Does Afterpay and Buy Now Pay Later affect your credit score?

Buy Now Pay Later (BNPL) services like Afterpay, Klarna and Zip promise instant gratification, letting you get what you want now while spreading the payments over time. But is this convenience putting your financial health, and credit score at risk?

Everything you need to know about BNPL and your credit rating

Buy Now, Pay Later (BNPL) has quickly become a mainstream way to access credit. Letting you enjoy the dopamine hit of a new purchase without instant financial burden. But have you found yourself asking, what are the side effects of BNPL? More specifically, will it affect your credit rating?

In this article, we’ll get you up-to-date on all the latest legislation changes and explain how Buy Now Pay Later services like Afterpay can affect your credit score, and cover everything else you should know. We’ll unpack how BNPL works, when it might impact your credit rating, how to use it wisely, and what alternatives are out there.

New rules for Buy Now Pay Later (BNPL) in 2025

What’s changing with BNPL and how will it affect you?

From 10 June 2025, BNPL providers will officially be regulated under the National Consumer Credit Protection (NCCP) Act 2009, Regulatory Guide 281 just like traditional lenders.

So let’s break it down simply:

- BNPL providers must now hold a credit licence. This means they’ll need to meet stricter lending criteria, including assessing whether the product is suitable for you and verifying your financial situation.

- fee caps are coming in. Late fees and other charges will now be limited under the Act to prevent excessive penalties. BNPL providers can charge up to four missed payment fees and one monthly fee within any 12-month period, with overall charges capped based on the credit limit.

- BNPL providers must be members of AFCA. If there’s a dispute, you now have access to Australia Financial Complaints Authority for resolution.

- improved debt collection practices. BNPL companies must now follow industry standards when it comes to collections and credit reporting, which means clearer communication reasonable response times, fewer surprises, and more protection for you as a consumer.

These changes are designed to protect you, the consumer, from hidden fees, further debt and risky lending. If you’re already using BNPL services like Afterpay, Zip or Klarna, you may not notice much difference, they’ve been getting ready for this shift for some time.

What is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) has become a major player in our financial game, letting you grab what you want now and settle the bill later. It used to be all about splurging on fashion and home décor, but now it’s creeping into everyday essentials like groceries and fuel, especially as people juggle the pressures of the cost of living crisis.

BNPL giants like Afterpay, Zip, Openpay, Humm, and Klarna make it easy to break up your purchase into bite-sized payments over time. But before you get too complacent, remember: while BNPL can seem like a helping hand, it’s important to know the facts and use it wisely. Without careful consideration, you might find yourself in a web of debt faster than you can click “Pay in 4.”

Is Buy Now, Pay Later a type of credit?

Yes, BNPL is a type of credit, but with its own flair. It’s like the distant cousin of traditional credit, showing up with less formality but still playing by some of the same rules.

You don’t need a credit card or a big loan application to access BNPL, but it still operates on credit principles. While some BNPL services might not check your credit score initially, they could still impact it at any time. So, it’s credit, but with a laid-back vibe that is cleverly marketed to us, as an easy financial solution.

Why is BNPL so popular?

BNPL has taken over checkouts and is the go-to choice for so many Aussie shoppers. In September 2024, Finder found that 41% of Australians had used a BNPL service in the past 6 months, with 7% saying they’d paid a late fee in that time.

What are the benefits of BNPL?

- no interest: 51% say avoiding interest is the main drawcard

- fast and easy approval: approval while you’re still in the checkout line

- accessible: even those rejected for credit cards (21%) can often be approved.

What are the risks of BNPL?

This kind of delayed payment can:

- accumulate debt without realising it.

- encourage a false sense of affordability

- trigger impulse purchases and overspending

- cause difficulties making payments if there are multiple accounts with staggered due dates

- result in hidden fees from late or missed payments.

But one recent example shows just how easy it is to get swept up in the spending spiral. Afterpay now offers ‘no payment upfront’ to eligible users who have been paying on time. That means you can walk away with your goods and not pay a cent until 8–14 days later.

While BNPL can seem like a win-win, it definitely comes with potential credit risks. Stick with me as we dig deeper into the complexities of BNPL to see what’s really at stake.

How does BNPL work?

BNPL services let you take home your purchases now and worry about the bill later, breaking the cost into seemingly manageable payments. It’s like a shopping spree with a payment plan that kicks in after the dopamine rush is gone. Let’s take a look at how a BNPL account might look for you:

Making purchases and paying by instalments

Shop and choose BNPL: at the checkout you would select BNPL as your payment option, often via an app, digital wallet, or when making online purchases. The store will have stickers or flyers displayed advertising which BNPL service they are affiliated with

Divide the cost: the BNPL company splits the total purchase amount into agreed instalments over a set period

Automatic payments: regular payments are directly debited from your account according to the schedule

Tracking purchases and payments: the BNPL apps usually monitor your balances and upcoming payments and have notifications for when direct debits are about to happen.

Fees and other BNPL charges

BNPL fees are now regulated under the NCCP Act, meaning there’s a maximum of four late payment fees and one monthly fee allowed in any 12-month period. Total charges are capped based on your credit limit to prevent excessive costs.

Here are some examples of BNPL providers’ fees and charges, just remember each company will have varying rates, so it is wise to check out the terms and conditions of each provider for potential extra costs lurking in the fine print.

Establishment fees: while most providers do not charge a fee to join, humm outline on their website that they charge between $30 – $110 for larger purchases

Transaction fees: consumers typically pay no fees on any BNPL transactions as long as they make their instalment payments on time

Late fees: if you miss a payment, Afterpay says you can expect a late fee of up to 25% of the purchase price (capped at $68). Klarna customers also have a late fee, however, they have the option to ‘extend their due date for a fee’ if they think they won’t be able to pay on time

Monthly account-keeping fees: you’ll be paying $3.95 per month to have an account with PayRight

Payment processing fees: PayRight also charge a hefty $2.95 just to make a payment.

In the event of non-payment, you may also have to pay your own bank fees:

- overdrawn fees: if your account doesn’t have enough funds to cover your repayments, some banks will hit you with a fee for overdrawing

- interest: if you’re using a credit card to make your payments and are late paying your credit card bill, you’ll receive additional interest charges.

BNPL schemes are designed for ease and appeal, but remember, a big chunk of their profits are made up of late payments fees. Their business model thrives on the hope you’ll miss a due date. Definitely food for thought!

What happens if you can’t make your BNPL payments?

As a first step, most BNPL companies will place a hold on your account if you miss a payment, preventing you from making any new purchases and getting into further financial difficulty. Missed payments can lead to late payment fees and potential negative effects on your credit score. It’s essential to understand the terms and be prepared for the financial implications if you miss a payment. Most companies will cap their late fees and if you completely avoid payment, they have the right to report the default to the credit bureau and send your unpaid debt to a third-party collection agency. This default on your credit file could really hurt your credit score and affect your ability to gain approval for other credit products, like a home loan, personal loan or a business loan.

What is a credit score?

A credit score in Australia is a number that shows how trustworthy you are with borrowed money, calculated by one of the three major credit bureaus: Equifax, Experian, or Illion. Each bureau operates independently, so you might have three slightly different scores.

This number ranges from zero to 1,000 or 1,200, depending on the bureau. Lenders use it to gauge your financial reliability.

A ‘good’ credit score can land you lower interest rates and better terms. A ‘bad’ score? Expect higher rates, limited borrowing power, and fewer lender options. So, that little number? It’s a big deal.

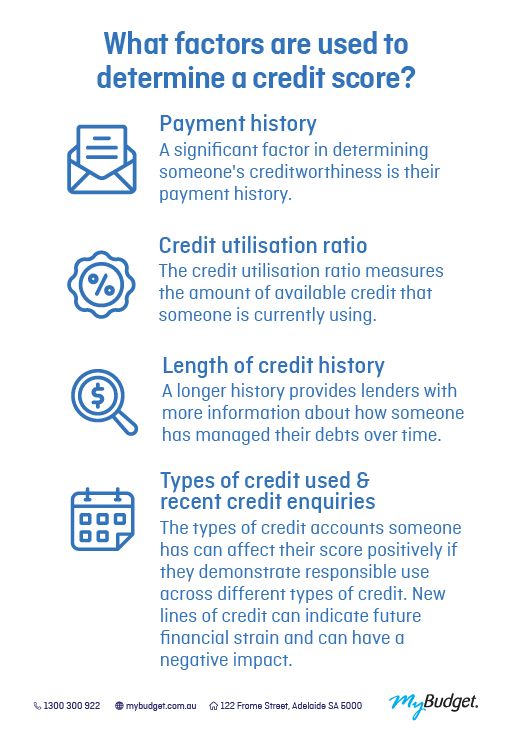

What makes up your credit score?

The exact formula for your credit score is a closely guarded secret, but we know what factors play a role in establishing whether you might be a credit risk. Here’s a simple breakdown:

- repayment history: are you paying your bills on time?

- total amount owed: how much debt are you juggling?

- length of credit history: the longer your credit history, the better

- types of credit: a mix of credit cards, loans, and mortgages can be a plus

- new credit: how often are you applying for new credit lines?

These factors blend together to create your unique credit score.

How does Buy Now, Pay Later affect your credit score?

As part of new credit laws , from June 2025, BNPL providers must now perform a basic credit check and hold a credit license to meet responsible lending standards (just like other lenders, like banks). This means signing up for a BNPL service like Afterpay, Klarna or Humm may involve a formal credit enquiry, that will be visible to other lenders.

Soft and hard credit checks on BNPL accounts

BNPL providers must now tell you upfront if they’re going to check your credit report, whether it’s a soft or hard enquiry, before you sign up or increase your limit.

A soft credit check won’t leave a mark on your file, but a hard check will appear as a credit enquiry that other lenders can see. One or two won’t usually impact your credit score much, but several new enquiries in a short time can send up red flags.

Zip has always conducted credit checks when signing up new customers, this shows up as a file enquiry and might cause a small dip in your score. From June 10, 2025, Afterpay introduced similar checks when you create an account or request a higher spending limit. These checks are now visible to other credit providers, although Afterpay doesn’t report your repayment history or spending limits. If that ever changes, they’ve stated they’ll give you a heads-up first. Klarna also performs credit checks visible to other lenders.

Missed payments

If you’ve missed a payment for over 60 days and owe more than $150, your credit provider or their nominated collections agency can list a default on your credit report. They’ll notify you twice about the overdue payment before this happens. This default sticks to your credit report for two years, even if you pay off the debt. If you make a hardship request, that information can remain on your credit report for one year. This listing can make future borrowing trickier since it’s visible to potential lenders. Here’s a more detailed breakdown of the Australian Government’s OAIC default listing rules.

Multiple BNPL accounts

Having multiple BNPL accounts can signal financial instability to lenders. It might make them wary of your ability to manage credit effectively.

Risk of overspending

BNPL encourages spending beyond your immediate means, potentially leading to financial strain. The convenience of deferred payments can lead to a cycle of debt.

Paying credit with credit

Using BNPL credit to cover existing debts can create a dangerous debt cycle. Relying on credit for regular expenses can lead to accumulating more debt and financial stress.

Can BNPL improve your credit score?

Regularly paying off your BNPL instalments might reflect positively on your credit score, showing you’re reliable with your payments. However, this benefit is limited. Not all BNPL providers report positive payment history to credit bureaus, so while missing payments can hurt your credit score, on-time payments might not help it as much as other types of credit. Take a look at the providers FAQ’s or terms and conditions to find out if this is part of their service.

Can BNPL affect my home loan eligibility?

Using BNPL services doesn’t automatically disqualify you from getting a home loan, but it can create challenges. Lenders may scrutinise your BNPL activity and consider it when assessing your loan application. Missed payments or multiple BNPL credit applications could raise red flags, impacting your eligibility for home loan approvals.

Tips for using BNPL wisely

BNPL can be a handy tool if you know how to handle it. But like any financial product, it comes with its own set of risks. Here are some practical tips to help you navigate this type of credit and make the most of it without free-falling into debt.

Don’t rush: read the T&Cs

Impulse shopping might be fun, but signing up for BNPL on the spot can lead to buyers regret. Read the FAQs and dissect their terms and conditions. Those documents hold the secret to avoiding surprise fees and managing your payments like a pro. Research all of the options and understand the long-term implications.

Stick to one BNPL provider

Imagine you’ve got groceries, fuel, and clothing spread over three different BNPL providers. Each purchase has a different due date, amount, and rules. Keeping track of it all? Absolute chaos. Simplify your life and avoid this headache by sticking to just one BNPL account. It will help you minimise credit report enquiries and manage your payments more effectively.

Budget for BNPL purchases

Treat BNPL payments like any other expense in your budget. Plan for them, so they don’t sneak up and blow your budget. A little foresight goes a long way in keeping your spending in check.

Keep track of BNPL payments

Set reminders, use apps, or even stick Post-it notes on your monitor, whatever helps you stay on top of your BNPL obligations. Avoiding late fees and protecting your credit score is all about staying organised and vigilant.

Alternatives to BNPL

If you’re concerned about the potential impact of BNPL on your credit score, there are alternative options:

Create a budget: budgeting is key to creating good financial health. Figure out where your cash is going, set spending limits and start budgeting for the life you want. The peace of mind knowing money is set aside for life’s expenses is much better than taking a debt detour

Save your way to success: want to go on a holiday? Channel your inner squirrel by building a savings fund that will eliminate the need for any BNPL schemes. Imagine the feeling of paying for that holiday with cash you’ve saved. Sure beats having a costly holiday hangover!

Need help? MyBudget is your go-to for helping you achieve the financial life you dream of. We work together to create a budget that suits your lifestyle and helps you reach your financial goals without having to rely on credit. So when you need those groceries, new shoes or a holiday the money is right there waiting for you!

How do you keep your credit score in good shape?

Maintaining a good credit score starts with treating Buy Now Pay Later like any other form of credit. Use BNPL sparingly, make repayments on time, and always read the fine print. Protecting your credit score now means more financial freedom later.

While it might feel like instant financial relief, it’s easy to lose track of repayments, especially if you’ve got multiple accounts on the go. One missed payment or default can leave a mark on your credit score.

Can MyBudget help me stop relying on BNPL to get by?

If Buy Now, Pay Later has become your go-to for everyday expenses, MyBudget can help you quit BNPL with a personalised budgeting plan.

MyBudget has helped over 130,000 Australians take control of their finances for more than 25 years. We’ll work with you to create a personalised budget that:

- automates your bill payments

- pays off debt

- builds savings

- helps you stop relying on BNPL to make ends meet.

Are you juggling multiple repayments, falling behind on bills, or simply want a more sustainable approach? MyBudget can help!

Enquire online or call 1300 300 922 to talk to a budgeting specialist today.