Want to get on top of your finances? Learn how to manage your money better with budgeting tips, debt strategies, and savings plans that actually work.

Can you really learn how to manage money?

Yes, you absolutely can. Managing money isn’t about being perfect, it’s about having a plan, sticking to it most of the time, and knowing when to pivot. Whether you’re living pay-to-pay or looking to grow your savings, learning how to manage money starts with a few smart moves and a solid budget.

“People who engage with their finances, budgeting, planning and tracking, report significantly higher financial wellbeing.”

Melbourne Institute, HILDA Survey

What is money management?

Money management is all about being in control of your income, expenses, savings and debt. It’s about making informed decisions so you can afford life now and still be setting up for the future, whether that’s buying a home, starting a family, or planning your retirement.

It means tracking what’s coming in and going out, using budgeting tools to keep your spending purposeful, and regularly reviewing your financial goals. Good money management makes space for both financial freedom and peace of mind

10 practical tips to manage your money better

- Start with a realistic budget

Think of your budget like Google Maps for your money. It should guide where your cash goes based on your income, fixed expenses, variable costs, savings goals, and debt repayments. - Build an emergency fund

Start small and grow it over time. Aim for at least 3 months’ worth of living costs to protect yourself from unexpected expenses. - Pay yourself first

Set up automatic transfers to savings every payday, before you pay any bills. This helps you build wealth without thinking about it. - Reduce debt with strategy

Choose a method that suits you: the Avalanche Method (tackle high-interest debts first), Snowball Method (start with smallest balance), or the Feel-Good Method (pay off the debt causing you the most stress). - Spend mindfully

Before tapping your card, ask: does this align with my goals? Create breathing room by cutting back on spending habits that don’t serve you. - Use budgeting tools and apps

Find one that works for you. MyBudget’s personal budgeting service offers complete money management, including paying bills on time and building long-term savings. - Understand your credit

Learn how credit scores work, review your credit report, and avoid late payments. Managing credit cards wisely is key to future borrowing power. - Set clear financial goals

Whether it’s owning a home, clearing debt, or retiring comfortably, your goals will guide your budget and savings strategy. - Boost your financial literacy

Read books, listen to finance podcasts, follow reliable sources like MyBudget, Moneysmart, and don’t be afraid to ask for help. - Review and revise often

Life changes, and so should your budget. Schedule monthly check-ins to stay aligned with your money goals.

Why personal budgeting is the secret to financial success

“A lot of people struggle with money because they don’t have a system in place or, if they do, it’s too hard to maintain or it’s a jumble of good and bad habits.”

Tammy Barton, MyBudget Founder & Director

Personal budgeting is the foundation of good money management. It gives you a clear view of your income, expenses, savings and debts. With a custom plan, you can stay on top of bills, avoid financial stress, and grow your savings.

If your budget keeps blowing out or you’re overwhelmed by debt, that’s where MyBudget can help. Our expert money coaches will build a personalised budget plan that pays bills, grows savings, reduces credit card debt and puts you back in control.

Whether you need help with your budget or a full financial planning and debt management strategy, we’re here to support you every step of the way.

MyBudget’s personal budgeting services and tools

There’s no shortage of budgeting apps out there, but tracking expenses is just one part of the puzzle. The MyBudget App goes further, giving you full visibility over your money 12 months ahead in real time. You can see your upcoming bills, savings progress, debt repayments and overall spending plan all in one place. It’s a complete financial picture, designed to help you stay in control without the stress.

Our money saving plans go beyond spreadsheets. With real-time insights and professional guidance, we’ll show you exactly how to budget your money, manage debt, and stay ahead financially, whether your goal is to save, get out of debt, or reduce financial stress.

Need some free tools to get ahead with your finances: explore MyBudget’s financial tools and resources today!

Creating an effective savings plan

Saving doesn’t have to be a drag; get creative with how you manage your money! Whether it’s tweaking your income, cutting down on expenses, or setting clear goals to secure your financial future, building solid savings habits is key. Trust us, saving with a purpose feels way more rewarding than just stashing cash for the sake of it.

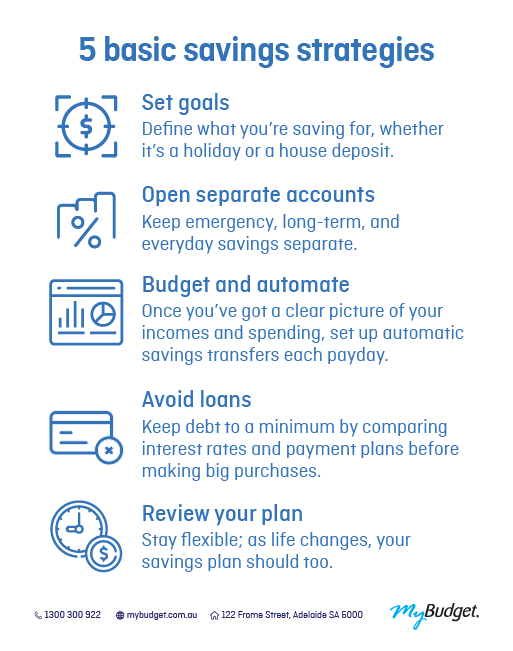

5 basic savings strategies

- Set goals: define what you’re saving for, whether it’s a holiday or a house deposit

- Open separate accounts: keep emergency, long-term, and everyday savings accounts separate

- Automate savings: transfer funds to savings automatically each payday

- Avoid loans: compare interest rates and payment plans before making big purchases

- Review your plan: life changes, and so should your savings plan. Adjust as needed to stay on track.

Want to know exactly how long it’ll take to reach your savings goal? Use MyBudget’s free Savings Calculator

How to manage debt without losing sleep

Managing your debts doesn’t have to rule your life. Whether you’re looking for fast debt help or long-term debt relief solutions, having a structured repayment strategy makes all the difference.

Start by getting everything down on paper: balances, interest rates, minimum repayments. Then decide on a strategy, debt snowball, avalanche, or consolidation, and start chipping away.

Check out our free eBook: 10 Steps to get out of debt to walk you through the process step by step.

MyBudget offers tailored debt help and even debt consolidation through MyBudget Loans. You’ll get support dealing with creditors and expert guidance every step of the way.

What is debt consolidation?

Debt consolidation is a way to round up all of your debts and turn them into one new loan. The idea is to slash those repayments by bundling everything together at a lower interest rate and have just one regular repayment and one single interest rate to manage, instead of a whole circus of bills.

It’s one of the most popular credit debt solutions in Australia and can offer real relief from debt stress.

Find out is debt consolidation right for you?

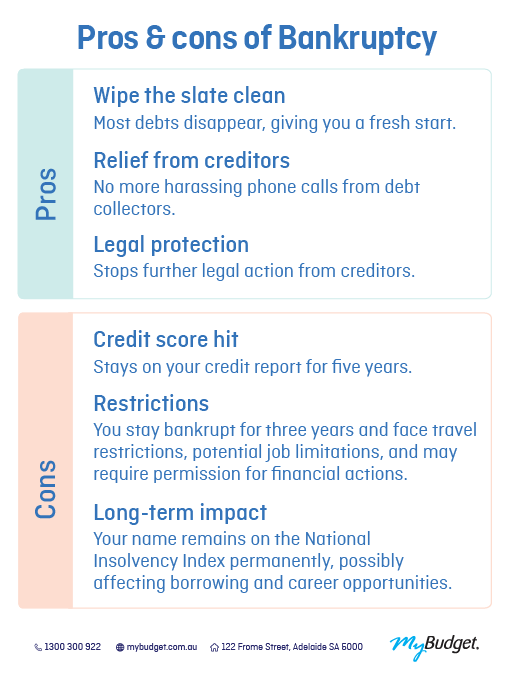

What is bankruptcy?

For some people struggling with debt, bankruptcy can seem daunting, but sometimes it might be the reset you need. This legal process helps those who can’t repay debts get a fresh start, though it does come with long-term impacts.

Pros of Bankruptcy:

- Fresh start: most debts are wiped clean

- Relief from creditors: no more debt collector calls

- Legal protection: stops further action from creditors.

Cons of Bankruptcy:

- Credit score hit: appears on your credit report for five years

- Restrictions: includes three years of bankruptcy with travel and job limitations

- Long-term impact: listed on the National Insolvency Index, which may affect borrowing power and career options.

Bankruptcy can affect your credit score and financial future. If you are considering bankruptcy, get in touch with our Debt Solutions team and they can work out the best solution for your financial situation.

How do I prepare for retirement and maximise superannuation?

Don’t leave retirement planning for future-you to figure out, it’s one of the most important parts of your long-term financial health. Superannuation is the backbone of your retirement income, but it’s often overlooked until it’s too late. By making regular contributions (even small ones) and harnessing the power of compound interest, you can set yourself up for a more comfortable and stress-free retirement. Voluntary contributions, salary sacrificing, and choosing the right investment options inside your super can all make a huge difference. For more info on retirement planning, check out our blog: How much do you need to retire?

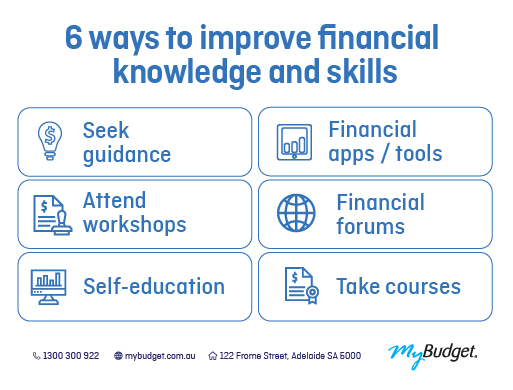

Financial literacy and education

Only 24% of Australians feel confident about achieving their long-term financial goals (WeMoney Financial Wellness Report 2024), but that number can change with the right knowledge and support.

Understanding money basics can change your life. Financial education helps you make informed financial decisions, build wealth, and secure your future goals.

6 ways to boost financial knowledge

- Seek guidance from financial professionals

- Attend workshops & seminars

- Self-education

- Use financial apps & tools

- Join financial forums & communities

- Take courses.

How MyBudget can help manage your money?

Managing money doesn’t have to feel overwhelming. Whether you need help paying debt, budgeting support, or savings for the future, MyBudget’s expert money coaches are here to help.

We’ll create a budget plan that fits your lifestyle and money goals. From automating your bill payments to growing long-term savings, and knowing your debt-free date. MyBudget takes the guesswork out of money management.

Ready to get started? Book your free, no-obligation appointment today or call us on 1300 300 922 and start living life without money worries.

Further money management tips:

Money management strategies – Debt

How does financial hardship affect your credit score?

Start with a FREE no obligation appointment