Credit card balance transfers done right: pay off credit card debt faster

Get the facts on how credit card balance transfers, done right, can fast-track your debt repayment and give you a fresh financial start.

Did you know? As of 2024, Australians had an average credit card balance of $3317, and Australians collectively owed $41.54 billion, according to money.com.au. While this number might be alarming, there is a silver lining: credit card balance transfers can be a smart way to manage debt; if done wisely. Let’s explore how you can use them to get ahead and take charge of your money.

What is a credit card balance transfer?

A credit card balance transfer allows you to move your existing card debt to a new credit card company with a lower (sometimes 0%) introductory interest rate for a promotional period. The idea? Save on interest and funnel your repayments directly towards your principal balance. But here’s the catch: once that promotional period ends, rates often skyrocket to 20% or more, so it’s essential to have a plan.

Balance transfer benefits: why they’re worth considering

The primary appeal of balance transfer cards lies in their ability to help you pay off high-interest debt faster. With some cards offering up to 24 months interest-free, your monthly payments can go entirely towards reducing your balance rather than being eaten up by regular interest rates. For example, transferring a $5,000 balance from a card with a 20% annual percentage rate could save you hundreds of dollars in interest in just six months. Additionally, many credit card companies offer rewards for timely payments during promotional periods.

But remember, it’s not a magic wand. Using a balance transfer card effectively requires discipline and a clear repayment strategy.

How having a budget helps with planning for credit card balance transfers

Before signing up to a balance transfer credit card, it’s crucial to know how much you can afford to repay. This is where having a solid budget becomes invaluable. A budget helps you understand your income, expenses, and how much you can allocate towards paying down your debt without overcommitting.

Take advantage of MyBudget’s Personal Budget Template to visualise how much you can pay off each month and see your path to becoming debt-free. With this knowledge, you’ll be able to choose the right balance transfer credit card deal and avoid financial stress.

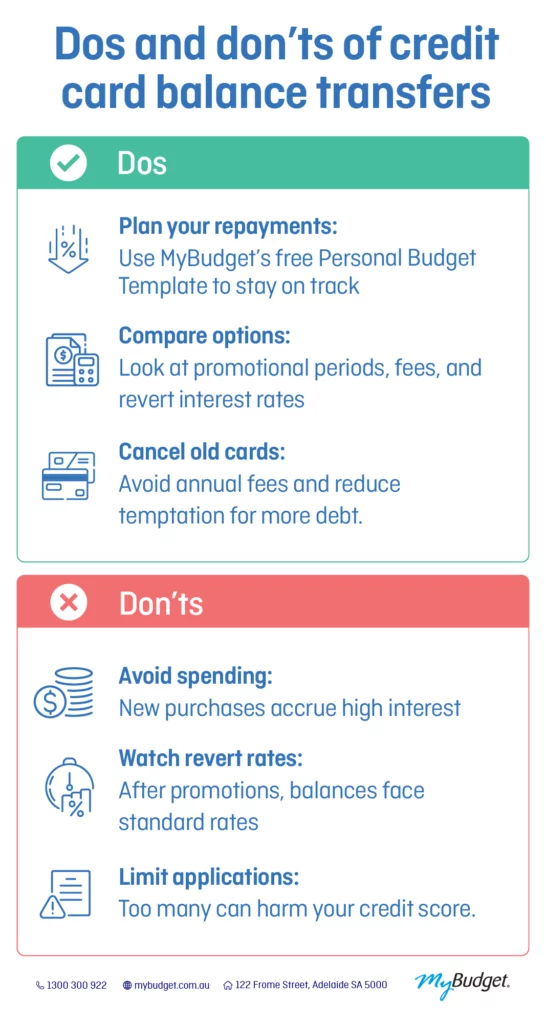

Dos and don’ts of credit card balance transfers

To get the most out of your balance transfer process, here are some best practices:

Avoid transfer fees where possible

Some balance transfer credit cards come with upfront fees, often 1-3% of the transferred balance. These costs can add up quickly, especially if you’re transferring a large amount. With careful research, you can find cards that don’t charge these fees, helping you save even more money. Also, check with credit unions as they often provide competitive rates and fewer hidden fees compared to larger banks.

Alternatives to balance transfers: how MyBudget can help you pay off debt

If a balance transfer isn’t the right fit for you, MyBudget has your back with smarter solutions. Consider MyBudget Loans for a personal loan or debt consolidation loan. These options provide a clear, structured path to tackle your debt, avoiding the risks associated with balance transfers like high revert rates and transfer fees.

MyBudget doesn’t just stop at loans; we specialise in creating tailored budgeting plans to help you manage your money and build better money habits. Our personalised strategies take the stress out of debt management and set you on a path to long-term financial freedom.

Further reading: Is debt consolidation right for you?

Balance transfer action plan: 5 steps to becoming credit card debt-free

- Budget first: know what you can repay

- Choose wisely: find 0% cards with low fees

- Repay fast: clear debt during the promo period

- No new spending: don’t use the new card

- Cancel the old card: avoid extra fees and temptation.

Ready to break up with credit card debt?

A balance transfer card can be a powerful tool in your debt-busting arsenal, but it’s just one part of the puzzle. Building a budget, adopting new spending habits, and creating an emergency fund are crucial steps towards long-term financial health.

If you’re unsure how to get out of credit card debt, MyBudget can help. Our team specialises in creating tailored budget plans to tackle debt while helping you build better financial habits for the future. With over 130,000 Australians guided to financial freedom, we’re here to simplify the journey.

Claim your free tailored budget plan today or call us now on 1300 300 922 for a free, no-obligation chat. Let’s transform your money story together.