

Final thoughts: Don’t give up on your property dream

Yes, the market is tough, and yes, it’s more expensive than it used to be. But homeownership isn’t out of reach. With the right strategy, patience, and persistence, you can make it happen. Explore every option, use the resources available, and don’t hesitate to seek professional advice. Remember, owning a home is a marathon, not a sprint; with a solid plan, you’ll be well on your way to securing the Australian dream of owning your own home.

Ready to take the next step?

Now that you’re armed with valuable economic insights and feeling inspired, it’s time to turn those homeownership goals into action. Whether you need help setting up a budget, reducing debt, or saving for that crucial house deposit, MyBudget is here to support you every step of the way. Enquire online or give us a call on 1300 300 922, our team of money experts is ready to create a personalised plan tailored to your financial needs. Don’t wait; take the first step today and let us guide you toward financial success and securing your dream home.

Try out our savings calculator to see how much you can save:

Cheryl is part of the MyBudget Corporate Finance team and manages the company’s finances with the same dedication that MyBudget extends to helping clients achieve their financial dreams. As part of her side hustle, Cheryl writes for MyBudget, speaking from the heart about relevant financial topics, drawing from her own personal journey through separation, single parenting, budgeting, and surviving cancer.