Planning for school fees: how to afford public or private schooling

This guide explains how parents in Australia can budget for school fees using practical budget planning, a personal budget and simple savings strategies to manage education costs across public and private schooling.

Why Australian school fees feel harder to manage each year

Now that the kids are back at school, (and… exhale!) the mad morning rush has settled back into a routine, there’s a quiet thought lurking in the back of your mind… those school fees invoices will be arriving any day now.

Tuition alone can feel overwhelming, especially when it creeps up year after year and can be one of the biggest fixed costs in a family budget.

According to Finder and ACARA data, public or government school contributions average around $382 per year for primary students and $764 per year for secondary students, while independent or private schools average about $7,413 per year at primary level and $13,115 per year at secondary level.

These figures reflect tuition or voluntary contributions only and don’t include uniforms, devices, camps or excursions, which should also be built into your budget.

When you layer extra school expenses on top of tuition, it’s easy to see why education costs keep climbing year after year, especially when comparing public and private options.

So, how do you afford school fees without throwing your finances into chaos?

With the right structure, school fees can become just another manageable line in your budget, not a once‑a‑year financial meltdown. Good budgeting, clear budget planning and the right tools make a real difference.

In this article, we’ll break down how to budget for school fees step by step, what costs to plan for, how much to set aside each pay cycle, whether that’s for public schooling or private schooling, and practical ways to reduce the impact on your family budget.

What school-related costs should you plan for across the year?

School fees are more than tuition alone. To budget properly, you’ll want to include every cost you’re likely face across the year.

Typical school expenses in Australia include:

- Tuition or school contributions

- Uniforms, shoes and bags

- Stationery, textbooks and workbooks

- Devices, software and technology levies

- Camps, excursions and incursions

- Sport fees, equipment and extracurricular activities

- Transport, public transport passes and before‑ and after‑school care.

And if you want a more in‑depth guide on how to save on back‑to‑school essentials beyond school fees, we’ve put together a practical guide on saving money on back‑to‑school costs that covers uniforms, stationery, devices and other everyday expenses.

How much should you budget each month for public school fees in Australia?

A simple rule of thumb is:

Estimated annual school costs ÷ 12 = monthly school fees amount

Using current national school fee averages from the same Finder’s report:

- Primary school: about $32 per month

- High school: about $64 per month.

If you’re paid fortnightly, divide your annual estimate by 26 instead. The goal isn’t perfection, it’s consistency. Smaller, regular amounts are far easier to manage than large lump sums.

How much should you budget each month for private school fees in Australia?

You can use the same simple approach for private schooling:

Estimated annual school fees ÷ 12 = monthly school fees amount

Using current national school fee averages from the same Finder’s report:

- Private primary school: about $618 per month

- Private secondary school: about $1,093 per month.

These figures cover tuition fees only. Uniforms, textbooks, digital devices, software, technology levies, school camps, school trips, sports uniforms, musical lessons, transport and extracurricular activities will add to the total, so it’s important to factor all education costs into your wider budget as well.

How do public and private school fees compare in Australia?

Understanding the difference between public and private schooling helps you decide what you’re really paying for, beyond just the headline fee. Neither option is ‘right’ or ‘wrong’, it’s about what fits your family and your budget.

What do you get with public schooling?

Public schools (government) are designed to provide accessible education for all families. Fees are usually structured as voluntary contributions, with core learning covered and additional costs layered on as needed.

Typically, public school fees contribute to:

- Classroom learning and curriculum delivery

- Basic school resources and facilities

- Access to extracurricular activities, often on a user‑pays basis.

Uniforms, devices, camps and excursions are usually charged separately, which means families have more flexibility to opt in or out depending on their budget.

Because expectations vary by school and state, it’s important to review your school’s full cost schedule so you understand what’s included and what’s optional.

What do you get with private schooling?

Private school (independent) fees generally cover a broader range of services and facilities, which is why costs are higher and tend to rise as students move through year levels.

Private school tuition fees may include:

- Smaller class sizes or additional learning support

- Enhanced facilities, technology and specialist programs

- A wider range of extracurricular and enrichment opportunities

In addition to tuition, some Australian private schools charge an enrolment or admission fee, application fee, annual fee, building or scholarship funds, and technology levies. Many families offset costs through scholarships, bursaries or sibling discounts, but private education usually requires earlier planning and a long‑term savings approach.

How to budget for school fees and all the extras

The simplest way to stay on top of school costs is to plan your budget before the school year begins.

Start by thinking ahead to the extra expenses that tend to pop up during the year, this includes things like uniforms, stationery, devices, camps, excursions and extracurricular activities.

Laying these costs out early helps you see the true cost of the school year, not just the tuition.

If you want a quick way to turn those numbers into a clear money saving plan, our Personal Budget Template supports simple budget planning by helping you build a practical personal budget that maps school fees alongside bills, groceries and savings. It’s a free money tool that shows you exactly what to set aside each pay cycle.

How do you actually put a school fees plan into action?

Once you’ve mapped out your school fees and extras, the key is to keep things simple. The easiest approach is to separate school money from everyday spending, so it doesn’t compete with groceries, bills or other essentials.

That usually means setting up a dedicated school fees account or savings stream, contributing to it weekly, fortnightly or monthly, and using it only for school-related costs. This way, you always know what’s set aside and what is safe to spend.

If you want to sense-check how much you need to save or test different financial goals, our free Savings Calculator can help you estimate timeframes before you lock it into your budget.

Did you know? If you’re a MyBudget client, this is all handled for you. We build a dedicated school fees savings stream into your personal budget, with money set aside automatically and ready for when school fees are due. Enquire online or call us now on 1300 300 922 to see how MyBudget could help you put a school fees plan in place.

Are payment plans, education loans or fee support options worth it for school fees?

For many families, yes. Payment plans and education loans can significantly reduce financial pressure, particularly for families managing higher private school tuition fees, boarding fees or living expenses.

They help by:

- Spreading costs evenly across the year

- Avoiding large upfront payments

- Making school fees easier to plan around rent, bills and debt repayments.

If money is tight, it’s worth contacting the school early to ask about flexible arrangements or hardship options. Schools would rather work with families than see payments fall behind.

How do single parents afford school fees in Australia?

There is financial assistance for single parents and low income families. Across Australia, there are government and community initiatives designed to reduce the financial pressure.

Depending on your state, you may be eligible for concessions that help with school fees and related costs like uniforms, camps or learning materials. For example, South Australia’s School Card provides assistance for eligible families attending government schools, while other states offer similar education concessions.

Some families may also access matched‑savings programs, no‑interest loans for essential school items, or charity support such as The Smith Family, which provides scholarships and essential learning resources. Speaking to the school early can also help you set up a manageable payment plan instead of relying on lump‑sum invoices.

If you’re navigating money on one income, our in‑depth guide on budgeting as a single parent walks through how to build stability, prioritise essentials and plan ahead with confidence.

What should you do if you can’t afford school fees right now?

If you’re under financial pressure, start here:

- List what’s essential versus optional

- Contact the school early to discuss payment plans or support

- Build a short‑term cash flow plan so you know what can be paid and when.

Feeling stretched doesn’t mean you’ve failed. It means you need a plan that reflects real life. If you’d like support right now, you can call one of our expert Money Experts for budgeting help on 1300 300 922.

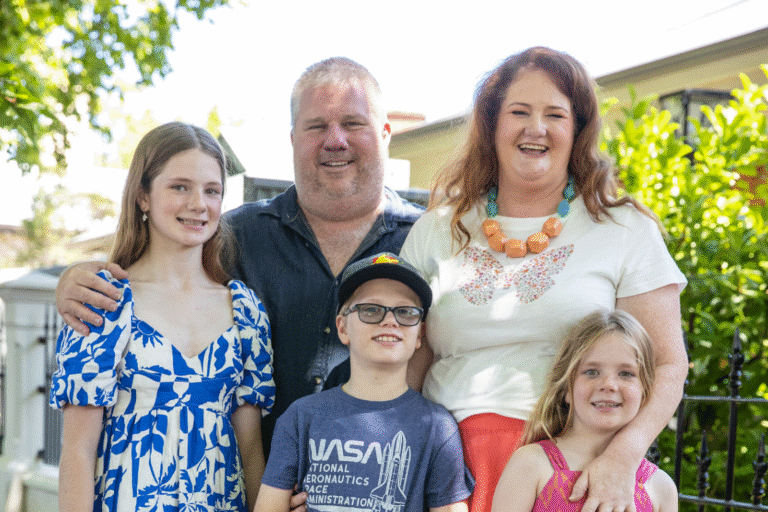

Jenni’s story: “I wanted stability for my daughter, so I made school fees part of my budget”

Choosing the right school is about more than the cost. For many families, it’s about stability, support and giving their child the best chance to thrive.

MyBudget client Jenni, a single mum to five‑year‑old Charlotte, knew this first‑hand. After moving schools repeatedly as a child herself, she was determined to give her daughter a more settled experience.

“I’ve chosen a school that offers reception to Year 12,” explains Jenni. “As long as my daughter’s happy and achieving, there’ll be no reason for her to ever change schools.”

Making that choice possible came down to planning early and getting the structure right with MyBudget.

“I said to MyBudget, ‘I want this for my child, but how much does private primary school cost? These are the amounts of money I need to have by these points in time.’ And they said, ‘No problem – we’ll add it to your budget and start making payments.’”

By setting up a dedicated school fees savings stream and understanding which costs were compulsory versus optional, Jenni was able to turn a long‑term goal into something predictable and far less stressful.

“Being a single mum, I looked for a school that could provide extra support for my daughter if she were to struggle, and by the same token, that they could support and extend Charlotte if she excels,” says Jenni.

While Jenni chose private schooling, the same budgeting structure works just as well for families managing public school costs too.

Read Jenni’s story about navigating single parent budgeting with MyBudget and building financial stability for her family.

How can MyBudget help you budget for school fees?

MyBudget helps you organise your money so when school fee invoices arrive, the money is already set aside and paid for you. Our financial coaching approach focuses on budgeting help that fits real life, not rigid rules. We help you:

- Build school fees and schooling extras into your personal budget

- Get practical debt solutions to get out of debt faster

- Set up realistic money saving plans to reach your savings goals.

For over 25 years, MyBudget has helped more than 130,000 Australians live life free from money worries. There’s no obligation to get started.

Book your free appointment and walk away with a clear 12‑month plan that includes school fees, bills and the things that matter most to you.

Enquire online now or call us on 1300 300 922. Imagine where your money could be 12-months from now!

School fees FAQs

Can’t find what you are looking for? See more FAQs…

Budgeting for school fees in Australia starts with upfront budget planning. List all expected education costs for the year, then use a budget template or personal budget to divide the total across your pay cycle. Setting up a dedicated school fees savings stream turns that plan into a simple money saving plan that runs automatically.

How much you need to set aside depends on whether your child attends a public or private school. Based on Finder’s 2026 national school fee averages, public school families can typically budget around $32 per month for primary students and $64 per month for secondary students, while private school families may budget closer to $618 per month for primary and $1,093 per month for secondary. Spreading costs evenly across the year makes school fees easier to manage.

If you’re struggling to afford school fees, contact the school early to discuss payment plans or hardship options. You may also be eligible for government concessions or state‑based assistance that help reduce education costs.

Yes. MyBudget helps clients plan for school fees by building them into a personalised budget and setting up a dedicated savings stream in the background, so funds are ready when invoices arrive and financial stress is reduced.

MyBudget helps people take control of their finances by creating a personalised budget, organising their bills and providing day to day money management support. We help reduce financial stress, manage debt, build savings and give clients a clear, structured plan for their financial goals. With over 25 years of experience and more than 130,000 Australians helped, our system provides stability, confidence and long term results.

Every appointment to set up your personalised budget is completely free. If you decide to join, your fees will depend on the complexity of your financial situation and the level of support you need. Our mission is to improve financial wellbeing, so our fees are designed to be an affordable investment towards helping you achieve your financial goals.

This article has been prepared for information purposes only, and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information in this article you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.