Budgeting 101: Money management and achieving financial goals

It’s time to take control of your finances and start budgeting. Budgeting is the key to successful money management and achieving your financial goals. By creating a personal budget and sticking to it, you can track your income and expenses, identify areas where you can cut back, and allocate funds towards savings and debt repayment.

Understanding the importance of budgeting

Budgeting helps you track your income and expenses, ensuring that you are spending within your means. It provides a clear picture of where your money is going, allowing you to identify areas where you can cut back on unnecessary expenses and save more. By setting realistic budgets for different categories such as housing, transportation, groceries, and entertainment, you can allocate your income efficiently and avoid overspending.

Budgeting is a powerful money management tool that can help you:

- Achieve your savings goals

- Analyse and take control of your spending

- Find extra money for saving, paying down debt or investing

- Escape the insecurity of week-to-week living

- Stop relying on your credit card and loans to make ends meet

- Make stronger financial decisions

- Be prepared for unexpected expenses

- Save time managing your money

- Stop fighting with your partner or loved ones about money

What is a budget?

A budget is a financial plan that helps you manage your money effectively and achieve your financial goals. It is essentially a guide that helps you allocate your income towards different expenses and savings in a structured manner.

A budget typically consists of two main components: income and expenses. Your income includes all the money you earn from various sources, such as your salary, freelance work, Centrelink payments, etc. On the other hand, your expenses encompass all the money you spend on different categories, such as mortgage/rent, transport, groceries, entertainment, debt repayments and more.

A good budget is like a map for your money. It should show you the fastest, most efficient path to reach your goals. If something unexpected happens along the way, your budget can even help to recalculate the route.

Of course, if you’re new to budgeting you might be wondering if this money mapping is going to be time consuming or difficult. We won’t lie—creating a workable budget does take a little time. But we promise the results are worth it. Budgeting reduces financial stress and uncertainty, which gives you more financial freedom in your life, not less.

Why do you need a budget?

Having a budget is crucial for keeping track of your finances, providing you with a plan that outlines your progress. Without a budget, it’s like driving blindfolded – you have no financial stability and no clear direction on where your money is going.

A budget also allows you to prioritise what is important for you. Do you want to be debt free? Do you want to live without money worries? Do you want to invest and retire early or would you prefer to plan frequent holidays? Are you saving for a wedding? Budgets should be created specifically for what is important to you.

Your financial objectives don’t have to be big or over-the-horizon to be worthwhile. In fact, it’s good motivation to have some short-term goals (such as saving for a concert ticket or date night) to look forward to on your way to achieving your long-term goals (such as saving for a house or retirement).

FURTHER READING: How to achieve your financial goals >>

Be realistic about your finances

Being realistic about your finances is crucial to the effectiveness of your budget. An honest budget involves assessing your current financial situation and making informed decisions based on your financial capabilities.

For example, if your income fluctuates, be sure not to overestimate as you don’t want to rely on money you may not have. If you sometimes do overtime or receive commission on top of your regular salary, consider forecasting on your base wage or the lowest amount you’ve previously received so that your budget isn’t expecting consistent substantial pays. That way, if your income does come in higher, you can put that extra money towards your savings goals, debt repayments or short- and long-term goals. Give every dollar a job.

Lastly, if your pay is inconsistent (e.g. if you’re a contractor), this can certainly be tricky as it’s difficult to predict how much income will be coming in and when. Therefore, if you can’t find your crystal ball, make sure you’ve laid out all of your expenses and then work off of a buffer amount to keep you afloat until the next pay comes in. This should be in addition to your emergency savings, which should account for six months of expenses should you suddenly were to lose your primary source of income.

And of course, be sure to budget on your net income (after tax). This is especially if you are a contractor and need to pay your own tax. If you’re unsure, be sure to speak with an accountant or a financial advisor.

Don’t underestimate your expenses

A common budgeting mistake is to include only essential, fixed expenses in your budget (eg. rent/mortgage, groceries, transport, utilities, insurance etc). However, for your budget to be realistic, it needs to include all of your discretionary expenses too.

Essential expenses describe required items you need to live. For example, housing, food, medical bills, transport, utility bills, etc.

Everything else you spend money on are what you can refer to as discretionary expenses. And when these expenses come up, they tend to either be taken out of savings (delaying your future goals) or worse, prioritised over required expenses.

Here are some discretionary expenses that we find are often forgotten:

- Birthdays, Christmas and special occasions

- Entertainment (eg. restaurant meals, going out, Ubers)

- Vet, grooming and pet supplies

- Haircuts and beauty treatments

- Electronics, music, magazines, hobbies, gadgets

- Subscriptions

- Clothes and fashion

- Alcohol and cigarettes

It’s all these little discretionary expenses that can add up quickly. The best way to uncover them is to go through your bank statements for the last three to six months. Then, organise them into two separate categories: Required and Discretionary. You can use a list, a budgeting spreadsheet, colour coordinate it; whatever is going to help you differentiate your expenses. Think of it as your own little fun spending plan.

Budget for 12 months in advance

By creating a 12 month budget, your entire year of finances is mapped out. A common budgeting mistake is for people to base their budget on their pay cycle or the calendar month. Budgeting your monthly expenses and income is a good start, but the challenge comes when an annual or quarterly bill pops up. Suddenly, there is not enough monthly income to cover the budget’s usual monthly expenses plus, for example, annual car registration.

For a lot of people, this is where they discover why their finances feel like ‘one step forward and two steps back.’ On a weekly basis, it looks like they live within their means. But it’s the annual accumulative effects of kids’ birthdays, Christmas presents, car registration and servicing, power and water bills, council rates, and so on, that make it impossible to save.

FURTHER READING: Your complete guide to budgeting >>

Cut down on unnecessary spending

Cutting down on unnecessary spending is can help free up more space in your budget. It’s all too easy to get caught up in mindless spending, buying things you don’t really need or indulging in impulse purchases. By identifying and eliminating these unnecessary expenses, you can free up more money for those required expenses, save or work towards your financial objectives.

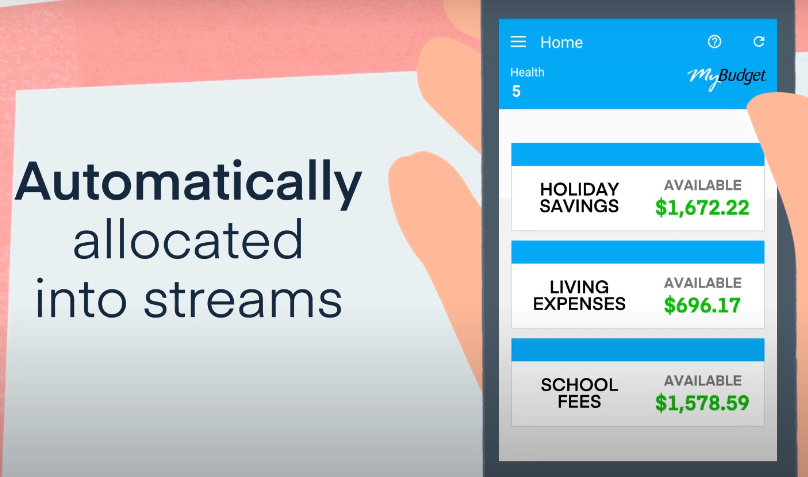

At MyBudget, we organise our clients’ expenses into ‘streams.’ These get prioritised in order of importance. For example, essential living expenses (eg. rent/mortgage, electricity, petrol, groceries) may take priority over ‘Netflix’ or ‘Takeaway Food.’

Ranking your expenses is an excellent way to make sure you meet your most important obligations first. It can also reveal where you can trim the fat. New budgeters often ask themselves questions like ‘do I really need Foxtel, Netflix, Disney-Plus, Stan and Kayo?’

For those managing multiple debts, this ranking exercise can help with working out which debts to tackle first or what sort of payment arrangements would be affordable. In fact, it’s important not to negotiate payment terms with your creditors without first creating a workable budget. If you break a payment arrangement, creditors are unlikely to offer you another one.

Build flexibility into your budget

Building flexibility into your budget can help to avoid budget burnout. Life is unpredictable, and unexpected expenses or changes in income can easily throw off your budget if you’re not prepared. By incorporating flexibility into your budget, you can adapt to these changes without derailing your financial progress.

FURTHER READING: The ultimate guide to saving money >>

The way to create a flexible budget is with savings. This is money you set aside regularly that builds up into an emergency fund. It should have its own stream in your budget. To differentiate it from other saving goals, you should call it something like ‘Emergency Fund’, ‘Rainy Day Savings,’ or ‘Buffer Money.’

Keep this money in a separate account or sub-account for safekeeping. It doesn’t matter if your savings start out small. Even just $5 to $10 a week will snowball over time. You can also top up your emergency savings with one-off payments, such as a tax refund, bonus or birthday money.

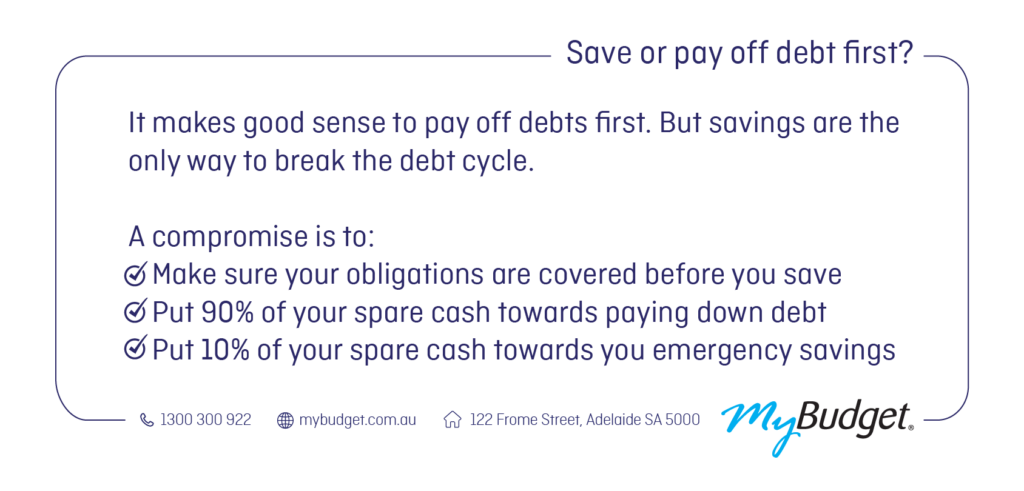

Should you save or pay off debt first?

Weighing up whether to pay off debt first before saving can be a difficult decision to make. There are pros and cons to either approach and this may come down to your personal situation. Of course, having a savings buffer may help with that piece of mind but not chipping away at that credit card balance can result in the bank charging more interest.

To learn more about which approach is right for you, you could speak to a financial adviser or a MyBudget money expert who can help you to build a budget plan.

FURTHER READING: 7 ways to pay off your credit card faster >>

What happens when the budget is not balanced?

A balanced budget is a budget where your income is equal to or greater than your expenses. With budgets that don’t balance, there is more money going out than coming in. The danger in this case is that either your savings are going down or your debt is going up. This is how a debt spiral can begin.

So, what is the right approach with a budget that won’t balance? The first step is to congratulate yourself. Instead of hiding your head in the sand, by creating a budget, you have a powerful money management tool that can help you to understand, explore and fix your financial situation.

Start by making changes to your budget to see what effect they have. These are all scenarios that can be explored with your budget:

- How could you trim your expenses?

- What if you were to refinance or consolidate your debts?

- You may be able to negotiate lower payments with your creditors

- Should you sell an asset?

- Does your budget need more income?

If your budget requires more income to balance, either your expenses are consistently higher than your income or your budget is experiencing a temporary shortfall, in which case an additional injection of cash could help you get back on track. Picking up some more hours at work could help if there is a short-term shortage, but this is not a viable solution over the long term. For the latter, you could consider asking for a pay rise from your company, looking for a new job, or starting a side hustle in your spare time.

Importantly, unlike Band-Aid measures, budgeting helps to uncover and fix the root of financial problems. And by getting to the underlying cause, you have the opportunity to stop them from happening again. In fact, with the right budgeting system, you have the foundation for lifelong financial success!

FURTHER READING: What to do when you can’t pay your bills

MyBudget has helped over 130,000 live their lives free from money worries. With the help of our caring money coaches and being able to keep track of your finances with the MyBudget budgeting app, we can help you too. Be sure to give us a call on 1300 300 922 or enquire online today.