How much do you need to retire in Australia?

Do you know how much you need to retire comfortably in Australia? MyBudget’s guide covers income targets, super savings, all the latest changes and how they affect you and essential retirement planning tips.

With Australia raising the pension eligibility age to 67, the stakes for retirement planning are high. But really, what does it take to truly enjoy retirement? The answer depends on several factors like: your lifestyle goals, personal circumstances, health needs, housing situation, and average life expectancy.

We’ll unpack the latest changes to the Australian Superannuation guarantee taking effect from July 1, 2025 and see what a comfortable retirement actually costs, the impact of living standards, and how budgeting now can help secure the lifestyle you want later in life.

Superannuation guarantee: what’s changing with super from July 1, 2025?

From July 1, 2025, the Superannuation guarantee (SG) rate will increase from 11.5% to 12%, marking the fifth and final increase in a series of legislated rises that have been gradually implemented since 2021.

Here’s a summary of what’s changing:

- super guarantee increase: from 11.5% to 12%, boosting employer contributions to your super balance

- Parental Leave Pay: super will now also be paid on government-funded Parental Leave Pay, helping bridge the super gap for women and families

- super splitting: more flexibility for couples to share super contributions, helping to reduce super imbalance and improve retirement outcomes

- transfer balance cap: increases from $1.9 million to $2 million, raising the limit on how much can be transferred into the retirement phase.

While the 0.5% increase might seem minor, it can make a meaningful long-term difference. For example, someone earning $70,000 a year could see an additional $350 contributed to their super annually, potentially adding up to a $29,000 boost over 30 years with a 6% annual return.

This change means more Australians will benefit from higher total remuneration packages, while it might not change your take-home pay immediately, it does improve your retirement savings and long-term financial situation. These changes aim to strengthen outcomes for all workers and support a comfortable retirement, especially for those who take career breaks to raise families.

How much income do I need to retire comfortably in Australia?

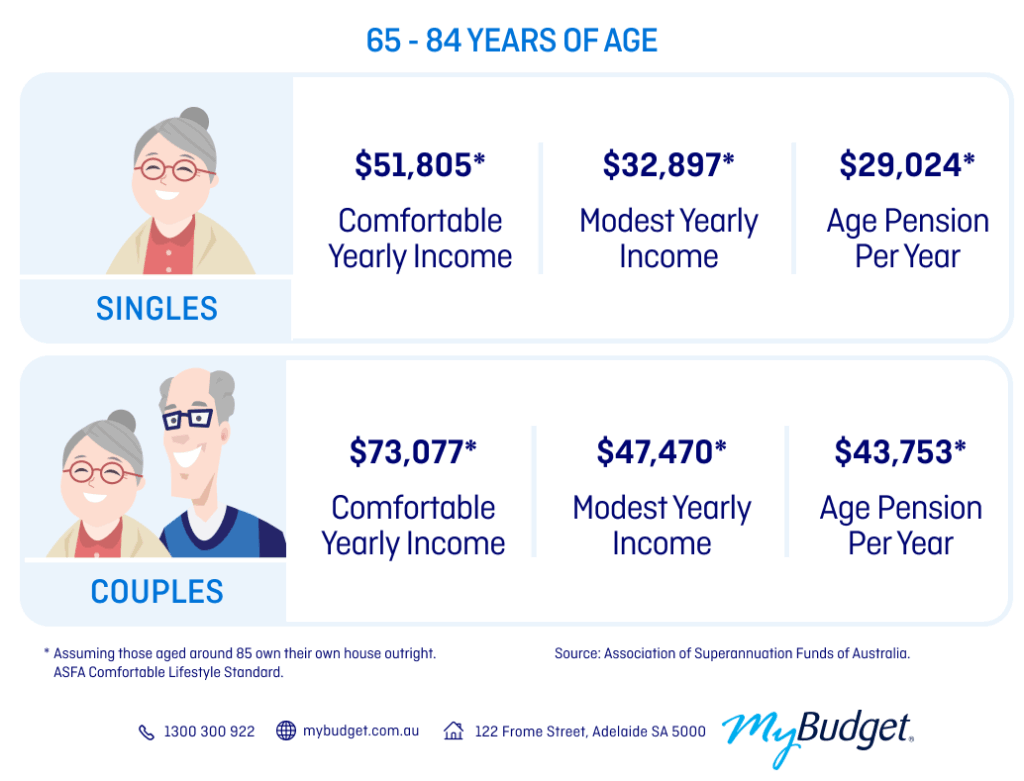

To maintain a comfortable standard of living in retirement, ASFA (Association of Superannuation Funds of Australia) outlines these annual retirement budgets for retirees aged 65–84:

- couple (comfortable lifestyle): $73,077

- single (comfortable lifestyle): $51,805

- couple (modest lifestyle): $47,470

- single (modest lifestyle): $32,897.

These figures assume you own your home outright and are relatively healthy. If you’re renting or expect higher health care costs and medical expenses, you may need significantly more retirement income.

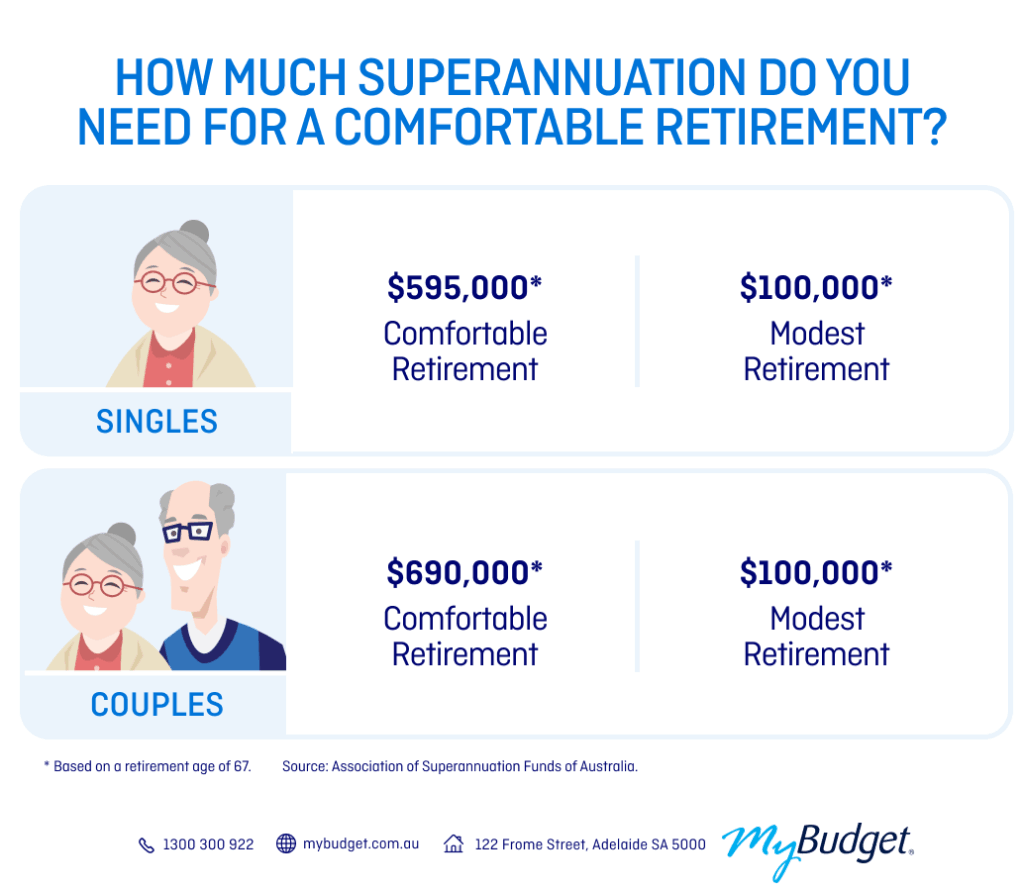

How much super do I need for a comfortable retirement?

According to ASFA, here’s how much super you’ll need by the time you hit 67 to support a comfortable retirement lifestyle:

- couple (comfortable): $690,000 combined

- single (comfortable): $595,000.

These amounts assume you’ll be receiving a part Age Pension and own your home. Use this retirement calculator to see how your current super balance stacks up against your future retirement goal.

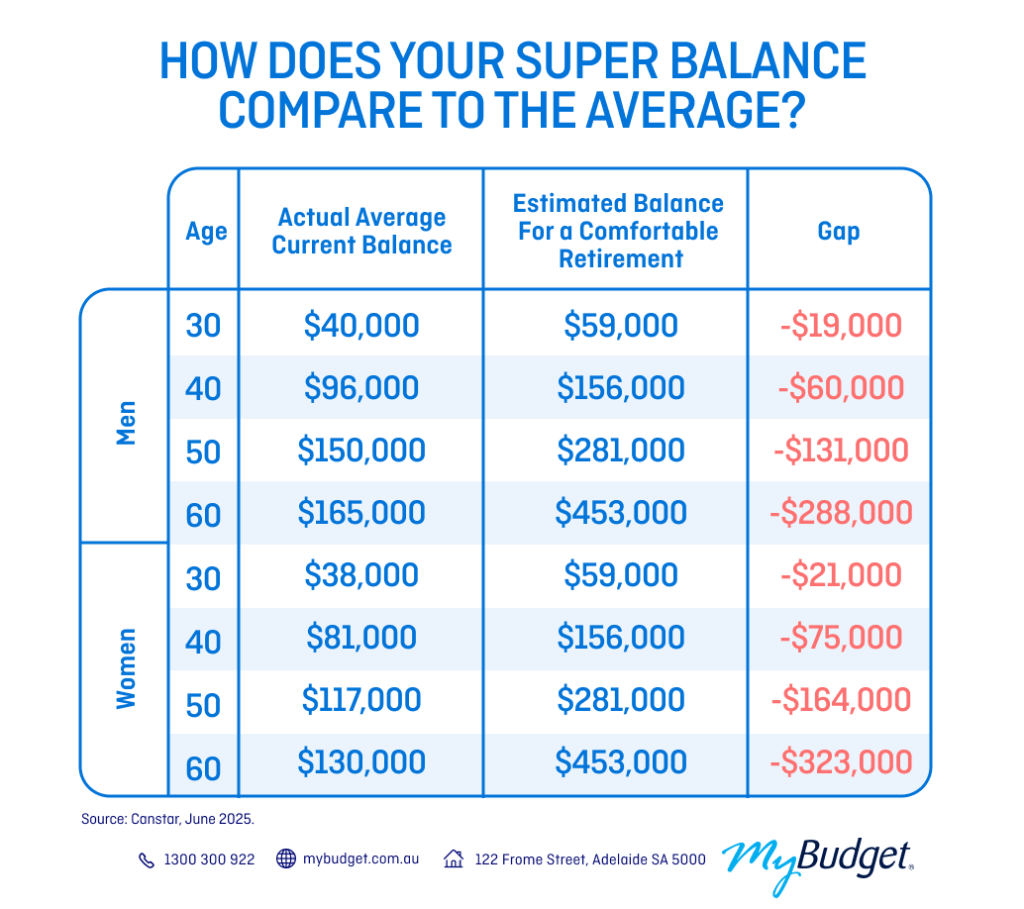

How does your super balance compare to the average?

Curious how your super stacks up? Here’s what Australians on average have saved, according to Canstar:

- men aged 30: $40,000 (required: $59,000)

- women aged 30: $38,000 (required: $59,000)

- men aged 60: $165,000 (required: $453,000)

- women aged 60: $130,000 (required: $453,000).

Many Australians, especially women, fall short of what’s required for a comfortable retirement. Taking time out of the workforce to raise families, combined with part-time work and lower average income, widens the super gap significantly.

Did you know? Only 30% of Australians currently retire with enough super to fund a comfortable lifestyle.

Help! I don’t have enough super

Did you know? 44% of Australians retire with less than $100,000 in super.

If you’re behind on your retirement savings, here are 5 smart moves that could help you retire comfortably:

Review your super fund

Use the ATO’s YourSuper comparison tool to compare performance, fees, insurance, and investment options.

Check for unclaimed super

The ATO is holding billions in unclaimed super. You could be entitled to some of it.

Make additional contributions

Automating even $50 a week into your super can grow significantly over time. Thanks to compound interest, those small amounts snowball into something bigger.

Review your investment strategy

Depending on your goals, a balanced or growth option might offer better long-term results. Get advice from a licensed financial planner that suits your personal circumstances.

Boost income options

Consider downsizing, part-time work or a side hustle to strengthen your retirement income plan. We’ve listed 25 side hustle ideas to get you started.

What is the retirement age in Australia, and when can I access the Age Pension?

In Australia, the Age Pension eligibility age is currently 67 for those born on or after 1 January 1957. If you were born earlier, you may qualify sooner. With increasing life expectancy, there’s been discussion about eventually raising this to 70.

When should I start planning for retirement?

Start planning for retirement today. The sooner you start, the longer compound interest can work its magic, turning small, regular contributions into a solid super nest egg.

How do I start retirement planning?

Build a detailed budget that considers your income in retirement, super savings, private health insurance, and lifestyle in retirement. Set your retirement goals and track your progress.

If you need a hand to get started, download our free Personal Budget Template. It’s a great first step toward achieving your ideal retirement lifestyle.

How can MyBudget help with retirement planning?

MyBudget clients get complete financial guidance and support, with:

☑️ budgeting plans for retirement

☑️ strategies to get out of debt

☑️ savings plans to reach financial goals

☑️ support with creditors and automated bill payments

☑️ life admin sorted, so you can focus on the fun stuff.

For over 25 years, MyBudget has helped Australians design personal budget plans to confidently reach their retirement goals. There’s no obligation to get started, why not give us a call?

Ready to get ahead and stay ahead? Enquire online or call MyBudget on 1300 300 922 to start planning your life, free from money worries.