Interest-free finance vs digital lay-by: What’s the difference?

Afterpay, Zip Pay, Ezi-Pay, Gem Visa, GO MasterCard, Creditline, Buyers Edge… all of these are ‘buy now pay later’ services. Each of them allows customers to receive their goods or services immediately and pay for them over time. But what is buy now and pay later? How does Afterpay work, really? Is interest-free financing a good idea? Are there any pitfalls and what are the tips to avoid them? And how do they compare with interest-free finance? Let’s answer these questions!

Interest-free finance: Let’s begin where it all began

Since the dawn of commerce, merchants have been dealing with the single most common buyer’s objection: “I can’t afford it.” And in two or three thousand years, not a lot has changed.

Affordability is still a hurdle and the driving reason that merchants are constantly looking for flexible ways for customers to pay. This is where interest-free finance and buy now pay later comes in.

This is the gap where consumer finance builds its bridge. Don’t have enough money? That’s okay, we’ll lend you some!

But to complicate things, there are a lot of different consumer finance products in the market, as well as hundreds of finance providers to choose from.

What is interest-free finance?

You know what interest-free finance looks like – you walk into a shop and there are posters advertising “Interest-Free Finance Available Here!”

The example below is taken from The Good Guys’ website. Latitude is an interest free-finance provider. In this case, they provide interest-free periods from six to 60 months.

Example of interest-free finance advertising (The Good Guys website)

What is buy now and pay later?

Some of the most common interest-free finance providers in Australia are Gem Visa Card, HSBC, GO MasterCard, Creditline and Buyers Edge, as well as many others.

These finance providers partner with participating retailers who offer the finance companies’ interest-free products to their customers.

So, how does Afterpay work for example? How do they get paid?

Firstly, the interest-free finance provider gets paid a commission by the store calculated as a percentage of the loan amount. This is the merchant’s cost for being able to offer the interest-free facility to their customers.

Secondly, the customer (borrower) pays an application fee, and/or an annual fee, plus a monthly fee and account charges.

Thirdly, the lender makes buckets of dosh in interest charges when around 20% of borrowers don’t pay off their purchases within the interest-free period.

Is interest-free financing a good idea?

People often don’t realise that applying for interest-free finance is the same as applying for a credit card. The only difference is that the participating retailer may help to process and submit the application to the lender.

Under the requirements of the National Credit Code, the lender then assesses the borrower’s creditworthiness and decides to approve or decline the application, based on your credit score.

If the deal goes through, the buyer leaves with their goods – and a new line of credit in the form of a credit card. A line of credit is a flexible loan that has a maximum borrowing amount (credit limit).

Alternatively, some credit cards come with an automatic interest-free facility. HSBC credit cards, for example, are all eligible to be used for interest free purchases.

“There’s no need to complete any application forms,” the HSBC Australian website says. “You can simply use your available HSBC credit at any of our participating retailers. Just be sure to mention you want to pay using HSBC Interest-Free.”

Just like a credit card, interest-free finance has a credit limit. As you use your card, the amount of each purchase is subtracted from your credit limit.

Potential pitfalls of interest-free finance

Just as with a credit card, the minimum monthly repayment on an interest-free line of credit is generally 3% of the balance or $30, whichever is higher.

It’s important to recognise that minimum payments may not pay off your purchase within the interest-free period.

Therefore, to work out your actual repayments, you need to divide your loan balance by the number of months in the interest-free period, for example:

Let’s say you buy a $1200 TV from The Good Guys on 12-month interest-free finance. That means you have 12 months to pay off the balance before it starts accruing interest.

To pay off $1200 within 12 months, you’ll need to make interest-free payments of $100 per month, plus fees and charges.

But what if you make only the minimum monthly payment? Well, $1200 x 3% = $36. If you pay only $36 per month, by the end of 12 months, you’ll still owe $768!

After the interest-free “honeymoon period” has lapsed, the lender will start charging interest on this remaining balance, at a rate of generally 12% to 19.95% per annum.

If you’re still thinking, ‘Is interest-free financing a good idea?’ Keep in mind that the lender isn’t obliged to tell you when the interest-free period is ending or to work out how much you should repay to avoid interest charges. That’s your job.

Lastly, be especially careful about drawing cash against a line of credit. Cash loans usually incur daily interest at the cash rate.

How does ‘buy now pay later’ compare?

What is buy now and pay later doing right? ‘Buy now pay later’ services are the latest merchant and retail finance craze. Afterpay is the most popular, followed by a string of others, such as Certegy Ezi-Pay, Zip Pay and Openpay.

Like traditional interest free finance, they allow the buyer to receive their goods or services immediately and pay via instalments.

In the case of Afterpay, for example, the buyer pays by automatic direct debit in four equal, fortnightly repayments and can have multiple orders on the go.

Example of Afterpay advertising: Shop now, take now, pay later.

How does afterpay work so well? Here’s an example of Afterpay advertising: Shop now, take now, pay later. Pretty convincing right?

Is it popular? You betcha! Afterpay’s annual revenue has been soaring year on year.

Afterpay reports that it earned around 13% ($68.8 million) of its annual income ($502.7 million) from customer late fees in 2020, and the balance from merchant fees ($433.8 million). All this from capitalising on impulse buying habits.

Merchants pay 30 cents per transaction, plus a commission fee based on around 5% of the sale.

Afterpay’s meteoric rise has a lot to do with its integration model. Shoppers can use Afterpay online or in-store and it applies to goods of all value, from humble haircuts to dental treatments.

Is buy now pay later (BNPL) a loan?

Not technically. What is buy now and pay later if it isn’t a loan? Afterpay and other similar BNPL services fall outside of the National Credit Code because they don’t charge the user any interest.

As such, applications are approved almost instantly and there is no credit check involved. All they need is for you to enter your personal information (name, address, suburb, state, postcode) and have an active debit or credit card account from which to make your repayments.

How does Afterpay work when it comes to interest?

Instead of interest charges, users incur late fees. According to Afterpay’s terms and conditions:

If a payment is not processed on or before the due date, late fees will apply – an initial $10 late fee, and a further $7 if the payment remains unpaid 7 days after the due date. For each order below $40, a maximum of one $10 late fee may be applied per order. For each order of $40 or above, the total of the late fees that may be applied are capped at 25% of the original order value or $68, whichever is less.

Afterpay may not come under the National Credit Code, but that doesn’t mean that BNPL purchases can’t affect your credit rating.

Late payments could still appear in your payments history. As with an interest-free line of credit, an Afterpay account counts towards the borrower’s credit liabilities, even when the balance is zero.

In fact, it’s not uncommon for banks and lenders to ask home loan applicants to first close down any ‘buy now pay later’ accounts.

What is buy now and pay later getting wrong?

Late fees are the most obvious downside of Afterpay. By its own report, the BNPL market leader collected nearly $70 million in late fees from Australians and New Zealanders last year alone. That’s a lot of household income down the drain.

There is also the potential effect that a ‘buy now pay later’ mentality can have on people’s spending habits. It’s especially concerning to see these services used for relatively small purchases.

On the upside, savvy consumers know that retailers who offer BNPL payments are fair game when it comes to expecting a cash discount. Smart shoppers know that BNPL retailers have hefty margins built into their pricing models to account for the cost of BNPL finance.

And that’s why smart shoppers save for the things they want. When they turn up to buy, they have money in their pocket and no hesitation asking for a cash discount. All it takes is a little discipline and the life-changing magic of a budget.

Become a smart shopper

So.. is interest-free financing a good idea? In short, no. Cards make us more likely to spend in general, let alone adding interest-free finance/repayments into the mix.

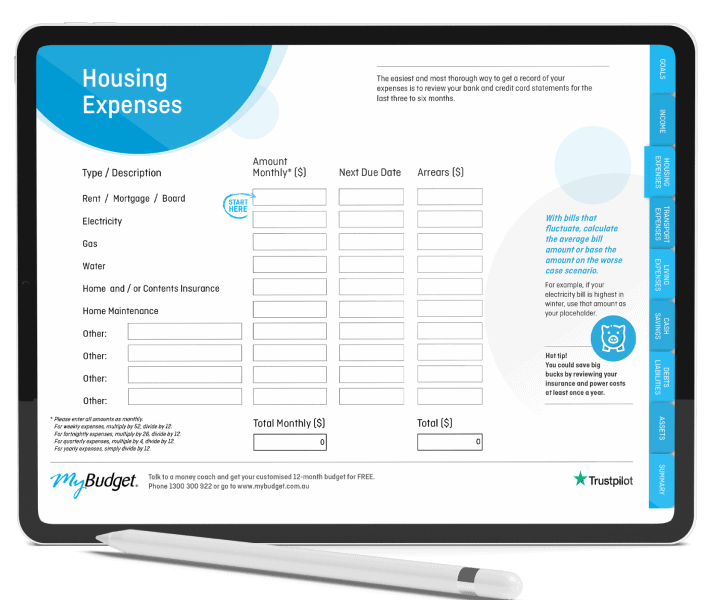

If you like the idea of saving for the things you want, a budget is the best way to go (here’s how to start a budget if you’re not sure).

If you’re daunted by the prospect of building your own, contact MyBudget. We’ll help to design a free customised budget that has you saving (and shopping smarter) in no time.

Ready to find out more?

Call 1300 300 922 or get started today

This content has been updated from the original post published in August, 2019.