Getting a home loan with bad credit: non-conforming loans in Australia

If you have bad credit and are struggling to secure a home loan in Australia, non-conforming loans may be the solution for you. While traditional lenders may reject your application due to a bad credit history, non-conforming loans offer an option for individuals looking to buy a home.

With the current housing market conditions in Australia, obtaining a home loan has become challenging. Non-conforming loans cater to borrowers with bad credit scores who may not qualify for conventional mortgages. These loans usually come with higher interest rates and strict credit requirements, but they can provide a path to homeownership.

If you find yourself in a situation where traditional lenders have turned you away due to your bad credit, consider exploring non-conforming loans as a viable option. This type of loan can help you overcome the hurdles of bad credit and increase your chances of being approved for a home loan in Australia.

Can you get a home loan with bad credit?

Non-conforming loans are available in Australia for individuals in this situation. These loans are offered by non-bank lenders who understand that life circumstances can sometimes lead to financial challenges like missed payments or unpaid defaults. They will work with you personally to understand your situation and explore potential solutions.

Just because you’ve faced credit issues in the past doesn’t mean you can’t secure a home loan. Non-conforming lenders provide an alternative to traditional banks and may be able to offer you a loan even with a less-than-perfect credit history. Don’t give up on your dream of homeownership!

What is a non-conforming loan?

Understanding what a non-conforming loan is, is essential for those with bad credit looking to secure a home loan in Australia. Non-conforming home loans are specifically designed for individuals or couples who have a poor credit score and may not meet the standard lending rules set by major banks for loan applications. These loans offer an alternative option for those who don’t qualify for traditional loans due to their credit history.

To qualify for a non-conforming loan, honesty about your financial situation and credit record is crucial. Lenders and credit unions will assess your ability to repay the loan, so it’s important not to hide any outstanding debts or issues that may impact your creditworthiness. Despite the challenges of securing bad credit loans, exploring non-conforming loan options can offer a path to homeownership for those facing credit challenges.

What are the benefits of getting a non-conforming loan with bad credit?

If you have bad credit and are looking to get a home loan, opting for a non-conforming loan can offer several benefits. These include better chances of approval, as non-conforming lenders are often more lenient during the application process.

Additionally, non-conforming loans typically come with more flexible loan terms, allowing borrowers with bad credit to find a loan that suits their financial situation. Furthermore, non-conforming loans may require lower deposits, making it easier for potential borrowers with bad credit to secure financing.

What are the potential drawbacks of getting a non-conforming loan with bad credit?

When considering a non-conforming loan with bad credit, it’s important to be aware of the potential drawbacks involved. These loans typically come with higher interest rates than regular loans, as lenders see them as riskier investments.

This means that you may end up paying more in interest over the long term, which can put additional stress on your budget. It’s crucial to carefully weigh the costs and benefits before deciding if a non-conforming loan is the right choice for your financial situation.

How can you improve your chances of getting approved for a non-conforming loan with bad credit?

Improving your chances of getting approved for a non-conforming home loan with bad credit is crucial if you’re looking to purchase a house. While it may be more challenging than getting a traditional mortgage with a perfect credit history, there are steps you can take to increase your likelihood of approval.

Potential borrowers with lower credit scores and higher debt-to-income ratios may face more obstacles, but they can still improve their chances. Before applying for a non-conforming loan, consider the following tips to enhance your approval odds:

Get your credit report under control

If you’re looking to improve your chances of getting approved for a non-conforming loan with bad credit, the first step is to take control of your credit report. Obtain a copy of your credit report from Equifax to understand what may be impacting your credit score.

Consider making a plan to address any overdue debts, as they can stay on your file for up to five years. Paying off balances, whether it’s credit cards or personal loans, can show potential lenders that you’re taking steps to improve your credit. Lenders will want to see that you’re making progress in addressing any credit issues.

If there are inaccuracies on your credit file, request to have them corrected promptly. Errors can negatively impact your chances of getting approved for a loan, so it’s important to address them with the credit reporting agency and the credit provider involved. Taking proactive steps to improve your credit history can strengthen your application for a non-conforming loan despite having bad credit.

Shop around

Each lender has different criteria and views on individual situations, so if one lender rejects your application, don’t lose hope; another lender may see things differently.

By working with specialist lenders like MyBudget Loans, you can access a wide range of lending solutions tailored to your circumstances. The team of lending specialists at MyBudget Loans will match you with the right lender and lending option for your needs, whether you’re looking to buy a new home or invest in property.

However, one important factor to keep in mind is to be cautious about applying for multiple credit sources within a short period of time, as this can negatively impact your credit score. It’s best to focus on one type of credit at a time to avoid potential setbacks. Having our team at MyBudget Loans can help you navigate the loan application process wisely.

Make sure you are in a situation to afford the repayments

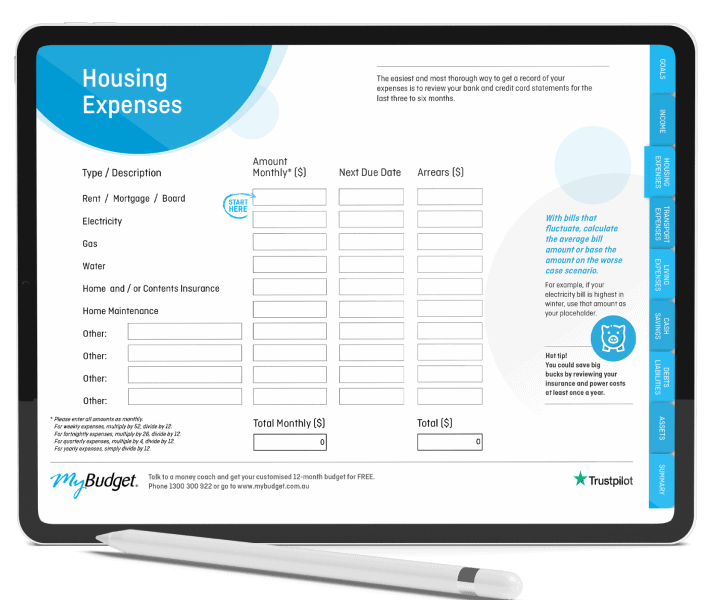

Before applying for a non-conforming loan with bad credit, ensure that you are in a financial position to comfortably manage the loan repayments. Non-bank lenders, just like mainstream banks, will want to see that you can afford the monthly repayments without putting yourself at risk of default. Take a close look at your budget to make sure you can afford the proposed repayments and have some flexibility to make extra repayments if needed.

While some lenders may advertise the lowest interest rates, it’s important to also compare competitive rates offered by different non-conforming lenders before submitting multiple applications. Ultimately, the goal is to find a lender that not only offers affordable repayments but also provides room for additional repayments in case you want to pay off the loan sooner.

Look at alternatives to Lender’s Mortgage Insurance (LMI)

If you’re struggling to secure a non-conforming loan with bad credit, one option to consider is looking at alternatives to traditional Lender’s Mortgage Insurance (LMI). When you have a low deposit, you may be required to pay for LMI to cover the lender in case you miss payments. However, some lenders offer a Lender Protection Fee (LPF) instead of using third-party mortgage insurers. This allows them to evaluate your loan application without needing approval from LMI providers, giving you more flexibility and potentially increasing your chances of approval.

If you have a bad credit history or uncertain income, traditional LMI providers may reject your application even if the main lender has approved it. By exploring alternatives like LPF, you may find a lender who is willing to work with you despite the challenges. It is also good to factor in and understand the Mortgage Risk Fee. If you’re interested in learning more about bad credit home loans or mortgages, don’t hesitate to reach out for guidance on connecting with lenders who specialise in helping individuals or couples in similar situations.

If you’d like more information on bad credit home loans/bad credit mortgages, talk to us today about how we may be able to help you make contact with lenders that can help if the major lenders have said ‘no’ to your loan application process. In addition, MyBudget has helped over 130,000 Australians live their life free from money worries. By setting up a budget, the automated system will work to improve your poor credit rating and credit situation by paying down debt and paying your bills on time.

Who is a non-conforming loan for?

Non-conforming may not be a common term, but you might be surprised by how many Australians have been denied a standard home loan because they fall into this category. A non-conforming loan may be for people who:

- Are self-employed

- Have recently started a business or a new job

- Have bad credit history

- Have been previously bankrupt

- Have an outstanding ATO tax debt

- Have a history of financial defaults

- Have a reliably solid income, but not much of a deposit

- Have irregular income

- Have a deposit but it’s an inheritance or a gift

- Have a Part IX Debt Agreement

- May regularly change jobs due to the nature of their industry

- Need to consolidate debts (such as personal loans, credit card debts or business debt)

- Are a new Australian resident

That’s a lot of Australians!

The good news is that in today’s world, there are plenty of options. MyBudget clients have exclusive access to our caring and innovative lending team who make finding the right lending solution easy. Click here to learn more and book in your free 15 minute appointment.

They take a much more flexible and holistic approach to traditional lenders and can provide a range of accessible alternatives.

What is bad credit?

Bad credit is when you’ve ended up with a history of not keeping up with some payments and the result is that you’re not easily able to get approval for any new loans.

The reason many lenders may steer away from you is because they see you as a high level of risk. The bottom line is that they’re concerned about your ability to make regular repayments on their loan if you’ve missed regular payments on other loans in the past.

What causes a bad credit rating?

There are a fair few things that can leave you with a bad credit history. For example:

- Having unpaid bills or loan payments

- Going over your credit card limit

- Having been declared bankrupt in the past

- A divorce leaving you in debt

- Registered credit defaults against your name

- A part 9 or 10 Debt Agreement

- Having time off work with no pay because you were ill

- Your credit file has ‘too many’ credit enquiries from previous applications.

How do I know if I have a bad credit rating?

If you’re wondering whether you have a bad credit rating, chances are you won’t know until you apply for a loan and get rejected. It’s at that point when you realise that you’ve been deemed ‘non-conforming’ due to your poor credit history by the lender you applied with, as you don’t meet their traditional lending criteria.

Whether the credit issues were significant or minor, intentional or unintentional, missing payments may have classified you as a high-risk non-confirming borrower in the eyes of the lender.

How to get a home loan with bad credit

Non-conforming lenders typically offer specialised loan features that go beyond the standard variable home loan. They take a more personalised approach, assessing your individual circumstances before making a decision.

At MyBudget Loans, we specialise in non-conforming home loans and can assist you in finding the right lending solution for your situation. If major lenders have rejected your home loan application, we can connect you with a lender who may be able to help.

Non-conforming loans are becoming more prevalent in today’s real estate market, offering opportunities for affordable home ownership, refinancing for existing homeowners, and debt consolidation for those with arrears.

How can MyBudget help with getting a home loan with bad credit?

MyBudget has helped over 130,000 Australians live their lives free from money worries, and not only that, we’ve helped many Australians get into their new homes when no major bank would consider them. We do this by creating a complete automated personal budget that is tailor-made to your unique circumstances. With this, we can then see which of our lending partners would be best suited to your situation.

To get started, give us a call on 1300 300 922 or enquire online today.