10 tips for budgeting for a holiday

Planning and budgeting for a holiday can be a daunting task, but with the right approach, you can make your dream vacation a reality without overspending. To avoid financial stress during your trip, it’s important to set a realistic budget and find ways to save on major expenses.

Whether you’re planning a weekend getaway or a longer vacation, following these 10 tips can help you enjoy a stress-free holiday without worrying about money. From setting a budget to exploring cost-saving options, we’ll provide you with practical advice and resources to make budgeting for your holiday a seamless process.

By creating a budget that suits your needs and finding ways to save money, you can ensure that you can relax and enjoy your well-deserved vacation without any financial burdens. So, take the time to plan and budget effectively for your upcoming holiday to make it a memorable and worry-free experience.

Start planning early

If you want to ensure a stress-free and enjoyable family holiday, it’s important to start planning early. Family vacations, whether local or abroad, can add up in costs, and giving yourself enough time to save up will allow you more flexibility in choosing your destination and activities.

Last-minute planning and budgeting can lead to unnecessary stress and headaches, so it’s best to plan ahead. By booking flights and accommodations far in advance, you can often secure better deals and save money on your holiday expenses. So, start planning early to make the most of your vacation budget!

Create a family budget

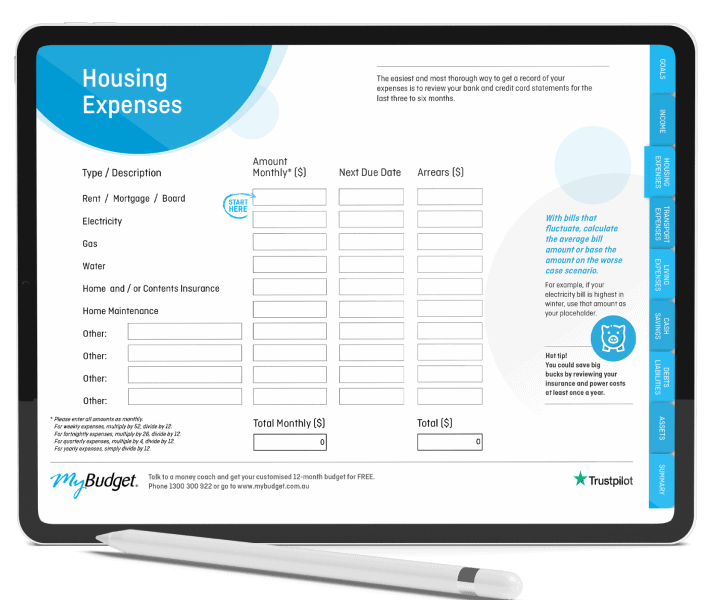

One important step in planning for a holiday is to create a family budget. If you find that there isn’t enough room in your budget for savings, it may well be a sign that you need to evaluate your expenses closely. Take a look at where you can cut back on monthly expenses to make room for your holiday spending.

Budgeting is essential for determining how much you can realistically afford to allocate towards your vacation. By creating a comprehensive family budget, you can make sure that you have a clear understanding of your financial situation and can make informed decisions about your holiday expenses.

Get the kids involved

When planning for a holiday, it’s important to get the whole family involved in the process. Share your family holiday ideas and travel plans with everyone, and listen to their input and opinions. This not only helps in making decisions together, but also creates excitement and anticipation among family members.

One way to involve the kids in the budgeting process is by allocating some of their pocket money towards their personal holiday spending. This teaches them about budgeting and the value of money while giving them a sense of ownership in the holiday planning.

Additionally, encourage them to help reduce household bills by reminding them to turn off lights, close doors, and take shorter showers, as this can save extra money that can be put towards the holiday fund. By getting the kids involved, you not only instill valuable financial lessons but also make the holiday planning a fun and collaborative experience for the whole family.

Open a special bank account for your holiday savings

One key tip for budgeting for a holiday is to open a special bank account specifically for your holiday savings. You can arrange to have a portion of your salary deposited directly into this account by your employer or set up automatic transfers so that your holiday savings are consistently growing without you even having to think about it.

Additionally, consider opening a high-interest savings account to help your money grow over time and maximise your holiday savings. This way, you can ensure that your holiday fund is separate from your daily expenses and steadily increasing towards your dream vacation.

Think local

When budgeting for a holiday, it’s important to consider the costs of airfares, especially for families with multiple children. However, don’t forget that the true essence of a holiday lies in the change of scenery and the break from routine. Don’t dismiss the idea of exploring local destinations that are affordable and enjoyable.

Australia is a stunning country, with so many natural landscapes, beaches, and landmarks waiting to be discovered. Instead of looking far and wide for vacation spots, why not hop in the car and embark on a sightseeing adventure in your own backyard? You might be pleasantly surprised by the hidden gems that await you just around the corner.

Think off-peak

To get the most out of your holiday budget, consider travelling during off-peak seasons. Many popular destinations offer fantastic discounts and deals during the slower times of the year. For example, visiting a ski resort in the summer can be much more affordable than in the winter months.

However, be aware that off-peak seasons may come with the risk of unfavourable weather or less-than-ideal conditions. So, while you can save money by travelling off-peak, be prepared for potential trade-offs in terms of weather and overall experience.

Anticipate all of your holiday costs

There’s nothing worse than being on holiday and realising you haven’t budgeted for something. When planning for a holiday, it’s crucial to anticipate all of your potential travel costs so that you don’t end up overspending.

Make sure to create a detailed holiday budget that includes all travel expenses such as transport (airfares, petrol, car hire, etc.), accommodation, meal costs, snacks, drinks, entertainment, tours, activities, shopping, travel insurance, visa costs, vaccinations, and some contingency money for unexpected expenses. This way, you can enjoy your holiday without any financial stress.

Shop around

Be sure to shop around for the best deals when you’re planning your next holiday. Whether you’re booking flights, accommodations, or activities, taking the time to compare prices from different sources can help you save money. This is especially important when it comes to booking flights, as reserving your seats early can often result in better prices.

Don’t forget to explore aggregator websites as well, as they can provide you with a comprehensive overview of available options and prices. By being diligent in your research and comparison, you can ensure that you make the most of your holiday budget. It pays to shop around for the best price. If you’re flying, it’s especially important to reserve your seats early. Websites you can check are kayak.com, webjet.com.au and wotif.com.

While on holiday, use cash rather than credit

When you’re on holiday, it’s important to be mindful of your spending and budget accordingly. While it may seem convenient to use a credit card for all your purchases, carrying cash can actually help you stick to your travel budget more effectively.

Within Australia, using a debit card is a simple way to manage your expenses. For international travellers, consider using a travel card that can be pre-loaded with funds in the local currency of your destination. This works like a debit card for purchases and ATM withdrawals, helping you avoid overspending and stay within your budget while enjoying your holiday.

In addition, you can hold out on exchanging your money until the exchange rate is more favourable, giving you more travel funds to enjoy yourselves with.

from money worries

Create your own budget plan designed to help you live the life you want

Consider “staycationing”

If you’re on a tight budget and looking to save money, consider “staycationing” for your holiday. Staycationing involves enjoying a vacation right at home or in your local area. To make the most of your staycation, treat it like a real holiday by unplugging from technology, avoiding work emails, and planning special activities and treats that everyone in the family will enjoy. It’s a great way to relax and have fun without breaking the bank.

How can MyBudget help me budget for a holiday?

MyBudget has helped many Australians go on their dream holidays, and the answer is budgeting. By organising your personal finances and making plans to achieve your savings goals, you can make the seemingly impossible possible.

MyBudget has helped over 130,000 Australians live their lives free from money worries. To get started on your budget and plan for your dream holiday, give us a call on 1300 300 922 or enquire online today.