Alternatives to debt consolidation loans: We found a better option for Debbie & Alan

Debbie and Alan, like many others, were desperately searching for a way to alleviate their mounting debt. They had heard about debt consolidation loans, a popular option for combining multiple debts into a single, more manageable payment. However, they were unable to get a debt consolidation loan from the bank, being left with little-to-no financial advice, and they had begun to consider a Part IX debt agreement when they realised the consequences were not dissimilar to bankruptcy.

The results from online calculators looked dire and extra repayments to pay down their larger loans looked almost impossible. After an appointment with our caring MyBudget team, we helped them find alternative debt solutions with regular repayments in a comprehensive repayment plan so they could pay their way out of debt instead. So if you’ve asked your bank, ‘How do I get a debt consolidation loan?’ in an attempt to simply pay your outstanding balances and they’ve turned you down, or you’re unsure if it’s right for you, keep reading.

Australia’s debt situation

Australians are among the most personally indebted people in the world. Our household debt-to-income ratio (how much people owe compared to how much people earn in a year) is just over 200%, a figure that has trebled since the 1990s.

In less than 20 years, the average Australian mortgage balance has grown from $160,000 to a whopping $610,000. Renters are feeling the pressure too. According to Suburbtrends, median-priced homes are nine times the average annual income, meaning that you won’t be able to fully pay off a median home loan until you’ve used 100% of your annual income towards it for over nine years.

In addition, with the RBA increasing interest rates last year, many current home owners are stuck with high-interest rates on their mortgage, resulting in repayment costs that are making it difficult to stick to dream financial plans, instead turning into financial burdens.

With the rising costs of living, many have been struggling to keep payments on time, resulting in negative marks and the potential for a bad credit score on credit checks. It’s not simply a matter of poor spending habits; Australians are feeling the pinch country-wide.

What do you do about debt collectors?

Debt collectors can be a major source of stress and anxiety for individuals and families struggling with debt. All of this debt, in addition to any personal loans, secured loans and bad credit card debt, adds up to a mountain of potential stress. When a household budget is already stretched, all it takes is an unexpected bill or even a small drop in income to break the bank. Over time, this is how savings get eroded, then credit card debt builds up, and suddenly the household is living week-to-week.

Brisbane couple Debbie and Alan were in exactly that position. A series of events led to snowballing debt. They were racking up fees and charges with late payments, and had the added stress of debt collectors chasing them. “It got to the point that we were scared of answering the phone, knowing that there could be someone at the other end wanting money from us,” says Alan. “Stress was causing a lot of anxiety in the household. It wasn’t a fun time at all.”

What do you do when the banks won’t help?

In such situations, where traditional banks are unable or unwilling to help, it becomes essential to explore alternative options for managing debt and seeking relief.

When Debbie and Alan found themselves in need of help to pay back their outstanding debts, they naturally turned to their bank. They wanted to pay back the money they owed by consolidating their credit card balances into their mortgage, a strategy called ‘debt consolidation’ or ‘mortgage refinancing.’

The aim of debt consolidation loan options is to roll multiple current debts into a single loan that has a lower interest rate and a lower repayment figure. It can also bring down the true cost of the debts as it can reduce the amount of interest you pay over time, especially if you’re able to bring down the balance with extra repayments with the newfound freedom. As well as saving money and easing cash flow, having one unsecured loan with one repayment can be easier to manage.

One of the limitations of a loan for debt consolidation is that lenders usually require a property with sufficient equity to be used as security. A real estate asset reduces the lender’s risk of losing money should the borrower stop making repayments, but this won’t necessarily get you approved if you have a poor credit score.

Debbie and Alan spoke to a number of lenders about refinancing their home, but with bills and overdue payments stacking up, none of them were willing to help. Alan explains, “We’d tried talking to the banks about debt consolidation loans, but no one was coming forward with any assistance.”

What is a Part 9 Debt Agreement?

A Part 9 Debt Agreement is an alternative form of debt consolidation loans for borrowers facing financial difficulties. It is a formal agreement between a debtor and their creditors that allows the debtor to repay their unsecured debts based on what they can afford, usually over a repayment period of three to five years.

While googling ‘debt consolidation,’ Debbie and Alan came across alternative debt solutions, including Part IX Debt Agreements. Alan explains, “It looked like a Part IX Agreement was something that could help us, but we didn’t know exactly what a ‘Part Nine’ was.”

Personal insolvency agreements (PIAs) and formal debt agreements, also known as Part IX debt agreements, are so-called because they form ‘Part IX’ of the Bankruptcy Act. Formal debt agreements are administered by licensed debt agreement administrators who, in turn, are regulated by the Australian Financial Security Authority (AFSA).

You make this offer to your creditors in the form of a debt agreement proposal, based on an amount you can afford. There is also an AFSA lodgement fee. The consideration and voting period for creditors is usually 35 days. Should your creditors accept the debt agreement proposal, the debts no longer attract interest and the payments are consolidated into one, regular payment that is divided between creditors by the debt administrator.

Creditors are obliged to no longer pursue you for any unsecured debts included in the agreement, but there are exceptions. Some of these include debts incurred after the agreement started and joint debts. In the case of joint debts, creditors are able to try to recover debt from the person who is not in the agreement.

Although a formal debt agreement is considered an alternative to bankruptcy, it’s important to understand that it comes with similar consequences. People who enter into a debt agreement have their names recorded on the National Personal Insolvency Index (NPII) and the agreement appears on their credit score for up to five years. In some instances, a debt agreement may expose applicants to the possibility of being forced into bankruptcy by their creditors against their will.

This is why Alan and Debbie decided to explore alternative debt solutions.

What other alternative debt solutions are available?

When it comes to alternative debt solutions, there are several options available for individuals like Debbie and Alan who are looking for alternatives to debt consolidation bank loans. These alternative solutions can provide different strategies and benefits based on individual circumstances and financial goals.

After talking with a free financial counsellor and a number of debt agreement companies, they were given advice that included looking for promotional period balance transfer credit cards, debt settlement, debt consolidation options, etc. However, Debbie and Alan decided to get a second opinion from MyBudget about alternative debt solutions. MyBudget is uniquely positioned to help people explore their situation from all angles because the focus is on creating a detailed budget before choosing a solution, such as bankruptcy or a debt agreement.

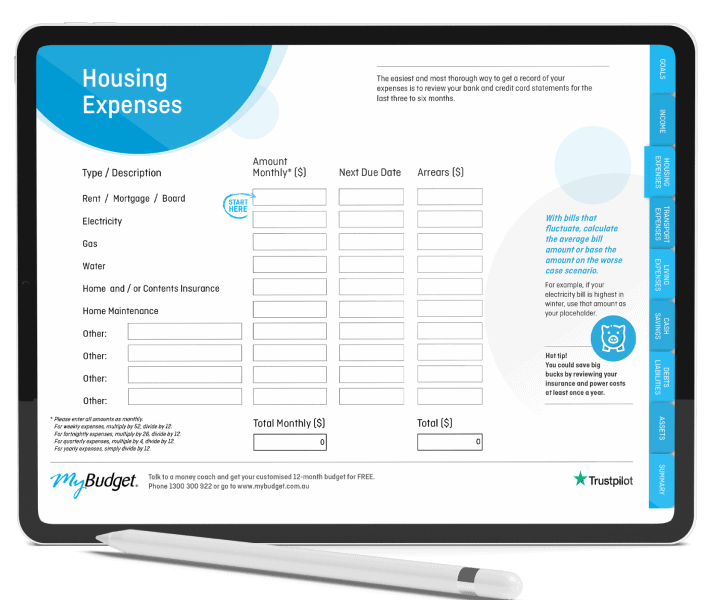

The first step was to help Alan and Debbie create a customised household budget for the next 12 months. This detailed debt management plan included all of their monthly income, debts, credit card bills, household bills, personal finances and living expenses, and mapped a path to their financial goals.

MyBudget founder and finance expert Tammy Barton explains, “Before you can help someone select the right debt strategy, you need to have a detailed understanding of their financial situation. Not just how much they owe and their loan repayments, but a complete picture of all their incomings and outgoings – everything.”

Informal debt negotiation may be an alternative

If you find yourself struggling with debt and unsure of how to handle the situation, one alternative is informal debt negotiation that doesn’t require entering into a formal debt agreement. This consists of contacting your creditors to establish affordable payment arrangements, helping you avoid late repayment fees and charges.

Debbie and Alan were pleasantly surprised when MyBudget was able to help design an affordable budget with their adequate income that allowed them to avoid any further late fees and charges by mapping out their required and additional debt payments and without going into a Part IX debt agreement. Instead, their budget showed that they would be able to pay their way out of debt with more traditional debt payoff strategies.

Rather than entering into a formal debt agreement, MyBudget negotiated directly with Debbie and Alan’s creditors to set up affordable payment arrangements until they got back on their feet. Debbie and Alan didn’t know what to do about debt collectors, but MyBudget had a solution.

As well as dealing with Debbie and Alan’s creditors, the stress of paying bills was taken away by MyBudget because all of their monthly payments were directly coming from their budget. Alan adds, “One of the best things MyBudget has done is handling all of our creditors on our behalf. So now we’re not scared of the phone ringing. MyBudget has taken our financial wellbeing into their hands and we now have savings we can work with. They’ve really done wonders for us as a family.”

This is all in addition to ensuring that Debbie and Alan still had access to funds when needed, allowing them to pay their day-to-day expenses and cover any emergency costs that may come up. When you’re living week-to-week, one unexpected emergency cost can topple the plan. So being able to afford to pay off various kinds of debt is often not enough; factoring in a safety net in your debt management strategy, working towards financial freedom, is just as important as the debt management strategy itself.

If you’ve been asking ‘How do I get a debt consolidation loan?’ or are considering a Part 9 debt agreement, it’s important to get a tailored debt solution

In some circumstances, a Part IX debt agreement is a solution for reducing the repayment costs and stress of consumer debt. In Debbie and Alan’s case, they were able to get back on their feet using their existing steady income and without needing a loan.

What’s more, the sense of relief was almost instant.

“The weight was lifted,” says Debbie. “We walked out of the [MyBudget] office smiling. We had ideas about what we could do in the future. It was wonderful.”

How can MyBudget help me with looking for debt consolidation alternatives?

If you’re not sure what to do about debt collectors and the bank won’t help you with any type of loan or types of debt, MyBudget may be able to help you with your monthly repayments. While a loan for debt consolidation can make the process simpler with only having to worry about a single payment, it may be time to avoid further lines of credit and look to improve your overall credit history.

No matter your situation, MyBudget can with your debt repayments, creating a tailored budget plan that will ensure you’re reaching your minimum payments. In addition, once you’ve finished paying down those dreaded loan amounts, you can focus on your future by putting away savings, rewriting bad habits and work towards paying your bills on time and achieving financial freedom.

To book your free budget appointment and improve your current lifestyle, give MyBudget a call on 1300 300 922 or enquire online.