What can I claim on my tax return in Australia? | A 2025 guide

Wondering what you can (and can’t) claim on your 2025 tax return? MyBudget’s comprehensive guide breaks it down so you can maximise your refund and avoid questions or even an audit from the Australian Taxation Office (ATO).

Tax time doesn’t have to feel like guesswork

Tax time. It’s a bit like playing a boardgame you’ve never read the rules for, confusing, a little chaotic, and you’re just hoping to get it right by sheer luck. But what if, instead of guessing, you actually knew what you could claim, and didn’t miss out on deductions you’re entitled to? Your tax return could be a powerful tool to kickstart your savings, clear debts, or even shave a few months off your mortgage?

At MyBudget, we’re not tax agents, so we don’t prepare tax returns. But, we are all about empowering Australians to take control of their money and understand how every dollar can work harder for them. We’ve put together this comprehensive guide, straight from the ATO, to help you understand what types of expenses you can claim this tax time, maximise your refund, and ultimately, feel confident when it comes to your deductions.

If you’re ready to make your tax refund truly count, or just want to get your financial life in better shape, stay with me!

What can I claim on tax in Australia 2025?

If you’re asking “What can I claim on tax 2025?”, you’re among friends. The ATO has three golden rules when it comes to work-related expense (WRE) tax deductions… Let’s nail down the non-negotiables.

The golden rules on tax deductions for work-related expenses

Think of these as your personal ‘pub test’ for every expense. If it doesn’t pass all three, it’s unlikely to be deductible:

- the expense must relate to how you earn your income

- you need to have paid for it yourself (and not been reimbursed by your employer)

- you need records to prove it (yes, receipts are still a thing!)

The ATO is keeping a keen eye on work-related expenses, particularly inflated claims, those with a personal element, or deductions not genuinely tied to earning your income. So, honesty and meticulous record-keeping are your best mates this tax season.

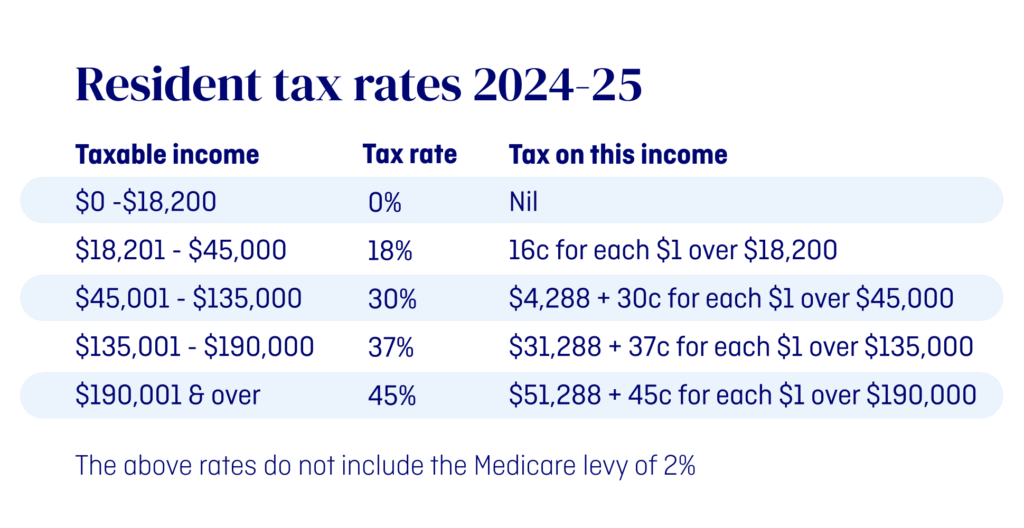

Australian income tax rates for 2025

Ever wondered what marginal tax rate means? It’s simply the percentage of tax you pay on each extra dollar you earn. Knowing which tax bracket you fall into is important for understanding your financial position and planning for the year ahead, especially if you’re thinking about a side hustle or second job.

Here’s a quick look at the Australian income tax rates for 2024–25:

What is the Medicare levy?

The Medicare levy is a separate tax most Australians pay to help fund our public health system. It’s 2% of your taxable income and is automatically included in your total tax payable at tax time.

Who pays the Medicare levy?

Most Australians pay the Medicare levy. However, you may be exempt (or get a reduced rate) if:

- your taxable income is below or between the threshold of $26,000 to $32,500 (for individuals with no dependants in 2024–25)

- you’re a senior or pensioner entitled to a rebate (threshold $50,119)

- you meet specific medical exemption criteria: for example, if you’re a foreign resident or temporary worker not entitled to Medicare benefits, you might be exempt.

What is the Medicare levy surcharge?

If you don’t have private hospital cover and your income is above $93,000 for individuals or $186,000 for families, you might also be hit with the Medicare levy surcharge: an extra 1% to 1.5% on top of your normal Medicare levy. This is designed to encourage higher-income earners to take out private health insurance and reduce pressure on the public system.

Why you should factor in the Medicare levy at tax time

When you lodge your tax return, the ATO works out your total tax payable, including the Medicare levy and any surcharge. That means your refund could be lower than expected if you haven’t factored in these extra charges.

You can usually find your taxable income details on your income statements or through your MyGov portal. This is what the ATO uses to work out your income tax and Medicare levy obligations.

Beyond receipts: proactive tax planning for a bigger refund

The secret to maximising your tax return refund isn’t a secret at all… it’s preparation.

Staying on top of your income, expenses, and records throughout the year can reduce stress and help you make the most of legitimate deductions.

What does proactive tax preparation look like?

Getting your claimable deductions ready ahead of tax time. With a little prep, you can feel confident you’re claiming everything you’re entitled to.

Track everything: log all sources of income, including weekend side hustles.

Categorise as you go: group your work-related expenses like travel, uniforms, and equipment.

Keep receipts: digital or physical, especially for claims over $300. The ATO can ask for proof, and you’ll need to keep your records for five years after lodging.

The ATO’s My Deductions tool in the ATO app can help you track expenses like travel, internet costs, and mobile use as you go.

What work-related expenses can I claim in 2025?

Most of us have work-related expenses, and knowing exactly what you can claim can make a noticeable difference to your refund.

Travel & vehicle expenses: beyond the daily commute

If you use your own car for work, say driving between job sites or to client meetings, you may be able to claim travel expenses. Just keep in mind that your daily commute from home to work isn’t deductible.

There are two ways to claim:

- Cents per kilometre: claim 88 cents per km (2024–25) for up to 5,000 work-related kilometres. This includes fuel, maintenance and depreciation. Just document how you calculated the distance.

- Logbook method: for claims over 5,000 km or actual costs, keep a 12-week logbook to track business use. You can then claim a portion of car expenses like fuel, rego, insurance, and repairs.

Using your car for work visits? There are some great apps out there that make it easy to track your trips.

Tammy Barton, MyBudget Founder and Director

Working from home: rules for claiming home office deductions

With more Aussies working from home, claiming home office expenses has become standard. Since March 2023, the ATO requires you to keep a record of your actual work-from-home hours… your calendar or timesheet will do!

There are two ways to claim:

Fixed rate method (70c/hour): covers energy costs, internet, mobile phone use, stationery, and computer consumables. You can’t claim these separately.

Actual cost method: claim a work-related portion of your additional expenses if you have detailed records.

You can also claim depreciation on big-ticket office expenses like a desk or monitor (even if using the fixed rate method). Just note: rent, mortgage interest or council rates usually aren’t deductible if you’re an employee.

Uniforms, protective gear & laundry: dressing for success (deductibly!)

Wearing a compulsory uniform with a logo, occupation-specific clothing (like scrubs or chef whites), or protective gear (like high-vis or steel-capped boots)? You can claim the cost to buy and clean them, including dry cleaning. Everyday clothes, even if only worn for work, aren’t deductible.

Tools and equipment: big vs small

This covers everything from your laptop to a tradie’s toolbox. The rule of thumb:

Under $300: Claim the full cost in the year you buy it, great for items like keyboards, headsets, or work bags.

Over $300: Claim depreciation over its effective life, based on how much you use it for work. This applies to bigger purchases like laptops or tools. Check the ATO’s depreciation and capital allowances tool.

Self-education: investing in your career (wisely!)

Courses that directly relate to your current income-earning job can be deductible, think a designer doing an advanced Adobe course. Astronomy while working in retail? Probably not.

Eligible deductions include:

- course fees (excluding HECS/HELP)

- textbooks and stationery

- internet and phone usage

- depreciation on computer equipment.

Mobile phone & internet: the work/life divide

Using your personal phone or home internet for work? You can only claim the portion you actually use for work. So, if 50% of your internet usage is work-related, you can claim 50% of the cost. Keep a logbook or a diary for a typical month to estimate your work percentage.

Overlooked opportunities: don’t miss these tax deductions!

Beyond the common work-related expenses, there are other deductions that often get missed:

Tax agent fees: yep, the fees you pay to a registered tax agent to prepare your previous year’s tax return are deductible.

Investment property expenses: If you own a rental, you can claim certain expenses to reduce your taxable income. They fall into three categories:

- claim now: loan interest, council rates, repairs, insurance, and management fees

- claim over time: capital works, borrowing costs, and assets over $300 (via depreciation)

- not claimable: personal expenses or second-hand assets bought after May 2017.

Some pre-rental expenses, like loan interest, may be claimable if your intent was to rent the property.

Union fees, membership fees & registrations: any fees paid to a professional association or trade union are claimable.

Income protection insurance: if you pay premiums for income protection insurance that covers lost income (not life or trauma insurance), you can claim them. Just not if your super fund pays for it.

Cost of managing tax affairs: this includes things like tax preparation software or even travel costs to see your tax agent.

Gifts & charitable donations: if you’ve donated $2 or more to a registered charity (a Deductible Gift Recipient or DGR), make sure you claim it and have your receipt.

What common tax deductions should you avoid in 2025?

The ATO is sharpening its focus for 2025, and there are certain areas they’re watching closely. This means it’s more important than ever to ensure your claims are legitimate.

What not to claim: skip these deductions to avoid a tax audit

Inflated work-related expenses: making claims that are simply too high for your occupation or income.

Working from home deductions: incorrect use of the fixed rate or actual cost method, or a lack of proper records for hours worked.

Multiple sources of income: ensuring all income (including from side hustles, gig economy work, or investments) is declared.

“Pub test” failures: daily commutes, gym clothes, children’s school fees, personal grooming, and entertainment expenses are not tax deductible.

TikTok “tax hacks”: don’t believe everything you see on social media. There are a lot of myths out there, make sure you’re following facts not fin-fluencers. These could lead to processing delays, audits, or even penalties.

Should you lodge your own tax return or use a tax agent?

How do you know if you should tackle your tax return yourself or call in an expert? The best choice depends on your confidence and the complexity of your financial situation. Here are some things to consider:

DIY tax return: if your financial situation is straightforward (e.g., one employer, minimal deductions), free tools like myTax might be all you need. You could save on agent fees.

Use a tax agent: around 70% of Australians opt for a registered tax professional. Why? Peace of mind, accuracy, and often a bigger refund. H&R Block reports that self-lodgers received an average tax refund of $2,576, while tax agent clients averaged $3,550. An agent can help uncover hidden deductions and ensure you’re compliant.

What tax deductions can I claim without receipts?

The ATO has allowable deductions you can claim without receipts, but there are limits. Here’s what you can generally claim:

Work-related expenses under $300: you can claim up to $300 worth of work-related expenses without receipts, but you still need to be able to show how you calculated the claim and prove it’s related to your work

Cents per kilometre method for car expenses: no receipts needed, but you must be able to demonstrate how you calculated the kilometres

Laundry expenses for eligible work clothing: claims under $150 don’t require receipts but must relate to deductible clothing (like uniforms or safety gear).

That said, you still need a reasonable explanation and a good memory. Keep a logbook, diary, or bank statement as backup just in case the ATO asks questions.

What should I do with my tax refund in 2025?

Your tax refund isn’t just a nice surprise, it’s a chance to do something intentional with your money.

Whether it’s:

- wiping out high-interest credit card debt

- making a lump-sum repayment on your mortgage

- boosting your superannuation contributions.

Every dollar has the potential to grow your wealth or reduce future costs.

By using your refund strategically, you can strengthen your overall tax position, avoid costly mistakes, and set yourself up for a smoother, more rewarding tax return next year. Just keep it simple: stick to legitimate deductions, stay organised, and let your refund work in your favour.

“Treat your tax refund like a bonus. Don’t budget for it, and when it lands, use that lump sum to really set yourself up for lasting financial success.”

Tammy Barton, MyBudget Founder and Director

Here’s 5 ways to make your tax refund count:

- Pay off high-interest debt: the average Aussie credit card balance hovers around $3,461. Your average refund of $3,063 could nearly wipe out an entire credit card debt, saving you a packet in interest.

- Make a lump sum payment on your mortgage: even a modest $3,063 extra payment could save you thousands in interest over the life of your loan. Want to see your potential savings? Jump on MyBudget’s free Home Loan Repayment Calculator and run the numbers for your own loan.

- Boost your emergency savings: set your refund aside in a high-interest savings account. This financial cushion can cover unexpected costs like a broken fridge or a car repair without resorting to debt.

- Grow your super: even a small super contribution today can significantly boost your retirement nest egg. Plus, you might even get a tax offset depending on your income.

- Treat yourself (strategically): need a new appliance or a work-related gadget? Now’s the time to buy outright and potentially claim it if it’s work-related, avoiding impulse purchases that don’t add real value to your life.

Ready to budget your way to financial freedom? MyBudget can help!

Tax time is just one piece of your financial puzzle. At MyBudget, we help you get your whole financial life sorted, so when tax time comes, there’s no panic. Your bills are paid, your records are ready, and your refund can have more impact.

We’ve helped over 130,000 Australians gain control of their finances and start living life free from money worries.

We’ll work with you to:

✅ be tax-time ready

✅ automate bill payments

✅ build long-term savings

✅ achieve your financial goals.

Whether you’re chasing a bigger refund or just want to be more organised this tax time, our money experts are here to help. We’ll get you prepared for the end of the financial year, and beyond.

Book your free call today or call us directly on 1300 300 922 and start living your life free from money worries.