Personal Budget is a financial plan outlining an individual's anticipated income and expenses over a specified period. It serves as a strategic tool for managing finances, ensuring efficient allocation of resources.

The budget typically includes categories such as income sources, fixed and variable expenses, savings goals, and potential investments. By tracking expenditures and adhering to the budget, individuals aim to attain financial stability, control debt, and achieve long-term objectives. Creating, monitoring, and adjusting a personal budget demands disciplined financial awareness and decision-making, enabling individuals to make informed choices about their money.

What are the key components of a personal budget?

In the realm of personal finance, one crucial aspect that individuals must grapple with is the allocation of funds within their personal budget. This intricate process involves carefully considering various factors, such as income sources and essential expenses.

How do people allocate funds in a personal budget?

One approach to allocating funds in a personal budget involves determining fixed expenses and variable expenses. A successful budget requires careful consideration of both types of expenses.

Fixed expenses, such as rent or mortgage payments, remain constant from month to month and are essential for maintaining a stable lifestyle.

On the other hand, variable expenses fluctuate depending on individual choices and circumstances. These may include groceries, entertainment, or transportation costs.

To create an effective budget, individuals can utilise various tools, such as budget templates or budget planners, to track their monthly income and expenditures accurately.

By organising monthly expenses according to fixed and variable categories, individuals can gain a clearer understanding of their spending habits and make informed decisions regarding their financial goals.

Adjusting your budget regularly is crucial in order to align your spending with your financial objectives and maintain control over your finances.

What are common sources of income in a personal budget?

Common sources of income in a personal budget can include employment wages, investments, rental properties, and government assistance programmes. These sources of income play a crucial role in determining the financial situation of an individual or household. When creating a personal budget plan, it is essential to accurately track expenses and ensure that monthly income exceeds expenses. This helps determine the nett income available for savings goals and other financial aspirations. To illustrate the significance of these sources of income, consider the following table:

| Source of Income | Description | Frequency |

|---|

| Employment Wages | Earnings from a job or self-employment | Regular basis |

| Investments | Profits generated from investment portfolios | Irregular basis |

| Rental Properties | Income generated from renting out properties | Monthly basis |

| Government Assistance Programmes | Financial aid provided by government programmes | Periodic basis |

Understanding and effectively managing these common sources of income is vital for individuals seeking to create and maintain a successful personal budget.

What are the essential expenses people consider in a personal budget?

Essential expenses considered in the management of personal finances encompass categories such as housing, transportation, healthcare, education, and food. Budgeting for these expenses is crucial to ensuring financial stability and achieving long-term financial goals.

Monthly budgets help individuals allocate a portion of their income towards essential expenses while maintaining a savings plan. Housing costs typically include rent or mortgage payments, property taxes, and utilities. Transportation expenses may cover car payments, fuel costs, insurance premiums, and maintenance fees. Healthcare encompasses health insurance premiums, doctor visits, medications, and emergency medical services. Education expenses can include tuition fees, textbooks, and educational supplies. Lastly, food costs involve groceries and dining out expenditures.

Tracking spending on essential expenses allows individuals to identify areas where they can cut back or make adjustments to meet their financial goals effectively. Building an emergency fund is also important to cover unexpected expenses that may arise.

How does discretionary spending fit into a personal budget?

Effective expense tracking is a crucial aspect of maintaining a well-structured personal budget. By implementing strategies such as categorising expenses, setting spending limits, and regularly reviewing financial records, individuals can gain better control over their finances and make informed decisions about their spending habits.

Financial goals also play a significant role in shaping the structure of a personal budget, as they provide direction and motivation for saving and investing. Whether it's paying off debt, saving for retirement, or buying a house, having clear financial goals allows individuals to prioritise their expenses and allocate resources accordingly.

Furthermore, saving is an essential component of a well-structured personal budget, as it provides individuals with an emergency fund and helps them achieve long-term financial stability. By setting aside money regularly and making savings a non-negotiable part of their budgeting process, individuals can build wealth over time and protect themselves from unforeseen circumstances.

What are strategies for effective expense tracking in a personal budget?

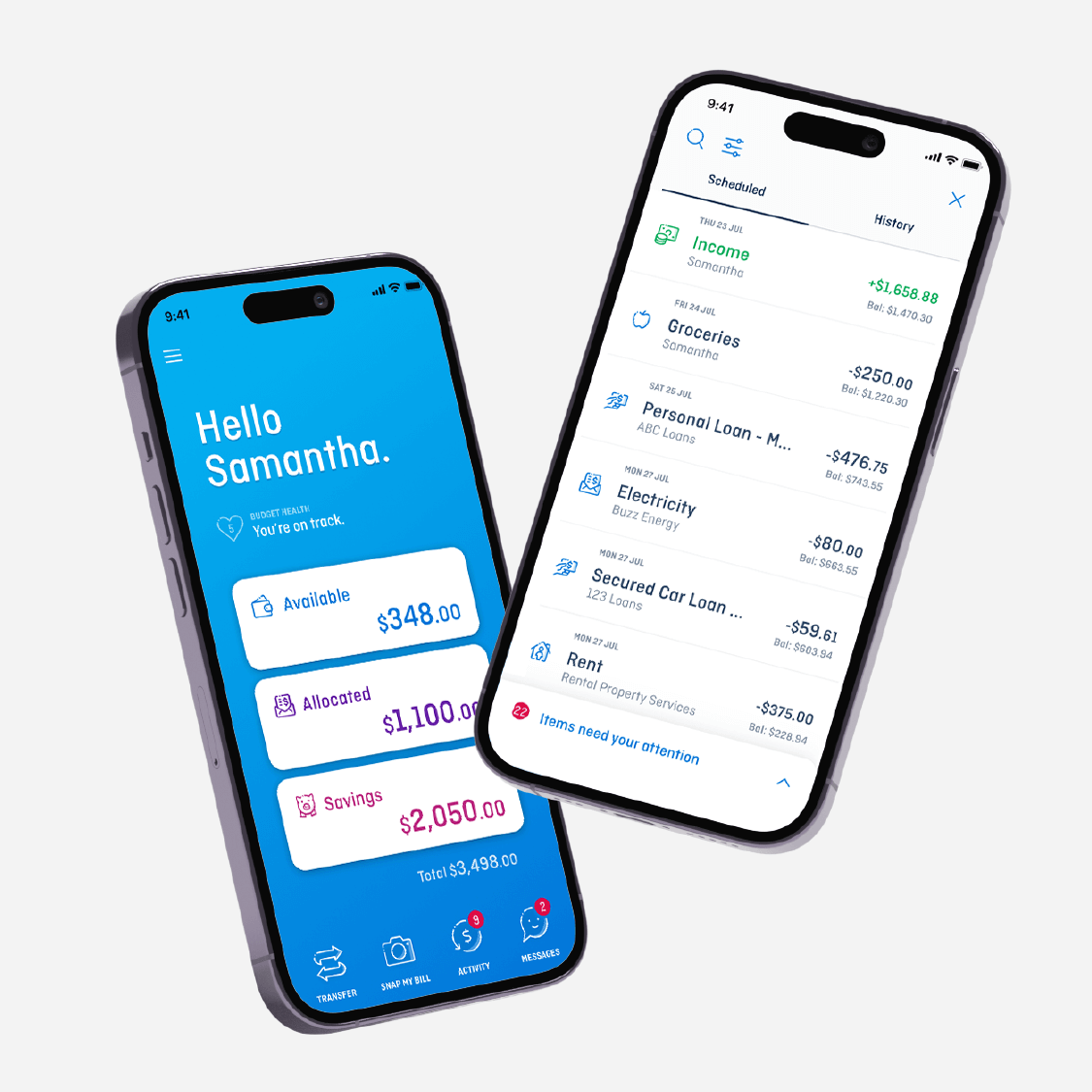

One approach to facilitating accurate expense tracking in a personal budget is to implement digital tools and apps specifically designed for this purpose. These technological aids provide individuals with the ability to effectively manage their finances, ensuring that they stay within their budget and meet their financial goals.

Budget spreadsheets and calculators offer users the means to organise and track their income, expenses, and savings accounts in an easily accessible format. By categorising expenditures into specific budget categories, individuals can gain a comprehensive understanding of where their money is being spent.

Furthermore, these tools enable users to link their bank accounts for seamless integration of financial data, providing real-time updates on transactions. With the help of digital tools such as budget worksheets and monthly budgeting apps, individuals can enhance their financial planning skills and save money more efficiently within the confines of a household budget.

How do financial goals impact the structure of a personal budget?

Financial goals play a crucial role in shaping the structure of an individual's budget. When setting financial goals, individuals need to consider various factors such as income, expenses, and long-term aspirations. These goals have a direct impact on how a personal budget is structured and managed.

To understand the relationship between financial goals and the structure of a personal budget, let's explore an example scenario:

| Financial Goal | Impact on Budget Structure |

|---|

| Save for a house | Increase savings category |

| Pay off debt. | Allocate more funds towards debt repayment. |

| Start a business. | Create a new category for business expenses. |

As seen from this table, different financial goals require adjustments to be made within the personal budget. This ensures that sufficient funds are allocated towards achieving these goals while still meeting other essential expenses.

Overall, understanding how financial goals impact the structure of a personal budget helps individuals align their spending habits with their long-term objectives. By making intentional decisions about allocating funds based on these goals, individuals can work towards achieving financial stability and success.

What role does saving play in a well-structured personal budget?

Saving plays a crucial role in the structure of a well-structured individual's financial plan. It serves as the foundation upon which one can build a secure and stable future. By putting money into a savings account, individuals are able to save money for emergencies, unexpected expenses, and long-term financial goals.

Creating a budget is essential for managing personal finances effectively. It helps individuals track their income and expenses, identify areas where they can spend less, and make adjustments to reach their financial goals. A well-designed budget helps individuals take control of their finances by providing them with a clear roadmap on how to allocate their resources wisely.

With proper budgeting practises in place, individuals can create personal budgets that not only ensure they meet their immediate needs but also allow them to save for the future and achieve long-term financial success.

What sources of income are typically found in a personal budget?

Typically, sources of income in a personal budget include various forms of employment, investments, and government benefits. Income is the lifeblood of any financial plan, as it determines our ability to meet expenses, save for the future, and achieve financial goals. Understanding our income sources allows us to make informed decisions about how we allocate our earnings.

Employment income is often the primary source and can be supplemented with investment returns or dividends from stocks and bonds. Government benefits such as social security or unemployment benefits provide additional support. By carefully analysing our actual income and expenses, we can identify areas where adjustments can be made to improve our financial situation.

This includes evaluating spending habits, reducing discretionary spending, and prioritising savings and debt repayment. Incorporating multiple sources of income into a personal budget provides stability and flexibility for managing finances effectively.

What are the fundamental expenses considered in a personal budget?

Expenses considered in a personal budget typically consist of necessary costs such as housing, transportation, and healthcare. These essential expenses form the foundation of an individual's financial plan and must be carefully managed to ensure financial stability. In addition to these basic needs, individuals may also allocate funds towards other living expenses, such as groceries, utilities, and insurance. It is important for individuals to prioritise their spending and make informed decisions based on their income levels and financial goals.

To provide a visual representation of the different types of expenses that can be included in a personal budget, the following table outlines some common categories:

| Category | Examples |

|---|

| Housing | Rent/mortgage payments |

| Transportation | Car loan or lease payments |

| Healthcare | Health insurance premiums |

| Groceries | Food expenditure |

| Utilities | Electricity/water bills |

How does discretionary spending integrate into a personal budget?

Discretionary spending plays a crucial role in the allocation of funds within an individual's financial plan. It is the portion of one's personal budget that allows for choice and flexibility, providing the opportunity to indulge in non-essential purchases or experiences.

Integrating discretionary spending into a personal budget requires careful consideration and prioritisation. This article section will explore how individuals can effectively incorporate discretionary spending into their financial plans in a way that is relevant and contextually appropriate.

What tactics exist for efficient expense tracking in a personal budget?

One effective approach to efficiently tracking expenses within an individual's financial plan involves implementing a systematic method for categorising and documenting all financial transactions.

Creating a personal budget is the first step towards gaining control over one's finances. However, simply making a budget is not enough; it is crucial to track expenses on a regular basis to ensure that they align with the allocated amounts.

To achieve this, several tactics can be employed. One tactic is to keep all receipts and invoices organised in a designated folder or digital file.

Another tactic involves using expense tracking apps or software that automatically categorises expenditures and provides visual representations of spending patterns month-to-month.

Additionally, setting aside dedicated time each week or month to review and update expense records can help maintain an efficient expense tracking system within the personal budget.

In what ways do financial objectives shape the architecture of a personal budget?

Financial objectives significantly influence the structure and design of an individual's financial plan. A personal budget is like the architectural blueprint for one's financial goals, shaping the way income, expenses, and savings are allocated.

The first step in creating a personal budget is to identify specific financial objectives. These objectives act as guiding principles that determine how funds are distributed and utilised within the budget framework. For example, if someone's objective is to save for a down payment on a house, their budget will likely allocate a larger portion of their income towards savings and reduce spending in other areas.

Similarly, if someone's goal is to pay off debt, their budget may prioritise debt repayment by allocating more funds towards clearing outstanding balances. Financial objectives provide the structure and shape for a personal budget, ensuring that resources are allocated efficiently and effectively towards achieving desired goals.

What role does saving assume in a meticulously structured personal budget?

Savings assumes a crucial role in a meticulously structured financial plan, as it serves as a means of accumulating funds for future needs and goals.

In the context of a personal budget, saving is an essential component that ensures stability and security. By allocating a portion of their income towards savings, individuals can build up an emergency fund to handle unexpected expenses or create opportunities for future investments.

The role of saving in a meticulously structured personal budget is multifaceted. It not only provides a safety nett but also enables individuals to achieve long-term goals such as buying a house, funding education, or planning for retirement.

Choosing the appropriate amount to save requires careful consideration and analysis of one's income, expenses, and financial objectives.

Consequently, saving plays an indispensable role in shaping and maintaining the overall financial health of an individual within their personal budget structure.

How do people prioritise debt repayment within a personal budget?

The differences between fixed and variable expenses in a personal budget are crucial to understanding how one's financial plan adapts to life changes or unexpected events.

Fixed expenses refer to those recurring costs that remain constant month after month, such as rent or mortgage payments, insurance premiums, and loan repayments.

On the other hand, variable expenses are discretionary in nature and can fluctuate from one period to another, encompassing categories like entertainment, dining out, and travel.

When it comes to adapting personal budgets to life changes or unexpected events, individuals must be prepared for adjustments in both fixed and variable expenses.

Circumstances demand careful consideration of priorities and the allocation of resources.

What are the differences between fixed and variable expenses in a personal budget?

One key distinction in a personal budget lies in categorising expenses as either fixed or variable.

Fixed expenses refer to regular, recurring costs that remain relatively stable from month to month, such as rent or mortgage payments, utility bills, and loan repayments. These expenses are often non-negotiable and must be paid consistently to maintain one's financial stability.

Variable expenses, on the other hand, are more flexible and can fluctuate based on individual choices and circumstances. These may include groceries, entertainment, transportation costs, and discretionary spending.

Understanding the difference between fixed and variable expenses is crucial for effective budgeting, as it allows individuals to allocate their income appropriately towards meeting their financial goals.

How do personal budgets adapt to life changes or unexpected events?

Adapting to life changes or unexpected events necessitates a reassessment of financial allocations and adjustments in order to maintain stability. A personal budget is a crucial tool that enables individuals to keep track of their income, expenses, savings, and progress towards their financial goals.

However, when faced with unforeseen circumstances such as job loss, medical emergencies, or major life events, it becomes necessary to adapt the personal budget accordingly. This involves reevaluating income sources and potentially finding new ones, identifying areas where expenses can be reduced or eliminated, and reallocating funds towards immediate needs or building up emergency savings.

Furthermore, tracking expenses becomes even more important during these times of uncertainty in order to identify any unnecessary expenditures and make informed decisions about where to cut back.

How do personal budgets adapt to life changes or unexpected events?

In response to life changes or unexpected events, personal budgets require adjustments in order to maintain financial stability. A personal budget is a crucial tool that helps individuals manage their expenses, income, and savings and work towards achieving their financial goals. However, life is full of uncertainties, and one can never be fully prepared for the unexpected.

Whether it's a sudden medical emergency or a job loss, these unforeseen events can significantly impact one's financial situation. When faced with such challenges, individuals must adapt their personal budgets accordingly. This may involve cutting back on discretionary expenses, finding ways to increase income through additional sources or side hustles, and reevaluating short-term and long-term financial goals.

It is also important to ensure that emergency funds are readily available in a separate bank account to cover any unexpected expenses that may arise. By actively monitoring and adjusting their personal budgets in response to life changes or unexpected events, individuals can better navigate through challenging times while maintaining financial stability.

How do personal budgets accommodate life changes or unforeseen circumstances?

To accommodate life changes or unforeseen circumstances, individuals must make necessary adjustments to their financial plans. Creating a personal budget is crucial to managing one's finances effectively. It helps individuals set goals and allocate funds accordingly, ensuring that they are on track to reach their financial objectives.

However, life is unpredictable, and unexpected events can disrupt even the most thoughtfully crafted budget. For instance, an unexpected expense such as a car repair can throw off monthly expenditures and savings targets. In such situations, individuals need to adapt their budgets by reassessing their priorities and making necessary cuts or reallocations.

This may involve reducing discretionary spending or finding alternative ways to save money without compromising essential expenses. By being flexible and proactive in adjusting their budgets, individuals can navigate through life changes and unforeseen circumstances while still working towards their financial goals.

What advantages arise from maintaining a balanced personal budget?

Maintaining a harmonised financial plan provides several advantages, including increased control over spending habits and an improved ability to save for future goals.

A personal budget serves as a roadmap for effective money management, enabling individuals to allocate their income towards essential expenses while also setting aside funds for savings. By maintaining a harmonised budget, individuals can better monitor their expenses and identify areas where they may be overspending. This newfound control over spending habits allows individuals to make informed decisions about their finances and adjust their behaviour accordingly.

Moreover, a harmonised personal budget facilitates the development of healthy saving habits. It encourages individuals to set specific savings goals and allocate funds towards systematically achieving them.

Ultimately, maintaining a harmonised personal budget empowers individuals to take charge of their financial futures by actively managing their income and expenses in line with their long-term goals.

How do individuals modify their budgets to attain enduring financial stability?

Individuals can achieve enduring financial stability by making adjustments to their spending patterns and prioritising long-term savings goals. Modifying personal budgets is a crucial step in this process. It involves analysing income, expenses, debts, and savings to identify areas for improvement.

One way to modify a budget is by reducing discretionary expenses such as eating out or entertainment costs. This can free up funds that can be redirected towards paying off loans or credit card debt. Additionally, individuals may consider increasing their income through part-time work or freelancing opportunities.

Another strategy is to review insurance policies and compare rates to ensure optimal coverage at the best price. By modifying their budgets in these ways, individuals can gradually achieve enduring financial stability while still meeting their immediate needs and future aspirations.

What are the prevalent missteps to steer clear of when formulating a personal budget?

Common errors that individuals should avoid when creating a financial plan include neglecting to account for unexpected expenses and failing to regularly review and adjust the budget as needed.

Creating a budget is essential for managing personal finances effectively. It provides a clear picture of one's financial situation and helps determine how much money can be spent and saved. However, many people make prevalent missteps in this process.

One such misstep is not keeping track of expenses, which makes it difficult to know exactly where the money is going.

Another misstep is not setting aside enough money for emergencies, leading to financial strain when unexpected costs arise.

Additionally, failing to prioritise saving and instead spending all available income can hinder long-term financial stability.

Therefore, it is crucial to be mindful of these common errors while creating a budget in order to achieve financial success.

How do personal budgets contribute to realising financial aspirations?

Creating and adhering to a well-structured financial plan allows individuals to set clear goals, allocate resources effectively, and make informed decisions that contribute to the realisation of their financial aspirations.

A personal budget is an essential component of this plan, providing a roadmap for successful money management. By carefully tracking income and expenses, individuals can identify areas where they can save or cut back on spending. This enables them to prioritise their financial goals and allocate funds accordingly.

Moreover, a personal budget helps individuals stay accountable for debt repayment by allocating a portion of their income towards reducing outstanding balances. It also promotes saving for future needs or emergencies.

Through disciplined adherence to a personal budget, individuals can take control of their finances and work towards achieving their long-term financial aspirations.

In what manner does one's mindset influence the success of a personal budget?

The success of a personal budget is not solely dependent on the numbers and figures recorded in spreadsheets. Rather, it is greatly influenced by an individual's mindset and their approach towards financial management. The way one perceives and prioritises their expenses, savings, and investments can significantly impact the success of their personal budget.

To comprehend the influence of mindset on budgetary triumph, it is essential to explore various mindsets that individuals may adopt when managing their finances. A study conducted by researchers identified three distinct mindsets that people typically possess: scarcity mindset, abundance mindset, and growth mindset.

| Mindset | Characteristics | Influence on Budgetary Triumph |

|---|

| Scarcity | Focuses on lack and limitation regarding money and tends to prioritise immediate needs over long-term goals. | May struggle with saving or investing due to a fear of running out of money; might find it challenging to stick to a budget |

| Abundance | Embraces an optimistic outlook towards money and believes in abundance and opportunities for financial growth. | More likely to save consistently and allocate funds towards future goals; open to exploring investment options |

| Growth | Views financial setbacks as learning experiences and seeks continuous improvement in financial knowledge and decision-making skills. | Adopts flexible strategies when faced with unexpected circumstances or changes in income; actively seeks ways to increase earning potential through self-improvement initiatives |

Understanding these mindsets can help individuals identify their own approach to finances and make necessary adjustments. By cultivating a growth or abundance mindset, one can overcome limitations imposed by scarcity thinking, thereby increasing the likelihood of achieving success with their personal budget. In the following article section, we will delve deeper into each mindset's characteristics within the context of personal budgeting while providing practical tips for developing a positive money mentality.

This article covers

Budget template home loan term deposit search search monthly budget budget planner loans credit budget spreadsheet home loans free personal budget calculator travel insurance loans insurance loans home free budget car loans net income saving money term deposits spend money home insurance main content credit cards budget worksheet money coming car insurance total income you’re spending financial services australian credit cash flow create a budget make a budget adjust your budget amount of money credit cards personal loans income expenses reach financial goals make sure help make spending money budget help services help best budgeting save month spending month change month may need budget need need save creating plan spend save savings debt repayment know much much spend money spend create budget create personal budget paying debt use budget use personal take look take home pay long take actual income expenses help save money put money put toward money put expenses car keep money help keep know money part time period time change time help reach financial goals track spending control finances picture finances average monthly income creating personal budget creating budget ways save best ways bank credit first budget first bank first time set savings insurance car rent mortgage insurance cost child care regular income personal budget template zero-based budget monthly budgeting worksheets budgeting approaches step to budgeting amounts of money extra money streaming services monthly savings goal financial freedom peace of mind regular expenses tax income irregular income monthly budget template 50-30-20 budget system basic budget calculator basic budget tracker budget deficit budget for emergency expenses budget for fun budget planner template budget planning template budget tips college budget comprehensive budget customised budget plan budgeting features all-purpose monthly budgeting spreadsheet budgeting for groceries can budgeting method budgeting plan budgeting plan examples budgeting principle budgeting skills budgeting tips budgeting tool money worries money goals money guidance money leaks coffee money credit card charges credit card payments credit rating credit score bank holidays bank statements bank transfer quality service competitive service deals digital streaming services interest-bearing savings account contributions to savings goals shared bills annual bills breakdown by category category of expenses debt repayment category costs to insurance premiums cell phone plan child support payments construction projects nearest dollar dollar of income calculator worksheet cash paycheck huntington bank of america direct mail checking account student loans fixed costs paychecks debit.