Cost of living crisis in Australia: how to make ends meet

Australia’s cost of living crisis is still very much in play. Most of us are feeling the pressure on household budgets as prices continue to rise on everything from food to energy bills. While inflation has eased from its 2022 peak, it currently sits at 2.4%, gradually returning to the RBA’s target range of 2-3%. The Reserve Bank of Australia (RBA) after 15 months and 13 rate rises, have finally dropped the cash rate by 0.25%, bringing it down to 4.10% in February 2025. While this offers some relief, many Australian mortgage holders are still grappling with financial pressure.

So, how do we make ends meet in these tough times? Let’s explore the causes, solutions, and practical tips to help you navigate this ever-changing economic climate.

What caused the cost of living crisis in Australia?

Rising fuel prices continue to drive up the cost of living

Ah, petrol; the never-ending pain at the pump. Remember when filling up your tank didn’t feel like a complex maths equation? Those were the days. According to the ACCC, global tensions have kept fuel prices elevated, and with the typical fluctuation in the price cycles, the cost of fuel can change dramatically within just a week. This volatility, combined with ongoing geopolitical factors, continues to contribute to the rising cost of living on everyday essentials. With no relief in sight, it’s time to get savvy. Use fuel apps like PetrolSpy to track down the best prices in your area, because every cent counts when you’re trying to ease the strain on household budgets.

Escalating grocery costs put pressure on Australian families

The cost of groceries has jumped by 30% since 2022, and it’s not just because of global supply chain issues or natural disasters. Price gouging has also been in the media recently, with some retailers allegedly upping prices more than necessary. It’s no wonder that Aussie households are feeling the cost of living pressures. But here’s a little tip: meal planning. It’s a crucial tool in managing food costs, and we’ve got a Meal Planning on a Budget Guide that can help you stretch your dollars further while keeping your family healthy. Have you seen the latest CHOICE report on which supermarket is the cheapest? ALDI takes the crown, with prices now confirmed to be around 25% lower than Coles and Woolworths.

Check out Tammy Barton’s thoughts on price gouging and how it impacts grocery prices in Australia.

How the cost of living crisis is driving up housing costs in Australia

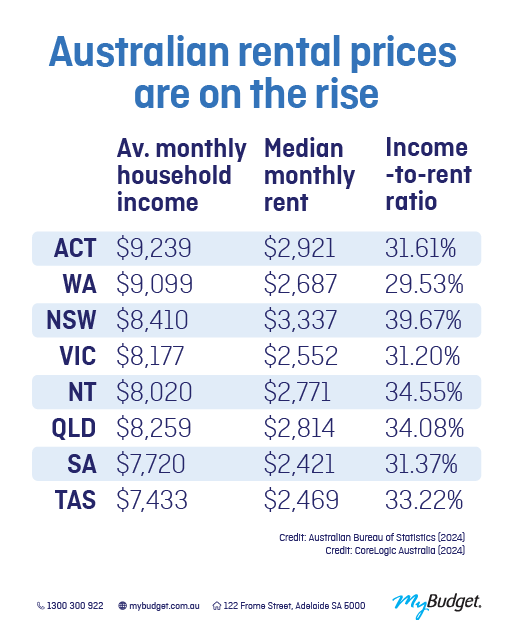

Renting these days? It’s like musical chairs with too many players and not enough chairs! Housing remains one of the most significant financial pressures, with the cost of living rising due to a 5.5% increase in housing expenses over the past year. The national median weekly rent has climbed to $620, marking a 6.1% increase over the past year. Many renters are now opting for rental properties with more bedrooms to share costs, which has driven up rental prices for three-bedroom apartments by 7.2% year-on-year. This trend underscores the financial resilience of Australian households who are increasingly finding ways to adapt in the face of this rental crisis.

Curious about how your expenses compare? Use the Cost of Living Calculator Australia to see how your spending stacks up.

For a broader look at expenses, check out the Canstar Cost of Living Comparison to compare costs across different Australian cities. Be sure to review the details carefully, as costs and savings will vary based on personal circumstances.

Will there be more interest rate rises, and when will the cost of living crisis end?

The RBA remains cautious about future rate increases, with many Australians wondering if we’ve seen the peak of interest rate hikes. While inflation is slowly stabilising, there’s no definitive answer on when rates will ease or whether the cost of living crisis will end anytime soon. But let’s be honest, none of us have a crystal ball to predict what’s coming next. It’s smart to get ahead of the game. Start by building up your financial cushion, whether that means boosting your savings, tightening up your budget, or even paying down some debt. The goal? Be ready for whatever curveball the RBA might throw our way.

How to make ends meet during a cost of living crisis?

It’s time to get up close and personal with your budget. A well-organised budget is like a map; it shows you where your money’s going and where the magic can happen. Here’s some quick tips to help in this cost of living crunch:

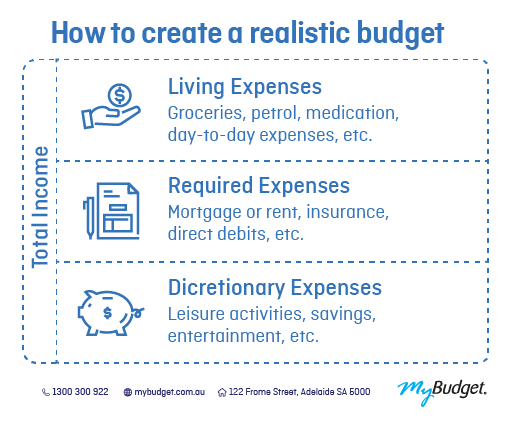

Create a realistic budget to manage rising living costs

- Create a realistic budget: jot down all your income, benefits, side hustles; and split your basic living costs into fixed (rent and ultility bills) and variable (groceries and entertainment). Track your spending for a month using MyBudget’s free Personal Budget Template, and you’ll quickly spot where you can start making savings

- Trim the fat: time to cut those non-essential expenses. Cancel or downgrade those subscriptions you forgot you had, swap pricey nights out for dinner parties at home, and embrace free fun like board game nights or local events

- Shop smart: the rising cost of food can swallow your budget fast, so get strategic:

- Plan your meals: a weekly meal plan saves money on food expenses and keeps you from those expensive last-minute takeaways

- Buy in bulk: stock up on non-perishables when they’re on sale, and go for in-season produce at your local green grocer for the best deals

- Choose store brands: they’re often just as good as the big names but much gentler on the wallet.

- Boost your income: if your budget’s still tight, think about generating more income. Pick up a side hustle, declutter or sell stuff online. Every little bit helps when you’re stretching those dollars in this cost of living crisis.

Managing Australia’s cost of living crisis

The cost of living crisis in Australia isn’t showing signs of easing up anytime soon. But by getting proactive with budgeting, meal planning, and even finding the cheapest fuel, you can take back control and eliminate financial stress.

Stay on top of rising living costs with MyBudget

We know how tough the cost of living crisis is right now. If you’re struggling to keep up with bills, rent, or everyday expenses, you’re not alone. For 25 years, MyBudget has helped over 130,000 Australians regain control of their finances with proven strategies to navigate rising costs.

Here’s how we can support you:

✔️ Personalised budgeting to stay in control

✔️ Bill management to avoid late fees

✔️ Debt reduction strategies to ease financial stress

✔️ Savings plans to help you build financial security

Let us help you stay on top of your finances and reduce financial stress. Enquire online today, or call us on 1300 300 922 to get started.