How do interest-free purchase credit cards work?

If you’ve ever wondered how do interest-free purchase credit cards work and why profit-focused, shareholder-oriented banks would want to lend money without getting anything in return, and thought there must be a catch – you’d be right.

The interest-free period on purchases may first present itself as a viable option, especially if you’re in a tight financial situation, but when the monthly repayments and unpaid balances begin to stack up on those spur of the moment credit card purchases, your future credit card statement may not be as smooth sailing as you’d initially thought.

How do interest-free purchase credit cards work?

Interest-free purchase credit cards aim to give consumers access to money without being charged credit card interest for a set period of time.

Many credit cards come with 55 interest-free days on purchases, and you’ve likely seen advertisements saying 50 months interest-free period or 60 months interest-free period; however, if you simply pay the minimum repayments and you’re unable to pay off these purchases within the allotted time frame, leaving you with an unpaid balance, you’re then more likely to be hit with heavy interest charges, which is where consumers can fall into a spiral of credit card debt.

You can also be charged a late payment fee if you’re late on any monthly repayments across your credit card billing cycle.

We should mention that this range of credit cards is not the same as zero-interest balance transfer cards. Balance transfer credit cards are cards where you transfer the entire credit card debt from one card to another, often coming with an interest-free period, usually ranging from six to 24 months. But when the ‘honeymoon’ period is over, the card reverts to its standard interest rate, meaning you’re back to where you were before.

Keep in mind that these cards definitely aren’t free, either. Instead of charging credit card interest on the card’s closing balance, customers pay a monthly fee. This varies depending on the card’s credit limit.

Interest-free credit cards explained: what is interest-free?

New credit card sign-ups have been declining in recent years, with consumers instead turning to alternatives, such as Afterpay and ZipPay. These ‘buy now pay later‘ (BNPL) services are proving to be incredibly popular as consumers lose trust and interest in traditional credit products.

Interest-free credit cards are aimed to compete with BNPL services, but unlike BNPL lenders, credit card providers are subject to credit regulations and responsible lending laws.

These regulations aim to protect consumers. They put the onus on lenders to make sure people don’t borrow more than they can afford. Lack of regulation is one of the common criticisms levelled at BNPL providers.

Other key differences are that interest-free credit cards can be used for a wider range of purchases and generally have more flexible credit card repayment arrangements and eligible transactions.

Interest-free purchase credit card restrictions

There are some other important restrictions on these interest-free credit cards. Most of these cards don’t allow:

- Cash advances

- Money transfers from this card to another account

- Balance transfers

- Gambling transactions

- Travel or reward points

- High credit limits

- Additional cardholders

What is interest-free in comparison to a balance transfer or interest-free offer?

If you’re still wondering how do interest-free purchase credit cards work, then perhaps we can compare them with other options. As already mentioned, interest-free credit cards are different to 0% balance transfer offers. They are also not to be confused with introductory interest-free periods for new purchases.

These types of cards or interest-free offers are for a specified timeframe and credit card interest charges apply after the ‘honeymoon’ period ends.

A balance transfer can be useful if you want to consolidate multiple debts on additional cards or transfer existing debt from a high-interest rate credit card. Introductory interest-free periods on purchases can also work in your favour, as long as you pay off your purchases and entire balance on time.

Is interest-free financing a good idea? Will it save you money?

An analysis by finance website Finder found there may be some savings for some card users. However, the amount of money you could save isn’t as much as you might think. It’s in the realm of tens rather than hundreds of dollars.

As with all Australian credit cards, the key to avoiding paying out money in fees, charges and interest is to pay off the debt as quickly as you can. By including the debt in your budget plan and prioritising debt reduction, you could find ways to pay more than the required minimum payment, allowing you to pay off the debt much faster, within the 55 interest-free days on purchases, and it would cost you less.

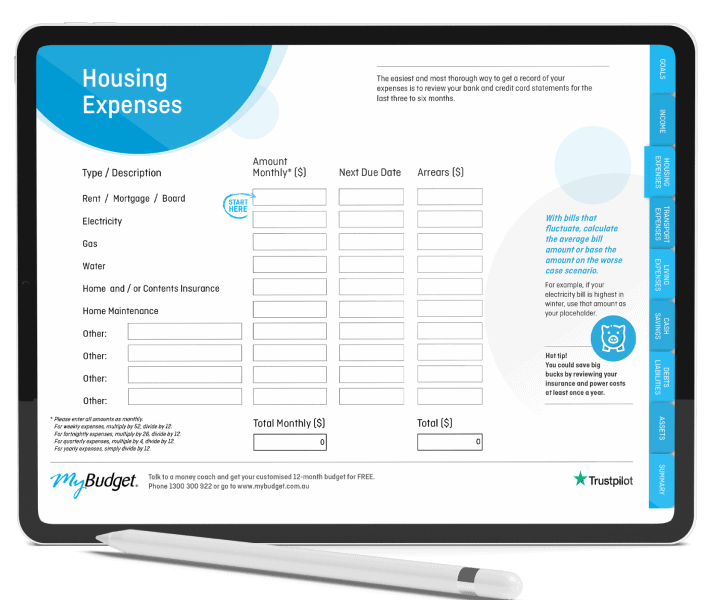

Download MyBudget’s free DIY Budget Workbook & Template.

How MyBudget can help

By planning ahead, budgeting and saving for the things you want, you’re in the driver’s seat. MyBudget has helped over 130,000 Australians with their personal finances, allowing them to live their lives free from money worries.

Be sure to enquire online or call MyBudget on 1300 300 922 to talk with a money expert today.

Ready to find out more?

Call 1300 300 922 or get started today

About the writer

Michelle Bowes

Michelle Bowes is an experienced business journalist and personal finance writer based in Sydney. As a mum of three growing and very busy kids (and one growing and not so busy cat), she knows all about the daily juggle and understands the challenges Australian families face in managing their household budgets in the face of the ever-rising cost of living.