How to manage money with ADHD: budgeting for the neurodivergent

Managing money with ADHD can be overwhelming, but at MyBudget we’ve seen many neurodivergent clients succeed, recognising the common challenges and using practical steps to stick to a budget and build financial confidence.

If you’ve got ADHD or you’re neurodivergent, managing money can feel like herding caffeinated cats. There’s impulsive spending, forgotten bills pile up, and before you know it, payday is gone and you’re staring at overdue notices and late fees. You’re not lazy or bad with money, your busy brain is simply wired differently. And that makes managing your money harder, but not impossible.

At MyBudget, we know that ADHD and money stress often go hand-in-hand. Here’s how to recognise the challenges and put systems in place that actually stick when it comes to budgeting with ADHD and building financial confidence.

Why is managing money harder with ADHD?

Australian data is still limited, but a UK study by Monzo found that adults with ADHD are up to three times more likely to face overdrawn fees, twice as likely to miss bill payments, and often lose money to unused subscriptions.

Is overspending a symptom of ADHD?

ADHD often comes with impulsivity, which may show up as overspending or impulse buying. Impulsivity can feel good in the moment, but it often makes it harder to keep your budget and financial wellbeing on track.

For neurodivergent people, having ADHD can bring daily challenges like:

- Impulsive spending: emotional spending, retail therapy, or chasing dopamine hits

- Forgetfulness: missing due dates and racking up interest fees or late fees

- Overwhelm and procrastination: juggling spreadsheets, overdue bills, and trying to track expenses can feel like too much, so it often gets put off until later.

These are common signs of money challenges with ADHD, but they can be turned around with the right financial tools and strategies.

What ADHD money type are you?

While there aren’t any official ADHD money types, we’ve mapped out common money personalities based on the most common ADHD money challenges, and we know you’ll relate to at least one of them. Knowing which one feels like you can help you find the right fixes.

As someone with ADHD I have always been absolutely horrible with my finances. Forgetting bills, no budgeting, zero savings and living pay-to-pay. Within 3 years we’d paid off 50% of our debt and saved and paid for our wedding.

Jacqueline, MyBudget client – Trustpilot review

Sound familiar? Let’s pick one ADHD money type that’s most “you”:

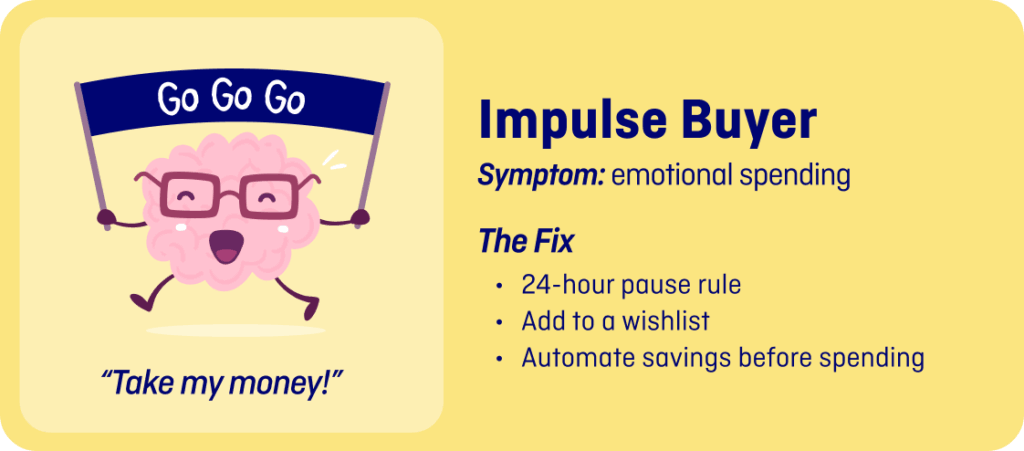

The Impulse Buyer

“I see it, I want it, I buy it. Budget? What budget?”

Your fix: Pause big purchases, keep a wishlist instead of buying instantly, and set up automatic payments or a savings debit card so money is tucked away before you can spend it.

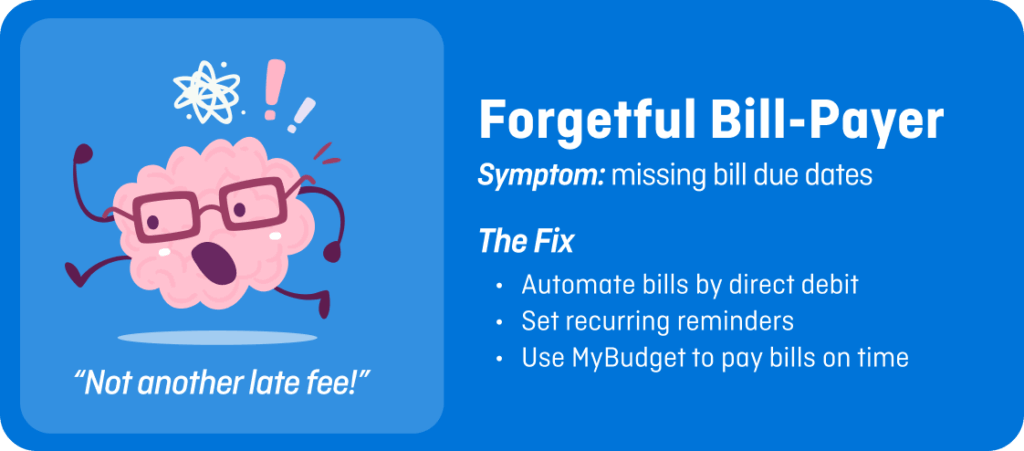

The Forgetful Bill-Payer

“Oh no, was that bill due yesterday?!”

Your fix: Automate bill payments through online banking or direct deposits, set reminders and alerts in digital calendars, or let MyBudget handle automatic bill payments for you.

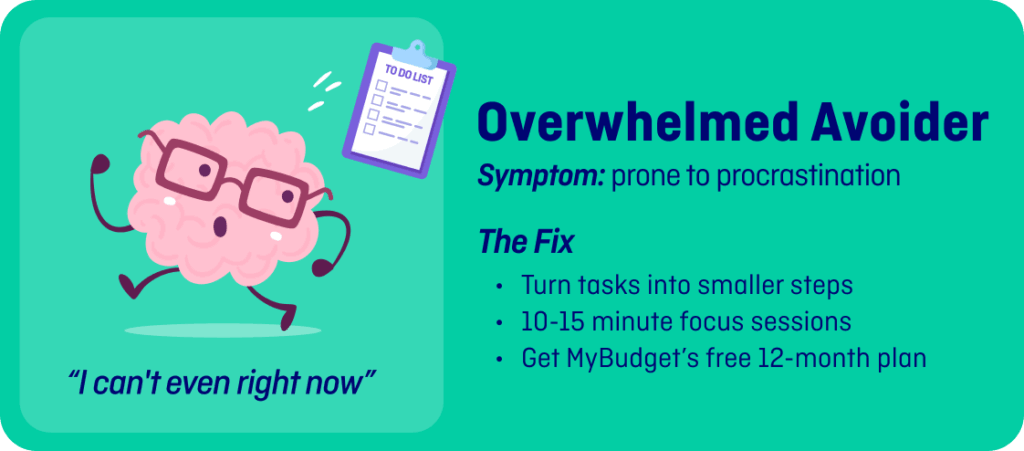

The Overwhelmed Avoider

“Managing your money feels overwhelming and gets pushed aside.”

Your fix: Break financial tasks into micro-steps, use a simple spending plan, or if it still feels overwhelming, outsource to MyBudget where we can take care of the hard stuff.

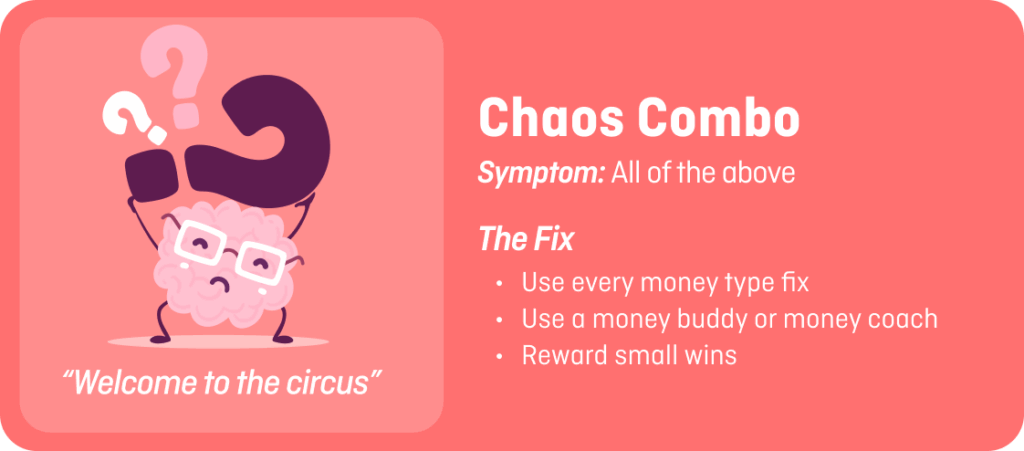

The Chaos Combo

“Yep, that’s me, impulsive, forgetful, overwhelmed… hello, chaos.”

Your fix: Combine the above strategies, add accountability with an ADHD buddy or a MyBudget Money Coach, and focus on progress over perfection.

Tips to manage your money with ADHD

1. Brain dump your financial tasks

Get it all out of your head and onto paper (or your notes app). List:

- Utilities

- Groceries

- Credit card payments

- Subscription costs

- Upcoming expenses like school fees or rego.

Seeing it in black and white reduces overwhelm. You can also try our free Personal Budget Template to get started and keep everything in one place. These are practical ways for budgeting for people with ADHD.

2. Automate everything you can

Direct debits and autopay systems are your friend. If it can be paid automatically, let it be. Think of it as future-you giving present-you less stress. This is one of the easiest answers to how to budget with ADHD, and it prevents late fees.

3. Create a money “launch pad”

Just like you need a home base for your keys, set up a system for your money. That might mean a dedicated bank account for fixed expenses, a separate account for variable expenses, or a MyBudget plan that shows you exactly what’s coming in and going out. Visualise your budget with pie charts or bar graphs to track cash flow.

4. Break it into micro-steps

Don’t write “sort my finances.”

Write “log in to online banking,” “check electricity bill,” “transfer $50.”

ADHD brains thrive on small wins and this helps when you’re wondering how to stick to a budget with ADHD.

5. Add accountability

ADHD and money love a buddy system. Whether it’s a friend, a partner, an ADHD coach, or your MyBudget Money Coach, having someone to keep you on track makes all the difference. Accountability boosts financial literacy and financial wellbeing.

MyBudget: money management for busy brains

For over 25 years, MyBudget has helped more than 130,000 Australians (ADHD or not) manage their money:

- We pay your bills on time

- We set up a clear spending plan

- We help pay off debt faster

- We help build savings and long-term goals.

You can also explore how your savings will grow using our free Savings Calculator.

Clients often tell us that the most valuable part of MyBudget is our 12‑month forward projection, showing where their money is heading, when they could be debt free, and how their savings will grow, a clear future view that sets us apart from traditional budgeting.

Need help with impulse spending, forgetting bills or building a financial plan? Call MyBudget!

With the right systems, financial advice, and a team that cares, everyone can feel in control of their finances and reach financial success no matter what part of the beautiful spectrum they are on.

Book a free appointment now, or call us on 1300 300 922 because you know it always feels easier once it’s done!

As an adult with ADHD I struggled for years with debt and impulse spending. MyBudget has changed my life. My bills are paid on time, no more debt, I saved to achieve my dream to travel.

Gina, MyBudget client – Trustpilot review

FAQs for managing money with ADHD

What does MyBudget do?

MyBudget is a personal budgeting service that helps you organise your finances, pay your bills on time, reduce debt, and grow savings with a clear 12-month budget plan.

Does MyBudget pay your bills?

MyBudget is a personal budgeting service that helps you organise your finances, pay your bills on time, reduce debt, and grow savings with a clear 12-month budget plan.

How much does MyBudget cost?

Costs vary depending on your circumstances and the level of support you need. Your first appointment is free and you will recieved a tailed 12-month budget plan.

Can MyBudget help people with ADHD?

Yes. Many of our clients are neurodivergent. We provide the structure, systems, and forward planning that help overcome challenges like impulsive spending, procrastination, and forgotten bills.

Is MyBudget like a financial planner or a bank?

No. We’re not a bank and we don’t sell financial products. We’re a budgeting service that creates a forward plan for your money, pays bills on time, helps reduce debt, and builds your savings so you can reach your money goal

Will I still have control of my money?

Absolutely. You stay in control, we just take care of the organising, bill payments, and help you reach your money goals so you can focus on your life instead of money stress.