How to avoid paying interest on credit card purchases

Credit card interest rates on purchases can result in hard-earned money going down the drain. Learn how to avoid paying interest on credit card purchases and pocket the savings understanding how credit card interest works.

Credit cards can be a convenient financial tool

Used responsibly, a credit card can be a useful addition to your money management toolset. Doing all your shopping on one card, for instance, can help you keep track of spending more easily. You might also benefit from credit card rewards, such as frequent flyer points or free travel insurance. Not to mention that making on-time payments can have a positive effect on your credit rating. How? By showing lenders that you manage credit responsibly.

But credit cards can have a dark side, too. If you don’t pay your credit card bill on time, interest can start adding up and quickly become a problem. Money that should have gone in your pocket gets paid to the bank instead. Before long, you might even begin paying interest on interest. That’s when credit cards can turn into a debt spiral.

How does credit card interest work?

Instead of sliding down the debt slope, become a savvy credit card user and avoid paying interest on your purchases by understanding how credit cards really work. The key is to understand how credit card interest is calculated, which credit card transactions to avoid and how to use interest-free periods to your advantage.

According to the Reserve Bank of Australia (RBA), the national average credit card interest rate in 2021 was 19.94%. Perhaps the interest rate on your credit card is lower than that. Nonetheless, paying any interest on your purchases is too much. The focus of this article is not about getting a better rate, but rather avoiding credit card interest charges altogether.

When it comes to how credit cards work, the starting point is to understand how credit card companies make money. And make money they do! The major banks make more than $1.7 billion of revenue every year from credit cards and similar products. And that’s just the major banks. Collectively, the industry is projected to be worth around $7 billion annually.

Credit card providers make money in two ways. Firstly, they charge merchants a percentage of the transaction value, around one to two percent. Most sellers factor credit card levies into their prices. Others pass the cost on to customers in the form of a credit card surcharge.

Secondly, the credit card provider charges you, the cardholder, fees (eg. annual card fee) and interest. Interest is charged on your credit card balance when you fail to pay the balance by the due date. Based on 2021 data, Australians are carrying a collective credit card debt of $18.5 billion.

Why is credit card interest so high?

Compared with most other forms of lending, credit cards generally have much higher interest rates, at nearly 20% per annum on average. (‘Per annum’ — meaning “for each year” — is abbreviated to ‘p.a.’). In comparison, the current interest rates for home loans are generally in the low single-digits, just a few percentage points above the nation’s official interest rate set by the RBA.

So, why is credit card interest so high? It’s because credit cards are a form of unsecured debt. ‘Unsecured’ means that the debt is not tied to a specific asset. The opposite is called secured debt. With a secured loan, the lender provides finance for the borrower to buy a specific asset, such as a home or car. The lender holds a lien (a legal right) to take possession of the asset should the borrower stop making repayments.

With a credit card, on the other hand, you can spend up to your credit limit on anything you like–clothes, groceries, furniture, holidays, subscriptions, and so on. With no asset to guarantee repayment of your debt, the credit provider applies a higher interest rate to cover their increased risk. Other examples of unsecured credit include medical loans, student loans and utility bills.

How is credit card interest calculated?

Credit card interest rates may be advertised as per annum, but credit card interest is in fact calculated daily. To calculate your credit card’s daily interest rate, take the annual interest rate and divide it by 365. For example, say you have a credit card balance of $500 attracting interest at 19% p.a.:

- The equivalent daily rate is 0.052% (19% divided by 365)

- On the first day, you would accrue 26 cents of interest ($500 balance x 0.052%)

- On the second day, you would accrue interest on $500.26 balance, and so on

- If you paid nothing off the balance, by the end of the month (day 30), your balance would be $507.86

This is called compound interest. With compound interest, you pay interest on the principal (original balance) and on any accumulating interest. By comparison, simple interest is charged only on the principal at the end of the period. Term deposits are an example of simple interest.

When it comes to compounding interest, how much interest you pay is not only affected by the interest rate, but also by the frequency of compounding. The higher the frequency, the more interest will accrue. This is why credit card debt can quickly snowball–because interest is being charged on interest daily.

How to take advantage of interest-free periods

The good news is that most credit cards offer an interest-free period on new purchases (eg. “up to 55 days interest-free on purchases”). This grace period means you can shop using your credit card without being charged interest, as long as you pay your credit card bill on time. (This grace period is not to be confused with promotional 0% interest-free finance.)

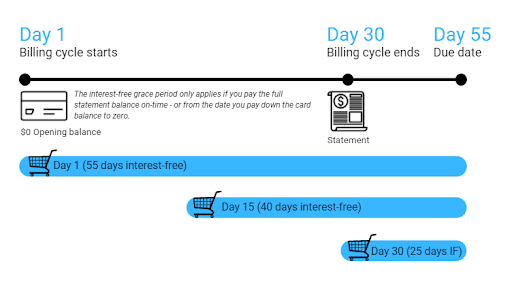

One of the most common credit card myths and questions is around how these interest-free days really work. Does each purchase come with its own interest-free period? When does the grace period start and end? Generally speaking, the interest-free grace period is defined by the billing cycle. Using this example–“up to 55 days interest-free”–if ‘day one’ represents the first day of the month, ‘day 55’ represents when the statement is due.

A crucial point to understand is that the interest-free period only applies if you pay the statement balance in full by the due date. If you are unable to pay your credit card in full–which includes paying late, only paying the minimum or making a partial payment–you will be charged interest on any outstanding balance and lose your interest-free period.

It is important to note that carrying over even a small balance from one statement period to the next will cancel out your interest-free entitlements. Any new charges to the card will now attract interest immediately. The only way to reset your interest-free grace period is to bring your card balance back to zero.

To take advantage of interest-free periods:

- Only spend as much on your credit card as you can afford to pay back every month

- Set up an automatic payment to make sure you pay on time

- If you do carry over a balance from one month to the next, pay it in full as soon as you can

- If your current credit card does not have an interest-free grace period, swap to a card that does

FURTHER READING:

There’s a new breed of ‘no interest’ credit cards. Sounds too good to be true? Discover the catches.

Different types of credit card transactions

Some types of credit card transactions are not eligible for the interest-free grace period. Cash advances are a good example. Most credit cards charge a higher rate of interest and offer no grace period on cash advances. It pays therefore to understand what counts as a cash advance and to avoid these types of transactions. Withdrawing cash from your credit card at an ATM is an obvious one, however, your credit card company may also treat buying traveller’s cheques, money transfers, gambling and other transactions as cash advances.

from money worries

Start today with a FREE no obligation appointment

Generally speaking, credit card transactions are categorised into different types. below are two pitfalls to avoid when figuring out how to avoid paying interest on credit card purchases:

Purchases

A purchase transaction describes using your credit card to pay for groceries, petrol, Netflix, restaurant meals and other goods and services. Protect your interest-free grace period on purchases by paying your credit card balance in full every month by the due date.

Promotions

A promotion describes where the card provider offers a lower interest rate for new joining customers or for promoting certain purchases (eg. concert tickets) to existing customers. Read the fine print to make sure you understand how promotional offers or ‘honeymoon’ periods work.

Balance transfers

A balance transfer describes moving an outstanding debt from one credit card to another. A balance transfer card often comes with a discounted interest rate for a period of time. This can be a great way to get out of debt sooner, but there are also dangers to watch out for.

Cash advances

A cash advance describes using your credit card to access cash rather than goods and services–eg. withdrawing cash from an ATM, transferring money from your credit card account to another account, or using your credit card to gamble.

How to avoid paying interest on credit card purchases

In a perfect world, everyone would pay their credit card balance in full every month. But we know that life is rarely perfect. Expenses can pop up and finances go awry. So, what should you do in the event of being unable to pay on time or in full? Problems like these don’t go away on their own, but with some quick actions, you can better understand how to avoid paying interest on credit card purchases.

If your situation is short-term, contact your card provider to request a payment extension. To avoid paying fees and penalties, make sure you do this before the due date. Most card providers will be happy to help, especially if you have a good history of paying on time.

If your cash-flow issues are likely to be ongoing–for example, you have high medical bills or you’ve lost your job–your credit card company will be able to help with hardship assistance. Depending on your circumstance, they may offer you a range of options, including deferred payments, instalments or freezing interest charges while you get back on your feet.

Most importantly, you should not be embarrassed or delay putting off asking for help. Lenders are obliged to help borrowers who are experiencing financial difficulties. Your credit card provider will very likely direct you to a financial hardship application. Alternatively, you can send them a letter or email that explains your situation.

Your hardship application should include as much relevant information as possible, for example:

- Your full name, address and other contact details

- Account name and number

- Copy of your latest statement

- Explain the cause of your financial difficulty (eg. I broke my leg and have been unable to do my job as a carpenter for the last six weeks)

- Attach evidence (eg. medical certificate, Centrelink statement, unemployment notice)

- Describe how you would repay your debt if your hardship application is approved (eg. My doctor says that I will be able to return to light duties in around eight weeks. I can pay small weekly instalments in the meantime and then increase my repayments when I am working again.)

The card provider will consider your hardship application and reply with their proposal. If the arrangement is reasonable and affordable, great. If not, take the opportunity to reply with your concerns and a counter-proposal. Lenders are able to decline hardship arrangement proposals, however if this occurs (or if their proposed terms are unreasonable), then the borrower is within their rights to lodge a complaint with AFCA (Australian Financial Complaints Authority).

This is where having a detailed budget can be very powerful. Your budget will show how much you can afford to pay and on what terms.

FURTHER READING:

Stressed about debt? Here are seven ways to consolidate your credit card debt faster.

Tammy’s top 12 tips for avoiding credit card debt

- Create a budget so you only spend as much on your credit card as you can afford to pay back every month.

- Automate your credit card payment to make sure you pay on time, every time.

- If you carry over a balance from one statement period to the next, pay it in full as soon as you can to reinstate your interest-free period.

- If your current credit card does not have an interest-free grace period, swap to a card that does.

- If you’re chipping away at credit card debt, use compounding interest to your advantage by setting up a daily or weekly payment plan.

- Opt out of credit limit increases.

- Avoid paying expensive annual card fees for features you don’t use or need.

- Do you have multiple credit cards? Simplify your finances by eliminating all but one.

- Read the fine print–understand promotions and how different transactions are treated.

- Avoid cash advances and other transactions that attract interest immediately.

- If you’re finding it hard to pay on time, contact the card issuer to ask for help or an extension before the due date.

- Transform your money habits away from debt and credit with a positive focus on goal setting and getting ahead.