Debt Solutions are strategies and methods designed to alleviate and manage financial obligations that individuals or entities owe to creditors. These solutions encompass a range of approaches, from negotiating new repayment terms to consolidating debts. They aim to address financial distress and prevent default by offering tailored paths for debt resolution. Common approaches include debt consolidation loans, credit counselling, and negotiation with creditors for reduced payments. Bankruptcy proceedings might also be considered in dire situations. Debt solutions offer actionable routes to regain financial stability, helping individuals navigate complex debt landscapes effectively.

Overview of Debt Solutions

Debt can often feel like a looming shadow, creeping closer and closer with each passing day. However, there is hope to be found in the darkness.

In this discussion, we will explore the different types of debt solutions that can help individuals escape the clutches of their financial burdens. From debt consolidation to bankruptcy, these solutions offer a glimmer of light in an otherwise bleak situation.

Types of Debt Solutions

One widely discussed approach in financial literature is exploring the various types of solutions available to address outstanding obligations. When faced with overwhelming debt, individuals seek debt relief through different avenues, such as debt management, debt settlement, and debt consolidation.

Debt management involves creating a structured plan to repay debts over time, typically facilitated by a reputable debt management company.

Debt settlement programmes aim to negotiate with creditors to reduce the overall amount owed, often resulting in a partial payment of the original debt.

Another option is debt consolidation, which involves combining multiple debts into a single loan with lower interest rates or extended repayment terms. Individuals can obtain a debt consolidation loan from financial institutions or enrol in a professional debt management service programme.

These various approaches offer potential solutions for those burdened by excessive obligations and seeking ways to regain control over their finances.

Credit Card Debt

Credit card debt, like a silent predator lurking in the shadows, has become an increasingly prevalent issue in our society. The causes of this menacing debt can range from impulsive spending habits to unexpected emergencies that leave individuals vulnerable and susceptible to its grasp.

However, there is hope amidst the darkness as solutions such as budgeting, debt consolidation, and financial counselling emerge as beacons of light, guiding those trapped in the clutches of credit card debt towards a path of redemption and financial freedom.

Causes of Credit Card Debt

Financial mismanagement and overspending can lead to an accumulation of credit card debt. When individuals fail to adhere to responsible financial practises, they may find themselves trapped in a cycle of debt that becomes increasingly difficult to escape.

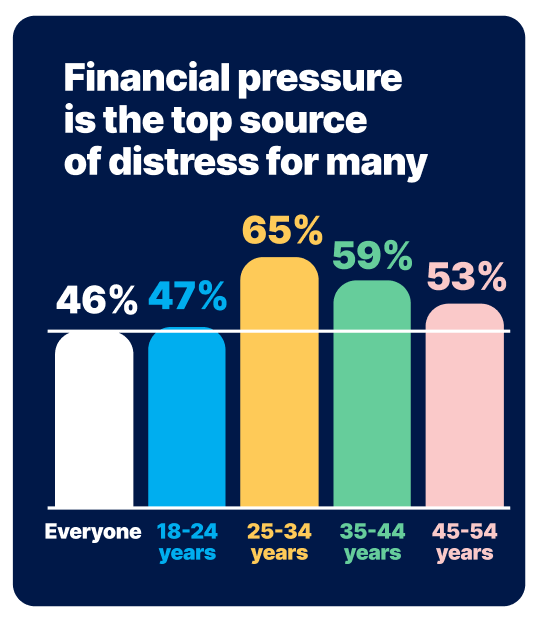

The allure of easy credit combined with the pressure to maintain a certain lifestyle can create a dangerous environment for financial stability. As debt burdens increase, individuals may experience heightened levels of financial stress and anxiety, impacting their overall well-being.

Seeking assistance from debt relief programmes or companies can provide much-needed support and guidance in managing debt problems. These organisations offer various debt solutions tailored to individual circumstances, such as debt relief orders or structured repayment plans.

Solutions to Credit Card Debt

Addressing the underlying causes of excessive spending and implementing effective strategies for managing personal finances can help individuals regain control over their financial situation and ultimately find relief from the burden of credit card debt.

When faced with mounting debt, individuals may consider various debt relief options, such as enrolling in a debt management programme or seeking assistance from a credit counselling agency. These programmes typically involve negotiating with creditors to establish a manageable repayment plan that suits the individual's financial circumstances.

In some cases, individuals may also explore the option of engaging a debt settlement company to negotiate with creditors on their behalf. This process involves settling the outstanding balance for less than what is owed.

Additionally, exploring ways to lower interest rates through a debt management plan can significantly reduce overall payments and expedite the path towards becoming debt-free.

Unsecured Debts

Unsecured debts, lurking in the shadows of financial insecurity, are a haunting reality for many individuals. These debts, unlike their secured counterparts, do not require collateral and thus leave borrowers vulnerable to the whims of creditors.

As these dark spectres continue to plague households, it becomes imperative to explore solutions that can offer respite from the suffocating grip of unsecured debts.

What are Unsecured Debts?

When considering debt solutions, it is important to understand the nature of unsecured debts. Unsecured debts represent a dark and ominous force that can haunt individuals and disrupt their financial future. These debts are not backed by any collateral, making them more susceptible to default and collection efforts.

As a result, many individuals seek debt relief through various means, such as debt management plans offered by credit counselling agencies or debt settlement companies. These entities aim to assist individuals in reducing their unsecured debt burden by negotiating with creditors for lower monthly payments or reduced overall balances.

Solutions to Unsecured Debts

One potential approach to managing unsecured debt involves seeking assistance from professional debt relief organisations. These organisations offer a range of services, such as debt management plans (DMPs), debt consolidation loans, and debt settlement services.

A credit counselling organisation can provide guidance on the most suitable option based on an individual's financial situation. In a world consumed by insolvency, these organizations act as beacons of hope in the darkness of overwhelming debt. They offer individuals a lifeline, promising to alleviate their burden and restore financial stability.

Through careful analysis of income and expenses, a financial counsellor can create a customised DMP that allows individuals to repay their debts gradually over time. For those with limited options, bankruptcy may be considered a last resort for discharging unmanageable debts.

In this battle against insurmountable liabilities, professional debt relief organisations provide solace while navigating the treacherous path towards financial freedom.

Financial Counsellor Services

In the depths of financial despair, when debts loom like ominous shadows and hope is but a distant memory, there exists a glimmer of light in the form of a Financial counselling Service.

Defined as an essential lifeline for those drowning in debt and seeking guidance, this service offers professional assistance and expertise in navigating the treacherous waters of financial hardship.

Definition of a Financial Counsellor Service

A Financial counsellor Service is a professional service that offers guidance and advice to individuals facing financial difficulties. In a world consumed by debt, these services provide a glimmer of hope amidst the darkness.

With debt relief solutions seeming elusive, individuals find themselves trapped in an endless cycle of debt recovery and mounting stress. The Financial counsellor steps in as a beacon of light, offering strategic debt planning and empowering clients to take control of their financial situation.

Through personalised debt management programmes, they equip individuals with the tools necessary to achieve financial freedom and become debt-free. By analysing the debt amount and formulating realistic goals, they guide clients towards making manageable monthly debt service payments.

A Financial counsellor Service serves as both an ally and a lifeline for those drowning in the depths of financial despair.

Benefits of Using a Financial Counselling Service

Utilising the services of a Financial counsellor can provide individuals with valuable financial guidance and assistance in managing their financial difficulties. In a world plagued by money and debt stress, these professionals offer a glimmer of hope for those drowning in their financial obligations.

With their expertise in debt help Australia, fast debt help, help paying debt, and help paying off debt, Financial counsellors serve as beacons of light amidst the darkness that often accompanies overwhelming monetary burdens.

Through online debt help platforms and personalised consultations, these counsellors strive to clear my debt and provide small debt relief solutions tailored to individual circumstances. By offering Australian debt relief options and strategies aimed at improving financial well-being, they empower individuals to regain control over their finances.

The assistance provided by Financial counsellors not only alleviates immediate monetary concerns but also equips individuals with the knowledge and tools necessary to navigate future financial challenges.

Debt Agreements

A debt agreement, also known as a Part IX Debt Agreement, is a legally binding agreement between a debtor and their creditors to repay outstanding debts.

It provides an alternative to bankruptcy for individuals who are struggling with their financial obligations.

This discussion explores the definition of a debt agreement and delves into its benefits, shedding light on how it can potentially alleviate the burden of debt in a suspenseful and imaginative manner.

Definition of a Debt Agreement

One way to define a debt agreement is as a legally binding contract between a debtor and their creditors that outlines the terms and conditions for repayment of outstanding debts. A debt agreement serves as a potential solution for individuals struggling with overwhelming debt, offering them an opportunity for debt relief.

These agreements are often facilitated through debt settlement companies or other debt service providers who negotiate with creditors on behalf of the debtor. The terms of the agreement typically include a payment schedule, interest rates, and participation in a debt management programme.

While such arrangements can help individuals regain control over their finances, it is essential to consider the potential implications for one's credit score and future financial prospects when entering into a debt agreement.

Benefits of a Debt Agreement

The advantages of a debt agreement include the potential for reduced interest rates, simplified repayment plans, and the opportunity to negotiate with creditors for more favourable terms. These benefits can provide much-needed relief to individuals struggling with overwhelming debt.

By participating in a debt management programme or seeking assistance from debt services or settlement companies, individuals can enter into a structured debt agreement that allows them to regain control over their finances. This not only helps save money in the long run through lower interest rates and monthly payments but also provides a sense of hope and empowerment.

Negotiating with creditors can lead to more manageable repayment plans, alleviating the burden of mounting debts. Thus, a debt agreement offers tangible benefits that enable individuals to escape the dark depths of insurmountable debts and embark on a path towards financial stability.

Debt Management Plan (DMP)

Implemented by credit counselling agencies, a Debt Management Plan (DMP) is an effective strategy for individuals to repay their debts through negotiated lower interest rates and consolidated monthly payments.

This dark yet hopeful system offers debt relief services to those burdened with overwhelming credit card debt. By enrolling in a DMP, individuals can seek help with their debt from reputable debt relief companies such as National Debt Relief or Accredited Debt Relief. These organisations provide expert assistance in negotiating with creditors to secure lower interest rates and create a structured payment plan that aligns with the individual's financial situation.

Through this debt management programme, individuals gain control over their spiralling debts and embark on a path towards financial stability. The ability to negotiate with creditors allows for the possibility of reducing overall indebtedness while providing much-needed relief to those trapped in the clutches of mounting financial obligations.

This Article Discusses

Help with debt problems, help with national debt, help with my debt relief assistance, relief from debt relief orders, and help with rent interest rate rises What are debt services? What is a debt management programme? business bureau Freedom Debt Relief Monthly Payment: Debt Relief Company interest rate debt management companies credit report free consultation help make need help make sure make payments creditors may work creditors much money money management debt free become debt free free debt rate payment minimum payments may be able creditors may refuse want work pay debt pay debts pay back debt management plan dmp loan options options may settle debts find debt help find the best find the best debt becoming debt free debt relief programme amount owe reduce amount period time first time time takes student loan new loan credit card debt relief lower interest rate credit counselling agency credit counselling organisation personal loans personal finance personal loan use credit loan debt consolidation The best debt relief companies The best debt settlement companies help people save unsecured debt and credit card balances. Organisations offer credit counselling programmes and public service services. reduce debt and help reduce late fees high fees charge fees make a single monthly payment making monthly payments loans credit cards medical pay credit cards high interest rates credit card debt solution, unmanageable debt, legal advice debt collector debt situation debt repayments loan debt secured debt financial futures period of time personal insolvency agreement personal insolvency single interest rate mortgage provider credit rating financial wellbeing payday loans Commonwealth Bank legal proceedings business loans consolidated loan voluntary arrangements affordable repayments formal agreement informal agreement dedicated team regular payment debt management services regulations and debt analysis debt management assistance debt negotiators debt counseling debt helpline debt management authorisation energy debt internet debt accessible debt advice affordable debt relief solutions alternative debt solutions, assistance with debt management cards with debts clients on debt solutions common debt control of debts Conversations with debt collectors debt advice charity debt advocacy debt arrangement scheme debt collection calls Debt consolidation calculators debt consolidators, debt information, and debt management options debt management specialists debt options debt payment programme debt relief charity debt relief foundation debt repayment plan debt restructuring finance for tax debt forms of debt implications for debt forgiveness licence application application fees application for lodgement application from creditors complete application basic consumer loan consumer complaints consumer credit contracts consumer in relation to consumer protection agency bankruptcy assistance bankruptcy attorney bankruptcy checks filing for bankruptcy hardship variation Financial hardship advocates hardship team amounts over time to actual persons assistance to people Cash interest rates, realistic budgets, budget planners, and customer service customer success managers federal income taxes: initial phone consultation credit providers emotional stress.