How financial hardship affects your credit score

Financial hardship doesn’t have to mean lasting credit damage, take control of your finances with strategic repayment plans and MyBudget’s expert support.

Financial hardship can happen to anyone, whether it’s due to a sudden loss of income or unexpected challenges. It can make keeping up with bills overwhelming and may affect your credit score. However, financial hardship doesn’t have to lead to permanent credit report damage. In this article, we’ll explore how hardship arrangements affect your credit file and how to rebuild your credit if things don’t go as planned.

What is financial hardship?

Financial hardship happens when life throws you a curveball; whether from rising living costs, a major life event, or other unexpected pressures; and suddenly, paying for everyday essentials like rent, utilities, or loan repayments becomes overwhelming. In these moments, many people turn to their credit provider for help, requesting a financial hardship arrangement or a hardship variation. These adjustments can temporarily ease the pressure by making your repayments more manageable.

Acting quickly is crucial. By reaching out early, you could access options like debt consolidation, refinancing, or a tailored repayment plan. While these solutions may appear on your credit report, they’re a much better alternative to missed payments, which could lead to defaults and lasting damage to your credit file.

Causes of financial hardship

Financial hardship can result from job loss, medical expenses, or major life changes like divorce. Without savings, missed payments after job loss can harm your credit score for years, but a hardship arrangement can help protect your score if you stick to the terms.

Signs of financial hardship

After a series of interest rate hikes and ongoing cost-of-living pressures, financial hardship is something many Australians are likely to experience.

If you’re struggling to keep up with repayments, relying on credit cards for daily expenses, or frequently over drafting, these are warning signs that your finances are under strain. It’s important to act early to avoid defaults on your credit report.

How is financial hardship reflected in credit reports?

When you arrange a financial hardship variation, it appears on your credit report for up to 12 months. This won’t affect your credit score unless you miss payments outside the agreement. However, defaults can stay on your report for five years, so setting up a hardship plan early is crucial to avoid long-term damage.

Here’s how your credit report and repayment history can be affected:

Defaults: These can only be listed if:

- you’ve missed loan repayments

- you’ve been issued a default notice (which gives you 30 days to catch up)

- you’ve received notice that the default will be added to your credit file.

Repayment plans: If you’ve requested a repayment plan, creditors are required to wait 14 days after rejecting your request before listing a default. The faster you set up a plan, the more likely you are to avoid a default.

How to avoid financial hardship

Avoiding financial hardship isn’t about luck; it’s about being proactive and having a solid plan in place. Here are some steps you can take to stay ahead:

- Start with a budget: a budget is the best way to get your finances on track. It helps you plan for bills, track your spending, and work towards your financial goals; whether that’s paying off debt, saving for something special, or just reducing financial stress.

- Build a savings buffer: even small amounts saved regularly can add up and provide a cushion when times get tough, reducing your reliance on credit.

- Cut back on non-essentials: temporarily pause subscriptions or other discretionary spending until your finances stabilise. It’s a quick way to free up extra cash.

- Act early: don’t wait for bills to pile up. Take action as soon as you notice signs of financial strain. Setting up a budget and repayment plan early can prevent things from spiralling out of control.

By taking these steps and seeking help when needed, you can protect your credit score, avoid long-term financial damage, and get back on the path to financial stability.

What can I do if I’m facing financial hardship?

If you’re struggling to make ends meet, here’s what you can do:

- Assess your budget: prioritise essentials like housing, utilities, and groceries.

- Request a hardship arrangement: reach out to your creditor to prevent missed payments from impacting your credit.

- Seek emergency assistance: organisations like Foodbank Australia, the Salvation Army, and Lifeline can help with food and bills.

Budget your way out of financial hardship

Creating a budget is the key to navigating your way out of financial hardship. It gives you a complete picture of where your money’s going, helping you avoid missed payments that could hurt your credit score or credit file. Here’s a quick guide to get started:

- List all your income sources: salary, benefits, and side hustle earnings.

- Track essential expenses: focus on rent, utilities, groceries, and loan repayments.

- Cut non-essential spending: pause subscriptions or reduce discretionary spending.

- Build a savings buffer: even small amounts can prevent reliance on credit.

- Use a budgeting tool: MyBudget’s Personal Budgeting Template helps you organise your finances, stay on top of payments, and protect your repayment history.

A solid budget helps you manage loan repayments, avoid defaults, and improve your credit score. If you need some assistance in getting started, MyBudget’s Money Coaches can work with you to create a personalised plan, tailored to your financial situation. Plus, we can also negotiate with creditors on your behalf to help organise more manageable payment arrangements, so you can avoid further damage to your credit file and focus on getting back on track.

Prioritising debt payments

When facing financial hardship, paying off debt should be a top priority. Your repayment history is a significant factor in your credit score, so staying on top of essential payments is crucial. If you’ve set up a financial hardship plan, make sure you fully understand the terms and stick to them. This shows lenders you’re managing your finances responsibly and helps prevent further credit damage.

Common mistakes to avoid during financial hardship

Navigating financial hardship can be overwhelming, but avoiding these mistakes will help keep you on track:

- Ignoring bills: always communicate with your creditors; don’t ignore them.

- Taking on more debt: applying for additional credit cards or loans can make things worse.

- Failing to budget: without a clear budget, it’s easy to lose track of income and expenses, leading to more missed payments and a negative impact on your credit file.

How to rebuild credit after financial hardship

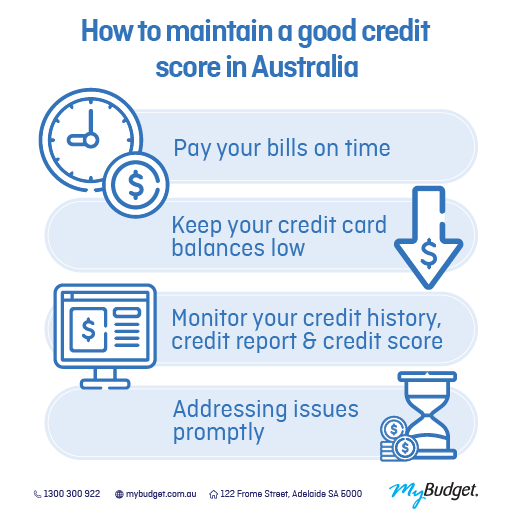

Rebuilding your credit score after financial hardship takes time, but it’s entirely possible with the right plan. Here’s how to start:

- Stick to your budget: keeping track of your income and expenses will help you avoid missed payments in the future.

- Keep credit utilisation low: aim to use no more than 30% of your available credit to maintain a healthy credit score.

- Check your credit report regularly: review your credit file for any errors and dispute inaccuracies with the credit reporting body.

MyBudget’s Money Coaches can work with you to create a personalised plan to rebuild your credit and help get you back on track financially.

How can MyBudget help to get out of financial hardship?

If you’re experiencing financial hardship, don’t put it off any longer; MyBudget is here to help. Our experts can help balance your budget, manage your repayments, and negotiate with creditors to create a personalised plan that fits your situation. Enquire online or give us a call on 1300 300 922 to book your free appointment today.

Cheryl is part of the MyBudget Corporate Finance team and manages the company’s finances with the same dedication that MyBudget extends to helping clients achieve their financial dreams. As part of her side hustle, Cheryl writes for MyBudget, speaking from the heart about relevant financial topics, drawing from her own personal journey through separation, single parenting, budgeting, and surviving cancer.