Bankruptcy in Australia: everything you need to know

Bankruptcy often carries a negative connotation, seen by many as an admission of failure. However, applying for it can sometimes be the best way to move forward financially and regain control of your life. If you’re unsure about the process in Australia, MyBudget has helped many people live free from money worries, some of whom have either gone through or been on the brink of insolvency. In this article, we consulted MyBudget’s talented insolvency team to explain how it works in Australia and to answer common questions.

What is bankruptcy?

Bankruptcy is a legal process where you are declared unable to pay your debts. It can release you from most of your debts, provide financial relief, and allow you to make a fresh start. You can enter voluntary bankruptcy by completing an online Bankruptcy Form. However, personal bankruptcy can affect your assets and income. Your trustee has the ability to sell certain assets to benefit your creditors. Though often seen as a last resort it can help you regain control of your financial affairs.

What are the 3 types of bankruptcy in Australia?

1. Bankruptcy

2. Personal insolvency agreements

3. Debt agreements

How does bankruptcy work in Australia?

Personal bankruptcy in Australia is a legal process that allows individuals to declare their inability to repay their debts as they fall due. Many personal bankruptcies are administered by the Australian Financial Security Authority (AFSA), though some may be handled by a private trustee. Under Australian bankruptcy laws, filing for bankruptcy can be considered if a person is insolvent, meaning they cannot meet their debt repayments as they fall due.

Once it has been accepted, the trustee notifies all creditors. Most unsecured creditors lose the ability to collect on the debt. In some cases when the bankrupt has assets above certain indexed amounts, the creditors may receive a dividend payment from the trustee.

It’s important to note that declaring bankruptcy can provide relief, but it also has serious consequences that may affect your future. Understanding these consequences can help you make an informed decision about whether this is the best option for you.

Duration and impact of bankruptcy in Australia

How long does bankruptcy last in Australia?

In Australia, bankruptcy lasts for three years and one day from when it’s accepted. It remains on your credit file for a further two years and on the National Personal Insolvency Index (NPII) for life.

How long do bankruptcies stay on credit reports in Australia?

Bankruptcies typically stay on credit reports for up to five years. During this period, obtaining credit or loans may be challenging due to the record. It’s important for those declaring bankruptcy to understand its impact on their credit history and to take steps to rebuild their financial credibility over time.

What happens when you declare bankruptcy in Australia?

There are two immediate actions that take place when you declare bankruptcy in Australia:

You are appointed a trustee

When you first declare bankruptcy in Australia, you are appointed a trustee who acts on your behalf with creditors. In addition, they work directly with you throughout the entirety of your bankruptcy.

You receive the protection of the Bankruptcy Act

When you’re declared bankrupt, you receive the protection of the Bankruptcy Act, which stops creditors from taking further action. This means that when you’ve filed for bankruptcy, you’ll no longer be contacted by creditors for debts included in your agreement.

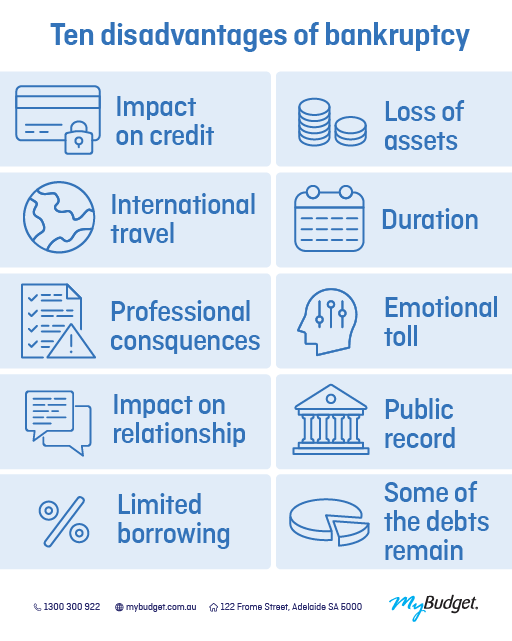

What are the consequences of bankruptcy in Australia?

The idea of being released from your debts and starting afresh can be attractive, but the reality is never as simple. While bringing relief from stressful communications from creditors and easing your cash flow, it may not resolve all of your financial issues. In fact, for some people, the consequences of bankruptcy in Australia can add more stress to an already stressful situation.

So how does the bankruptcy process work and what are the consequences?

The trustee may take control of your assets

Rather than being able to sell your assets and distribute the funds yourself, the trustee may take control of your property, vehicles (up to a certain value) and any other potential assets, sell them and distribute the funds to your creditors, as they deem appropriate. In some circumstances, they may investigate and claim your share of ownership in assets that are not formally listed in your name.

Can you work during bankruptcy? Your work and income may be affected.

Being bankrupt may restrict you from working in certain professions or running a company. If you own a business, you might need to inform your customers, professional association, or licensing body about your bankruptcy. Additionally, the trustee could claim a portion of your income as contributions.

Typically, it does not impact your ability to work and earn income. However, if your earnings surpass a specified threshold, the trustee will take part of your income to repay creditors. Therefore, you must keep the trustee informed of any changes in your employment and earnings.

While you cannot serve as a company CEO or director during bankruptcy, you might be able to continue operating a business. If you operate under a business name different from your own, you must disclose your bankruptcy status to those you deal with. If you are a sole trader using your own name, you are not required to inform others of your situation.

For a complete list of employment restrictions, which can vary by state, please visit the AFSA website.

Your ability to travel overseas will be affected

The Bankrupt is not able to travel overseas without written permission from the trustee. In some instances, you may be asked to surrender your passport.

Your name will appear on the National Personal Insolvency Index

Your name and details will be permanently listed on the National Personal Insolvency Index, a searchable public register. Credit reporting agencies will also keep a record for up to five years, sometimes longer.

Your ability to buy things on credit will be affected

While it will appears on your credit file, your access to credit will be limited. You may find that landlords require a higher rental bond and that utility and telephone companies will not extend credit to you without a bond deposit. You may be excluded from holding certain bank accounts and find it difficult to get affordable credit in the future.

The way back to financial health after bankruptcy can be difficult

The consequences of bankruptcy in Australia means that it can impact your career and, of course, future financial prospects. Some people don’t make the ongoing changes they need to and end up going bankrupt again. We at MyBudget can help you avoid this with a tailored budget plan that keeps you and your finances on track. Not only that, but our dedicated debt negotiation team can negotiate compulsory payments with creditors on our clients’ behalf; in fact, in the past two years, we have saved our clients over $1.5 million by negotiating lower interest rates and repayments.

What assets can you keep during bankruptcy?

During the period of your bankruptcy, the trustee will take control over any share of ownership you have in assets, such as real estate, vehicles and other investments. They will determine which assets you can keep and which must be sold to help repay your creditors. They may also investigate assets that you owned before petitioning for bankruptcy and potentially attempt to recover them. For instance, the bankruptcy trustee may find that you have an interest in a property, even though you are not listed on the title, and may take legal action to possess your share. You will be allowed to keep your everyday household belongings, vehicles (up to a certain value), tools of trade (up to a certain value), as well as some other asset and income types.

Reasons why you may declare bankruptcy

Declaring bankruptcy is a legal matter that can help protect you from creditors and erase some of your financial debts when you are unable to repay them. People may declare it for a variety of reasons, sometimes at little-to-no fault of their own. Here are some reasons why people may need to consider declaring bankruptcy:

Unmanageable debt

When faced with unmanageable debt from credit cards, personal loans, etc., declaring bankruptcy may seem like the best option in order to achieve financial stability. It can be a difficult decision to make, but one that can bring relief from overwhelming financial pressure.

Credit card and personal debt can quickly spiral out of control, making it impossible to pay down. Interest rates and late fees add up quickly and the balance owed can become insurmountable.

With the accumulation of high-interest debt and no means of paying it down, it might be the only way out. Declaring bankruptcy may not be the ideal solution for getting out of debt but it is often preferable to being in constant financial strain.

People should try and take measures to avoid racking up unmanageable credit card debt if they want to avoid facing bankruptcy options. MyBudget helps Australians to create a budget and stick to it, so you don’t get overwhelmed by debt payments every month. Head to our debt solutions page to find out more.

Debt collectors contacting everyday

Facing financial difficulties can be stressful, and oftentimes frightening. One of the reasons why you may declare bankruptcy is if debt collectors are contacting you everyday. No one wants to receive constant phone calls and messages from multiple sources while they’re trying to take control of their finances.

Having numerous debt collectors attempting to collect on past due accounts can be overwhelming and you may be feeling helpless. If not dealt with properly, creditors may even take legal action and begin garnishing your wages or placing caveats on your assets.

If a person feels that there is no way out of this vicious cycle, declaring bankruptcy may be the answer. Bankruptcy can provide relief from these persistent claims and give someone a fresh start financially.

By understanding the importance of addressing any overwhelming debts in a timely manner, it can help people avoid reaching a point where filing bankruptcy might become necessary.

Loss of employment

One of the primary reasons why an individual may consider declaring bankruptcy is due to a loss of employment. Losing your job may not only leave someone without a regular source of income, but it can also leave them with outstanding debts they are unable to pay.

If you lose your job or have been out of work for some extended length of time, then you may be left with a serious financial strain. Of course, you’ll want to apply for unemployment benefits and look for employment opportunities as soon as possible; however, this may not be enough to cover all your bills, resulting in delinquent payments and eventually debt collectors knocking on your door.

You may be able to apply for financial hardship by contacting your creditors, being granted a grace period designed to help you get back on your feet; however, if you find yourself unemployed for an extended period of time, creditors may begin to grow impatient.

Filing for bankruptcy might just be the best solution in these situations as it can allow you to stop servicing your debt and restart your finances in a much healthier manner. It’s important to realise that declaring bankruptcy isn’t an easy decision, but rather one that may need to be faced if all other alternatives have been exhausted.

Business losses

Business losses are one of the many valid reasons why someone may decide to declare bankruptcy. If a business experiences significant financial losses, they may be unable to continue making debt repayments and may need to file for bankruptcy in order to avoid foreclosure on their property.

Declaring bankruptcy due to business losses can be incredibly hard on an entrepreneur as it can have a profound effect on their personal credit score and overall financial wellbeing. It is incredibly important for entrepreneurs to keep tight finances so that they are aware of when their business begins to experience difficulty.

By understanding both the potential risks and rewards associated with running a small business, entrepreneurs can stay informed on how best to proceed should their business experience considerable monetary losses. This will help them make the best decision for themselves and their business, whether that’s filing for bankruptcy or taking other measures such as renegotiating with creditors.

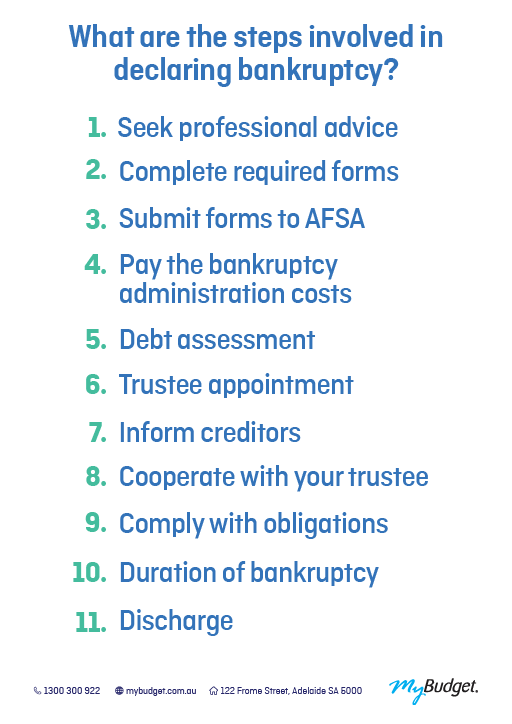

What are the steps to declaring bankruptcy in Australia?

Declaring bankruptcy in Australia may seem like a complex process, but it doesn’t have to be overwhelming. There are several steps that you need to take in order to officially declare yourself bankrupt and start the debt relief process.

The first step towards declaring bankruptcy in Australia is to get financial advice from a financial counsellor through a financial counselling service or insolvency practitioner. This professional can answer your questions, assess your financial situation, and point you in the right direction.

The next step is to apply for bankruptcy. This is done online by creating an account with AFSA and completing the online application which outlines your income, assets, and liabilities.

Once AFSA have reviewed the application and determined that you are insolvent, they accept this and provide you with a bankruptcy number. AFSA then notify your creditors of the bankruptcy which ceases collections for most unsecured debts.

What if bankruptcy is the right option?

After learning how the bankruptcy process works, should you decide that bankruptcy is in fact the right option, having a workable budget in place is more important than ever. You will no longer be able to use your credit card to make ends meet and you will have to be careful that your income stretches from payday to payday. Budgeting is also the key to addressing and fixing the issues that got you into financial difficulty in the first place.

While we aim to do everything we can to help you avoid bankruptcy, if it works out to be the best option, MyBudget can explain what is involved in declaring bankruptcy and support you by answering your questions and guiding you through your online application with AFSA.

Why is budgeting important in bankruptcy?

Without a budget in place, bankruptcy is potentially a short-term measure rather than a solution to your underlying money problems. The key is to address the root causes of your financial stress and to develop new money management habits. As well as providing a money map to your financial goals, budgeting protects you from the vulnerabilities that bankruptcy can bring.

Imagine this common bankruptcy scenario…

You’re wondering, ‘how does the bankruptcy process work?’

You declare bankruptcy with no savings to fall back on, and because your credit cards have been cancelled, you have only your wage to live on. It’s great that creditors are no longer hounding you and you have extra cash in your pocket, but you still have other financial commitments to meet — paying your rent and car loan or school fees or child support payments for your children — as well needing to cover everyday living expenses.

Have you imagined a life without savings or credit? You reach the end of your money before payday and there’s nowhere left to go. The dark side of bankruptcy – and one of the consequences of bankruptcy in Australia that people rarely talk about – is that bankrupts often become reliant on borrowing cash from friends and family or they take out expensive payday loans to make ends meet. And although you may be discharge from bankruptcy after three years and one day, the consequences of bankruptcy in Australia can linger much longer — for up to five years or longer on your credit file.

Imagine instead that you have the security of a long-range, detailed budget in place. Your bills are paid on time, you have savings growing in the bank and can see a clear path to your recovery. When your budget changes or unexpected bills come up, you have the support of a caring team of experts to work it out for you. Creditors are no longer chasing you and you’ve forgotten what it’s like to worry about money.

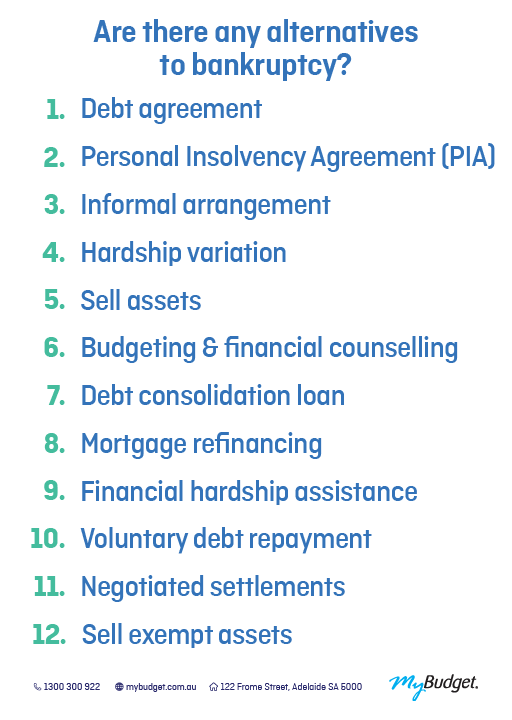

Alternatives to bankruptcy

When someone is struggling with their finances in Australia, it’s important for them to explore all the options available before turning to bankruptcy. This includes looking into debt consolidation and repayment plans, creating a budget and/or investigating if they qualify for financial hardship.

Debt consolidation involves combining multiple debts into one loan, which can help make repayments more manageable and improve cash flow. Repayment plans involve negotiating an affordable instalment plan with creditors so you can pay off the debt over time.

Creating a budget will allow people to understand where their money is going each month and help identify potential savings opportunities.

Financial hardship may also be an option – this involves making arrangements with creditors to temporarily change loan terms if you’re unable to continue payments due to a short-term problem such as loss of employment.

Making arrangements with creditors is a service we can offer our clients. In fact, MyBudget has saved one client over $36,000 by negotiating lower interest rates and repayments on their loan. In addition, thanks to our dedicated MyBudget Loans team, we save our clients on average $60,000 every month by negotiating lower interest rates and repayments.

But don’t just take our word for it! MyBudget client Jo Scholtz had this to say about us over on Trustpilot:

“I have been a customer with MyBudget for roughly 6 years now, and they have completely changed my life and outlook on the future. I was on the verge of bankruptcy and just couldn’t see my way out of it, but with the support and advice from MyBudget I am now completely debt free and have been able to rebuild my credit score and am planning to buy my own home.”

Bankruptcy should always be considered as a last resort but if you’re not sure of what your options are, feel free to give MyBudget a call on 1300 300 922. And if you’re finding yourself struggling to keep your head above water, you can seek help from a free financial counsellor by calling the National Debt Helpline on 1800 007 007. You can also talk to a registered trustee, registered debt agreement administrator, lawyer or an accountant. And for general information on bankruptcy, be sure to visit the AFSA website.

Informal debt arrangement

Before going down the path of bankruptcy, first speak to your creditors about informal payment arrangements that you can afford. Most creditors want to help, especially if you demonstrate that you’re earnest about meeting your debt obligations. You may be able to arrange a break from payments for a reasonable time, a payment plan or hardship arrangements. Sometimes

Formal debt agreement

As well as bankruptcy, the Bankruptcy Act includes provision for formal debt agreements that allow you to propose a reduced settlement amount to your creditors that you can pay off over time (see section below).

Declaration of Intention to Present a Debtor’s Petition (DOI)

While you explore your payment options, you have the option of lodging a ‘Declaration of Intention to Present a Debtor’s Petition’ (DOI). A DOI won’t stop creditors from repossessing goods for secured debts, but it can provide a 21-day protection period where creditors of unsecured debts cannot take further action against you.

Personal Insolvency Agreements

A Personal Insolvency Agreement (PIA) is often referred to as a Part X debt agreement and is a legally binding agreement between you and your creditors. Similar to bankruptcy, you are appointed a trustee who will make an offer to your creditors in order to pay part or all of your debts, either by individual instalments or as a lump sum.

In some instances, you may be able to retain all personal assets (e.g. property, vehicles, etc.) that may be at risk under a bankruptcy in a Part IX debt agreement. However if you are over the set limits for a Part IX, a Part X PIA may be an option.

Affordably pay your way out of debt

By developing a detailed plan, you may be able to pay your way out of debt by using your existing income and without needing new loans or damaging your credit rating. The most effective way of achieving this is with a budget; MyBudget has helped many Australians avoid bankruptcy by putting together a budget strategy to get out of debt.

If you’re looking to avoid bankruptcy this way, give MyBudget a call on 1300 300 922 or enquire online today.

What’s the difference between bankruptcy and a formal debt agreement?

Where bankruptcy releases you from your unsecured debts, a Part IX debt agreement is an opportunity to negotiate a reduced sum payable to your creditors in instalments over a set amount of time. Should your creditors accept your proposal, your debts will no longer attract interest and your payments will be put into a single, easier to manage repayment for three to five years.

It is important to recognise that entering into a debt agreement is considered an act of bankruptcy and that the consequences are not entirely dissimilar. Submitting a debt agreement proposal to AFSA is an act of bankruptcy. This means that if your creditors don’t accept your proposal, they can apply to take you to court and force you into bankruptcy.

What are some common myths about bankruptcy?

With the commons stigmas that arise from bankruptcy, many myths have arisen. It is very important to know that not everything your hear about bankruptcy is true.

Myth 1: “Bankruptcy will ruin my life”

While bankruptcy will have an impact your life, it shouldn’t ruin your life. There’s no avoiding the fact that bankruptcy will have an impact on your life. There are definitely serious consequences of bankruptcy, which is why at MyBudget, we consider bankruptcy a last resort.

But in a lot of cases, it can be the catalyst for a fresh start – one that might never be possible without pursuing a bankruptcy. If coupled with a strategy based on developing great habits around money, it has the potential to transform your life. The first step, however, is to explore all of your other options by creating a detailed budget plan. Only then can you properly know if bankruptcy is the way to go.

Myth 2: “Bankruptcy is a quick fix for debt problems”

While we wish it were true, we’re sorry to say there are no quick fixes when it comes to debt. Bankruptcy is a three-year process in itself and it remains on your future credit report for a further two years. That’s why our first objective is to help clients avoid personal insolvency, if possible.

We do that through tailored personal budgeting and by doing the heavy lifting for our clients — we pay their bills, set aside savings and talk to their creditors for them. If it turns out that bankruptcy is the right path, budgeting and money management support is even more important because you’ll be embarking on three to five years of carefully managing your money.

Myth 3: “I’ll never be able to borrow money again”

This is not true. Your name will be listed on the National Personal Insolvency Index, but it doesn’t mean you’ll never be able to borrow money again. Once you’re discharged from your bankruptcy, banks and lenders will consider applications from you, just like anyone else. What lenders need however is confidence that you’ll be able to pay back your loans and credit.

You may want to view your bankruptcy period as an audition to prove you can be financially responsible. Create great habits around money and how you spend it and achieve your savings goals. That could be saving up for a house deposit or holiday or a new car or whatever’s important to you. As a MyBudget client, we may even be able to assist you with finance directly through our MyBudget Loans Team.

Myth 4: “Bankruptcy has a social stigma”

Financial stress is everywhere and bankruptcy is more common than most people are aware of. To put it in perspective, there were over 15,000 bankruptcies in Australia from 2018 to 2019. The reason you don’t notice a bankrupt person is that they look like everybody else.

In certain situations, you may be required to disclose that you are bankrupt – in certain professions, for instance – but the cases are very specific. Otherwise, it’s totally up to you who you choose to tell. At MyBudget, we don’t see our clients as anything other than amazing people willing to embrace change for themselves and their families.

Further information

To find out more about what is involved with all things bankruptcy, give us a call on 1300 300 922 or enquire online today to organise a FREE, no-obligation appointment with a friendly staff member.

Ready to find out more?

Call 1300 300 922 or get started today