Maximise your 2025 tax return: expert tips to boost your refund

Wondering how to make the most of your tax refund? Discover tax deduction tips, deductible work-related expenses, and get expert advice, plus discover smart ways to use your refund to improve your long-term financial situation.

If you’re like most Australians, you wouldn’t say no to a bigger tax refund, and with a smart, organised approach, it’s possible. MyBudget has been helping people make the most of their money for over 25 years, and we know that what you do with your tax return can impact your long-term financial position. With a few expert strategies, you could unlock extra money this tax season. While MyBudget does not prepare or lodge tax returns, we provide education and budgeting support to help you make informed decisions. Whether you’re lodging through myTax or working with a registered tax agent, this guide shows you how to maximise your refund, legally and confidently.

Tammy chats with tax expert Craig Whiteman from Ernst & Young

In this insightful webinar, Tammy Barton, MyBudget, Founder and Director caught up with Craig Whiteman, Partner at Ernst & Young, to break down everything you need to know about your tax return, including key changes for this tax season, how to maximise deductions, and common mistakes to avoid. As cost of living pressures are still impacting many Australian households, it’s never been more important to reduce your tax burden and keep more money in your pocket. This blog will help you understand your options, what work-related expenses to claim, make the most of your tax return, and learn how to make it work for you for a secure financial future.

Key topics covered in the tax webinar

- When your tax return is due

- How to maximise deductions and credits this year

- What the Australian Taxation Office (ATO) is watching closely

- Common tax-time mistakes to avoid

- Best practices for receipts and documentation

- How tax planning supports your long-term financial goals.

How to find out what tax bracket you are in

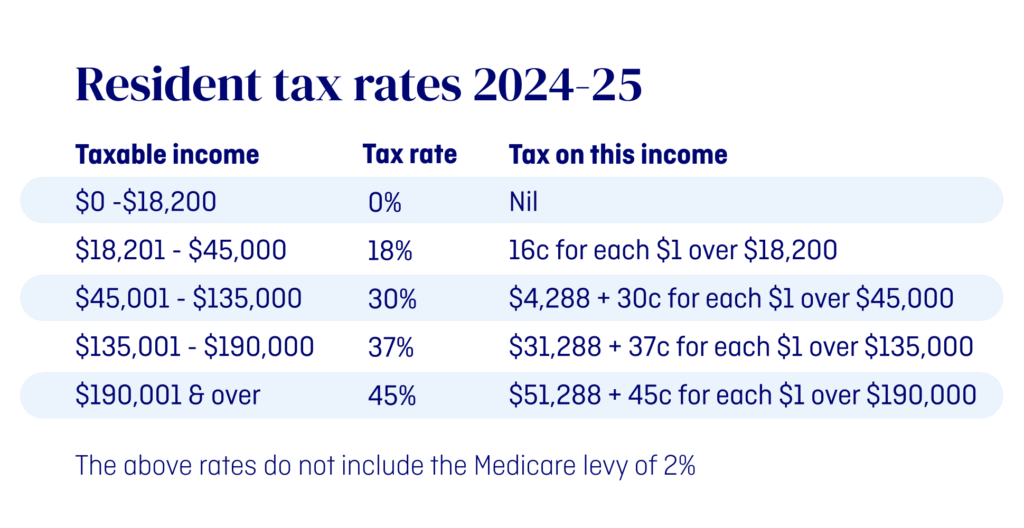

In the tax webinar, we ran a quick poll and found that only 23% of attendees knew which tax bracket they were in. Knowing where you sit on the current tax rates 2025 table can make a big difference when it comes to understanding your marginal rate, and how much of your income is taxed at each threshold.

Use this table to get a clear idea of where your taxable income lands, or try the MyBudget Income Tax Calculator for a quick estimate. It also helps if you’re picking up a side hustle, starting a small business, or managing an investment property.

Not sure where your income fits? A quick look at your payment summaries, income statements or the MyGov portal should help. On top of the standard tax rates 2025, don’t forget to factor in the Medicare levy, an additional 2% added to your taxable income for most Australians. Higher earners may also need to consider the Medicare Levy Surcharge.

What’s the secret to getting a bigger tax refund?

If you’re wondering, what can I claim on tax? It all comes down to one word: preparation. Keeping track of your income, expenses, and receipts throughout the financial year makes tax time smoother, and could lead to a larger tax refund.

Here’s what good preparation looks like:

- Recording all income sources (salary, side hustle, rental income, capital gains)

- Categorising deductible expenses like work-related car use, uniforms, equipment, and tools

- Including eligible donations, super contributions, and home office costs.

Don’t forget to keep digital or physical receipts for every claim. The ATO can ask for proof, and scrambling mid-audit is never fun.

What taxable deductions can you legally claim?

If you need to know more about ATO work-related deductions or deduction tips, Craig Whiteman explains, “You can claim a deduction when you’re incurring expenses related to earning your assessable income, whether that’s your wages as a driver, nurse, teacher or doctor. It all comes down to the connection between your expenses and your income.”

Here are a few frequently missed deductions:

- Tax agent or tax accountant fees (including travel to and from their office)

- Union fees, memberships, and registrations

- Uniforms, laundry, and protective gear

- Mobile phone and internet expenses if used for work

- Home office expenses via the fixed rate or actual cost method.

Can you claim work from home expenses in 2025?

Yes, you can. The ATO updated rules in March 2023, so now you need to keep a log of the hours you work from home.

You may be eligible to claim:

- Electricity expenses

- Home office furniture and equipment

- Internet and mobile phone costs

- Stationery and consumables.

Choose between the new 70c per hour fixed rate method or the actual cost method, and always keep a logbook or calendar records.

Are self-education expenses tax-deductible?

Yes, if expenses are directly related to your current job. For example, training in your profession is tax deductible, but unrelated study is not.

Tax deductible expenses include:

- Course fees (excluding HECS/HELP)

- Textbooks and stationery

- Internet and phone usage

- Depreciation on laptops or tablets.

Can protective clothing and tools be claimed this tax season?

If the expense is specifically for work, essential to your job and not reimbursed by your employer, the answer is yes. For example:

- High-vis or safety clothing

- Sunscreen and sunglasses for outdoor workers

- Laptops, bags, and even backpacks if used for transporting work equipment.

Again, proof of purchase is key.

Do you need receipts for every tax return claim?

Wondering what details the ATO might ask for? Craig Whiteman at EY reminds us that the Australian Tax Office (ATO) is focused on substantiation: “By all means, make a claim you think is viable, just be prepared. If the ATO asks, what would you show them?”

Remember these key points:

- Under $300 in work-related expenses: no receipts (except dry cleaning)

- Over $300: itemised receipts, proof of usage, and a paper trail.

How long should you keep receipts for each tax return?

Keep records for at least 5 years from the date you lodge your tax return.

Is there an app that stores receipts for your tax return?

Yes. The ATO’s My Deductions tool can help keep track of work-related expenses, travel expenses, and internet costs or mobile phone charges that may be claimable.

It’s a great option if you’re self-lodging, or even if you’re seeing a tax agent and want to come prepared.

Should you use a tax agent or DIY?

For simple returns, myTax may be enough. But a tax professional can uncover hidden deductions and help you get the maximum refund.

- Around 35% of Australians use a registered tax agent

- Self-lodgers average a $2,576 refund

- Tax agent clients average $3,550 (H&R Block).

A tax accountant can also help with complex claims like capital gains, negative gearing, or investment portfolio deductions.

Are TikTok ‘tax hacks’ worth trying?

Short answer? No. The ATO is cracking down on false claims, especially those pushed by so-called fin-fluencers (financial influencers) on social media.

Craig from EY emphasises the importance of staying within the rules: “You don’t want to be in a situation where you’ve claimed something and really shouldn’t have. There are a lot of myths out there, make sure you’re following genuine advice.”

You could face delays in processing, audits, or even penalties. Stick to legitimate ATO-approved deductions and seek a qualified tax expert if you’re unsure

What’s the best way to use your tax refund?

Being strategic with your tax refund can help support your future financial goals. Whether you’re expecting a few hundred or a few thousand, use your refund to:

- Treat yourself (wisely): make it something useful and, if work-related, potentially tax deductible

- Pay off high-interest debt: you could pay the average credit card balance in full

- Make a lump sum mortgage payment: use free tools like the MyBudget Home Loan Repayment Calculator to see how many years you could shave off your mortgage with a lump sum payment

- Boost your emergency savings: use a high-interest savings account to reach goals faster

- Top up your super fund: concessional contributions today could mean more in retirement

- Invest your tax refund: consider Exchange-Traded Funds (ETFs) or shares on the Australian Securities Exchange (ASX).

Need a plan to maximise your tax refund?

MyBudget has helped over 130,000 Australians gain control of their finances. We work with you to:

✅ Build a customised budget unique to your situation

✅ Pay bills on time

✅ Pay off debt faster

✅ Build long-term savings

✅ Reach your financial goals.

Ready to feel confident this tax season? Whether you’re chasing a bigger refund or just want to be more organised this tax time, our money experts are here to help. From setting aside savings for tax debt or planning how to make the most of your tax refund, we’ll help get you prepared for this financial year, and beyond.

Book an online appointment or call us on 1300 300 922. There’s no obligation, just a tailored plan to help you live life free from money stress.

Looking for more tax related tips?

What work-related expenses can I claim on my 2025 tax return?

Your tax return checklist: what to claim, what to avoid in 2025