Debt consolidation vs. personal budgeting: find the best solution for you

Struggling to keep up with mounting debts and endless repayments? Discover how MyBudget’s personal budgeting service offers a smarter, stress-free alternative to debt consolidation. Take control of your finances, eliminate debt faster and start saving for the future you’ve always wanted.

Juggling multiple debts can feel like an impossible balancing act. Debt consolidation might sound like the answer, but is it really the best option for you? At MyBudget, we believe there’s a better way to tackle debt; personal budgeting. With our approach, you’ll manage your finances, pay off debts, and still have room to save for your dreams. Let’s unpack debt consolidation, weigh the pros and cons, and find out why budgeting could be your ultimate solution for financial freedom.

What is debt consolidation?

Debt consolidation is a way to round up all of your debts and turn them into one single loan. The idea is to slash those repayments by bundling everything together at a lower interest rate and have just one streamlined repayment and interest rate to manage, instead of a whole circus of bills.

Types of debt consolidation loans

When it comes to consolidating your debt, there are two main types of loans to consider: secured and unsecured. Each option has its unique perks and potential pitfalls, so understanding the difference is crucial. Let’s break them down to help you figure out which path might suit your financial situation best.

Secured debt consolidation loan

With a secured loan, you’re putting up a specific asset, usually your beloved home as collateral. It’s like offering a little insurance to sweeten the deal for the lender so their risk is minimised if you can’t stick to the repayment terms. Often called mortgage refinancing, it’s a solid option if you’ve got property to back up this type of loan.

Unsecured debt consolidation loan

Without the security of collateral, lenders play it safe by hiking up interest rates. Tammy, Founder and Director of My Budget explains:

“They’re taking a leap of faith, placing trust in your ability to make the loan repayments without any tangible backup. So while it might offer an alternative to pledging your assets, it comes at a cost: a higher interest rate.”

So, whether you’re putting your house on the line or daring to go unsecured, ensure you weigh your options carefully. Each path has potential benefits and risks, and what works for one person might not work for another.

Case studies: real stories of financial transformation

Debbie and Alan: from financial stress to savings

Debbie and Alan’s lives were turned upside down by financial stress. As Debbie recalls:

“Going to MyBudget allowed us to pay our debts; we didn’t have to consolidate any loans. MyBudget negotiated payment arrangements for us. It allowed us to get back on top of things. Now we are looking for how to spend our savings.”

Alan agrees: “Life before MyBudget was, financially, incredibly hard… it got to the point you worry about answering the phone. Now, we know we have funds available if we need them. We have less stress and hassle.”

Their story is a powerful reminder that a personalised budget, expert guidance, and creditor negotiation can be life-changing.

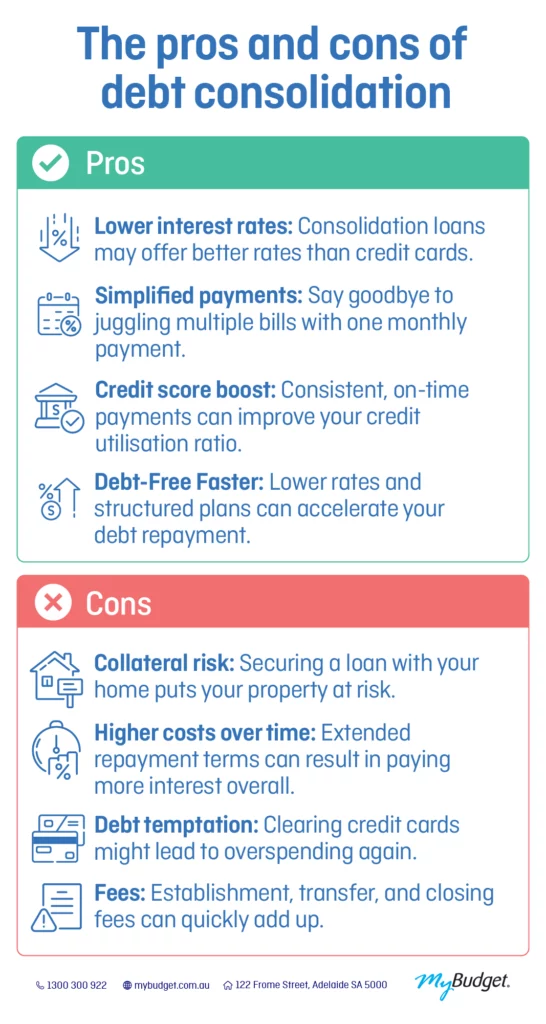

The pros and cons of debt consolidation

It is important to be informed and make the right decision for your needs: let’s take a moment to break down the top five benefits of debt consolidation, because knowing the perks can set you on the path to financial success.

Benefits of debt consolidation?

- Lower interest rates: say goodbye to those eye-watering interest rates on credit cards and hello to potentially lower ones when you consolidate.

- Streamlined payment: simplify your life with just one consolidated monthly repayment instead of juggling a circus of bills. No more late payments!

- Credit score boost: consistent on-time payments for your consolidation loan will improve your credit utilisation ratio.

- Better cash flow: lower monthly payments for your consolidated loan mean more money in your pocket for fun stuff (or other important things like emergencies).

- Debt-free faster: with lower rates and a clear plan, you might just pay off your current loans faster, together in one. Smashing goals and getting ahead… here you come!

Risks of debt consolidation?

Here’s the thing, debt consolidation might feel like a quick fix, but it can bring long-term challenges. From added interest to tempting overspending, it’s not always the solution it seems. Before committing, let’s explore the top five risks to help you make informed decisions and protect your financial future.

- Collateral risk: putting your home or property on the line for an all in one consolidated loan can be nerve-wracking.

- Higher cost over time: extending the loan term for the sake of consolidating? That’s extra time for interest to cosy up and compound over the long haul, increasing the debt balance.

- Debt temptation: clearing credit card debt might tempt you to spend again. Discipline is key!

- Fees: watch out for those pesky establishment fees, balance transfer fees and closing fees. They add up fast!

- Credit score hits: applying for a new loan can temporarily lower your credit score and credit age.

When you tie your debts to your home sweet home, there’s more at stake than just your credit score. So, unless you’re feeling rock-solid about your income and job security, it might be time to pump the brakes and explore some other options.

Alternatives to debt consolidation:

At MyBudget, we believe debt consolidation isn’t always the best answer. Here are three alternative approaches to consider:

1. Personal budgeting: a smarter way to manage debt

Getting a personal budgeting plan is the foundation for paying off debt and avoiding debt consolidation. A solid, realistic budget tailored to your lifestyle and goals will allow you to:

- Create a clear debt repayment plan with your personal budget: know exactly where your money is going and how to tackle debts step by step.

- Negotiate with creditors as a part of the professional setup of the budgeting process: a structured budget shows creditors you’re serious about repaying your debts and helps make a convincing case for reduced interest rates or better repayment terms.

- Manage daily expenses while saving for your goals: strike the perfect balance between living your life and planning for a brighter financial future

A well-structured budget plan is your ultimate tool for regaining financial control, avoiding the negative aspects debt consolidation if they are not right for your circumstances, and achieving goals and financial dreams that once felt out of reach. Whether you’re just starting out or in need of a budget refresh, a personal budget can set you on the right path. At MyBudget, we create personalised budgeting plans that help you tackle debt, build savings, and achieve your long-term financial dreams.

2. Direct negotiation

Direct negotiation with creditors is a powerful tool for taking control of your debt, where a new budget plan is a greater solution to your circumstances instead of debt consolidation, making repayments more manageable, and reducing financial stress.

Tammy makes the point that it is easier than is seems:

“It’s about opening the lines of communication to work out terms that actually work for you, and yes, it’s easier than you think.”

Here’s how direct negotiation can be a smart alternative to debt consolidation:

- Lower interest rates, potentially than you’d ever get with debt consolidation: slash the cost of your debt by negotiating reduced interest rates, giving you more breathing room in your budget.

- Extended repayment terms than a consolidation loan: stretch repayments over a longer period to ease monthly financial pressure without adding new loans to the mix.

- Simplified payment plans: combine multiple debts into one manageable repayment without the need for an all in one consolidation personal loan.

Direct negotiation isn’t just about cutting costs, it’s about taking back control of your finances. If handling it solo feels overwhelming, MyBudget’s Debt Arrangement Team can even do the negotiating for you, saving time, reducing stress, and helping you work toward your financial goals. It’s about making your debt work for you, not against you.

3. Avoiding pitfalls with debt management plans

Community-based credit counselors like The National Debt Helpline offer advice and negotiation assistance. These services can be valuable, but if you find you require a more comprehensive, personalised management, MyBudget provides tailored, hands-on support to ensure you regain total financial control.

When debt consolidation is the right solution

Sometimes, consolidating your debts into one, consolidation loan with a simple repayment structure is the right option. Review some case studies to understand and learn more to make an informed decision about what might be right for you when considering whether to consolidate your debts.

Hear from more of our clients: when to budget verses when to consolidate your debt

Callum and Sally: why debt consolidation was the best solution

17 personal debts all consolidated into 1 lower, simple repayment:

Callum and Sally were juggling 17 debts, including family loans, a home loan, and personal loans, with monthly repayments totaling $5,841. With help from MyBudget Loans, they consolidated their debts into a single payment of $4,099, saving $1,741 a month. This life-changing reduction allowed them to repay family loans and unlock $33,000 for much-needed home renovations.

Debt consolidation worked for Callum and Sally because they paired it with discipline and a clear repayment plan. With MyBudget Loans, Callum and Sally found a solution that simplified their finances, reduced their costs, and set them on the path to thrive financially for the long-term.

Jerry’s path to financial freedom: avoiding debt consolidation with a personal budget

Saving $5,000 with a budgeting plan instead of choosing debt consolidation.

Jerry thought debt consolidation was his only way out. Overwhelmed by bills and the soaring cost of living, he was living off his overdraft, and his mental health was suffering. Instead of taking on another loan, Jerry turned to MyBudget.

Our Personal Budget Specialists crafted a tailored budget and negotiated with his creditors to get his bills under control. No more sleepless nights or dodging overdue notices!

One year later, Jerry had saved $5,000, paid down his overdraft, and regained financial control. By choosing budgeting over debt consolidation, Jerry avoided the risks of another loan and tackled his financial challenges head-on with discipline and a clear plan. This sustainable approach didn’t just address the immediate problem; it laid the foundation for Jerry’s long-term financial freedom.

What about for you… is personal budgeting is better than debt consolidation?

The answer isn’t a one-size-fits-all, it depends entirely on your unique financial situation. Both options have their pros and cons, and finding the best solution requires weighing your goals and circumstances. That’s where MyBudget comes in.

With MyBudget’s tailored services, you’ll get a personalised approach to managing your debt, whether that’s through budgeting, debt consolidation, or a mix of both. Here’s what MyBudget will offer:

- Tailored budgets: we create personalised plans that fit your lifestyle and financial goals.

- Creditor negotiation: our team works hard to secure better repayment terms for you.

- Savings potential: build a financial safety net while tackling your debt.

- Ongoing support: our experts guide you every step of the way, so you’re never alone in your financial journey.

Ultimately, the best way to decide is to get in touch with us for a free consultation. Together, we’ll uncover the approach that works for you and sets you on the path to financial freedom.

Final thoughts: should you consolidate your debt?

Debt consolidation can simplify repayments by rolling them into one loan, and for some, it can be an effective way to regain control. But it’s not a magic fix. While it may offer short-term relief, it also carries risks like higher overall costs, potential fees, and even tying up your home as collateral.

On the other hand, personal budgeting offers a sustainable approach to tackling debt without the need for a new loan. With a tailored budget, you’ll gain clarity on what you can repay and how quickly, while also building financial stability. Budgeting helps you trim unnecessary expenses, manage repayments efficiently, and plan for a financially secure future.

Take control of your debt with MyBudget

At MyBudget, we specialise in creating personalised plans designed to empower you to pay off debt, save money, and achieve your financial goals. Both options have their place, but before committing to debt consolidation, it’s worth considering whether a fresh look at your budget might be the smarter solution for your unique situation.

Have questions about debt consolidation? Let us help you take control of your finances and tackle debt head-on. Enquire online or call 1300 300 922 and let’s create a plan that works for you.

Cheryl is part of the MyBudget Corporate Finance team, ensuring everything runs smoothly behind the scenes. A big fan of side hustles, her own is writing for MyBudget, where she shares insights from her personal journey through separation, single parenting, and surviving cancer.