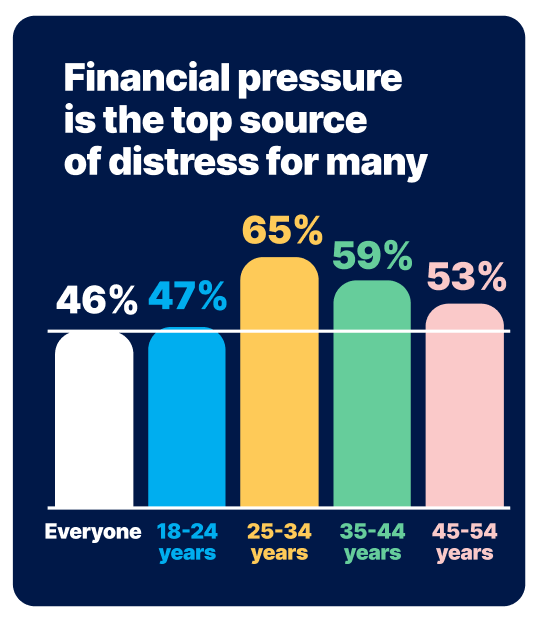

"Bloom proactively addresses the #1 cause of stress in Australia, financial health…!"

Tammy Barton | Founder and Director of MyBudget

Why Bloom? The real cost of employee financial stress

- Financial stress costs Australian businesses $88.95 billion in lost revenue every year 1

- Financially stressed employees spend an average of 11 hours per month dealing with personal finances at work

- 22% of workers take time off to deal with creditors or debt management.1

* Source: 1 AMP 2024

Prioritise your employees’ wellbeing and see the results

Financial stress doesn’t stay at home, it comes to work too. It can cloud focus, drain energy, and chip away at morale.

Bloom is your way to show that you care deeply about their whole wellbeing, not just their productivity.

Bloom gives your people the tools and support to feel secure and confident with their money, so they can bring their best selves to work.

Elevate your employee benefits!

Request your free Bloom Info Pack today and our team will be in touch.

Is Bloom easy to implement?

Yes! We make it effortless. From onboarding to employee communications, our team handles everything.

- No cost to your business*

- We take care of all onboarding, rollout, and staff communications

- Minimal admin required, our expert team manages everything for you

- You choose your level of involvement, with optional employer contribution.

Luke | MyBudget team member

Your benefits, transformed. Financial wellbeing with Bloom.

What your people get:

- A clear 12-month budget plan

- Support to reduce debt and build savings

- Budgets tailored to help them achieve their goals

- Automated bill payments that minimise distractions

- Confidence through an all-in-one money management tool.

The result: Employees feel less stressed, more secure, and more focused, so they can bring their best selves to work.

FAQs

What is Bloom?

Bloom is an Employee Financial Wellness Program, powered by MyBudget, designed to help your team reduce financial stress, build money confidence, and thrive at work and in life. Through personalised budgeting consultations, support services, and tools, Bloom empowers employees to take control of their finances.

How does Bloom benefit my business?

When employees are financially secure, they’re more focused, productive, and engaged.1 Bloom helps reduce absenteeism, improve engagement, and turnover by addressing the root cause of stress for many Australians; money.1 A thriving workforce drives stronger performance, retention, and workplace culture.

What services are included in the program?

Employees will receive exclusive access to:

- A free 2-hour consultation with a MyBudget Personal Budgeting Specialist

- A tailored financial wellbeing plan.

If they decided to join the MyBudget award-winning services, they receive:

- Ongoing budgeting support and expert money management

- Access to exclusive MyBudget tools, resources and money tips

- Exclusive discounts.

How is Bloom different from other wellness programs?

While most wellness programs focus on physical or mental health, Bloom addresses financial health, the #1 cause of stress in Australia.1 It’s proactive, practical, and personalised, with real outcomes that support both the employee and the business.

How do we know it works?

Bloom is powered by MyBudget, who has helped over 130,000 Australians take control of their finances since 1999. Research shows that employees who feel financially secure are more productive, more loyal, and less likely to be distracted or burnt out.1 Bloom is built on decades of proven success.

Why should I prioritise financial wellbeing now?

Because the cost-of-living crisis is hitting hard. Financial stress is now at its highest level in 10 years, and only 1 in 3 Australians feel financially secure.M1 By supporting your people now, you’re investing in a more resilient, motivated, and high-performing team. When employees are blooming financially, your whole business flourishes.

* Source: 1 AMP 2024

Can’t find what you’re looking for? More FAQs.

Don't just take our word for it

MyBudget has been featured in leading Australian media and trusted publications.

Empower your people to drive success!

Get in touch with our friendly team to discuss Bloom’s benefits.