From Drowning In Debt To Financial Freedom: Valerie’s Story

Many Australians struggle with debt and financial challenges. Unexpected life events can turn everything upside down. However, it’s never too late to turn things around. In this article, we’ll share the inspiring story of Valerie, a long-term MyBudget client who went from drowning in debt and addiction to achieving financial freedom.

By following a few key principles and making some smart financial decisions, Valerie was able to get her debt under control and start living her life free from money worries. If you’re ready to take control of your finances and start working towards a brighter future, then keep reading or listen to episode 3 of MyMoney MyStory.

When life throws unexpected financial challenges

When Valerie’s injury happened, she did not realise the long-term implications it would have on her life. Rendering her unfit to work and living with chronic pain, her life began to crumble. With the mental strain of lost income and living on WorkCover payments of 80% of her income (which at that point dropped to 60%), she found herself in a dark spiral.

“It’s not just physical; it was a mental breakdown. Having an injury to deal with and living with chronic pain, then all of a sudden your income’s cut by 20% but you still got the same bills you had before.”

Valerie’s struggle with debt and addiction

The strain began to impact her relationship, which led to the breakdown of her marriage. The bank refused to help her refinance her home loan; the deposit had come from her mother, which meant paying excessive interest. Unable to cope with the devastation that kept occuring around her, she was sucked into a gambling addiction. The majority of her small income was going towards cigarettes, alcohol, and pokies. She was living on less than a dollar a day for food.

“It was a very difficult situation to go through, where I needed an outlet. So I went to the pub and I gambled.” She felt so unsupported that she fell into the pattern of addiction. Every time she had asked for help, she was turned away or dismissed for being on WorkCover. She felt embarrassed about her situation, not realising how much could be done to turn it around. “The electricity bill was $3,500 in arrears. Water bills about the same. Rates, I think it was about six years behind.”

The journey to financial freedom

During a conversation with her neighbours she’d often have a smoke with, Valerie learned that they had given up cigarettes. She couldn’t believe it, and asked how they had done it. They explained they had joined MyBudget and told Valerie that she should too. Finally ready to take a leap and make change, which took a lot of courage, she decided to open up about her debt situation to a MyBudget Money Coach on the phone. She was in the MyBudget office the next day, for almost three hours, working out a debt management plan to achieve debt-free living.

Creating a budget and sticking to it

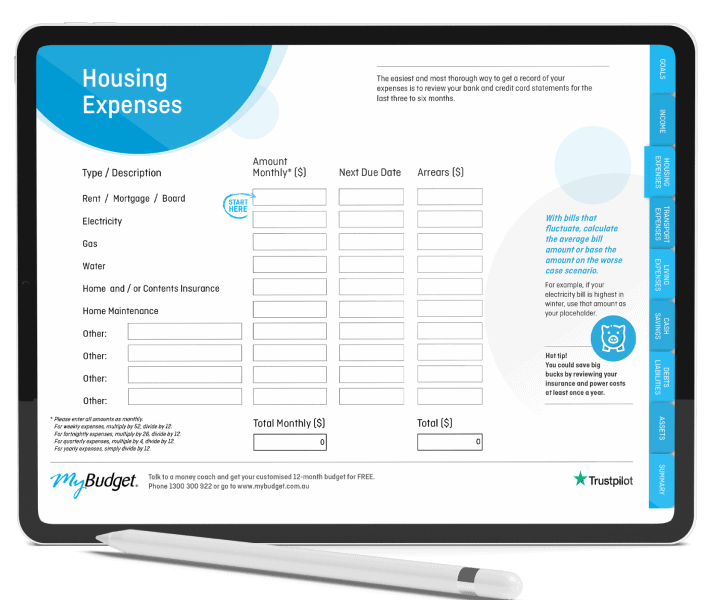

What she discovered was completely unexpected. “They showed me the first 12 months of what my finances were going to look like and what they would look like in two years. I couldn’t believe it. How can these bills be all paid out and then end up in credit? How can I have some savings here?” She had not realised how expensive her spending habits and debt bucket truly were, and how much she was capable of achieving with a little help. Her debt payoff journey was well underway in just one year, and now several years on, she has completed a new qualification, quit smoking, changed her spending habits and has her debt under control.

“I was living day-to-day on cheap two minute noodles, water, and doing nothing for myself. I looked at them and I said, how? They took their time and showed me what they’ve done and how it can be done.” Valerie’s budget showed how to make money work for her, not against her. She could pinpoint additional sources of debt and take the necessary action, encouraging her to make more positive choices that would lead to achieving long term financial goals. “Walking out of the office, I felt 10 times lighter.”

Paying off debt strategically

Living on WorkCover, no financial institution wanted to know about Valerie. Her mother had given her a house deposit, and gone guarantor on her mortgage. Her dream was to have her mother removed from the mortgage so her pension would not be impacted. She asked so many times for help with her mortgage but banks would simply refuse, topped with paying excessive interest on her minimum monthly payments. After refinancing through MyBudget Loans, she was able to take her mother off the mortgage in 11 months and was paying $900 less per month in interest.

In the first few years of sticking to her budget, Valerie also had a boarder living with her to assist with paying the mortgage. It was an additional income stream to work towards debt reduction, particularly when she had the spare space at home. For those that are able, taking on extra money can make a difference towards paying off debt and getting back on track.

Investing in yourself and your future

With the help of a budget and some of MyBudget’s guardian angels, Valerie learned that a realistic budget is an investment in both yourself and your future. Having the visibility to see how her money problems and various forms of debt were going to go away over time gave her the belief that she could soon achieve financial freedom.

Staying motivated and accountable

Sticking to a budget can be challenging at times, especially with a budget tight with a bit of debt. Valerie had to find ways to remain motivated and accountable, and she did this by reminding herself of how far she’d come by regularly checking her budget on the MyBudget app.

Valerie’s budget helped her to pay off unsecured debts that were in arrears, then move into credit for her annual bills. For the first time in her life, she was able to save money. She had an emergency fund and healthy spending habits, easily making the minimum payments on all of her personal debt and household debt foregoing any unnecessary spending.

Celebrating milestones and progress

Valerie’s new lease on life and her experience with MyBudget inspired her to complete a Cert IV in Accounting and Bookkeeping, which she finished in advance and achieved high grades for. She knew it was time to re-enter the workforce in a way that suited her injury and lifestyle, now with a new passion for helping people overcome their financial woes. She loved studying and committed herself entirely to it, and is currently looking forward to working and continuing her studies.

The birth of her granddaughter inspired her to prioritise her health, giving up smoking completely. She loves spoiling her granddaughter and is so grateful she can buy her things she would otherwise have not been able to afford in the past.

Encouragement for those struggling with debt

For Valerie, making the phone call and taking the leap was the best decision she could have made for her life trajectory. “I’m so glad I did. My shoulders weren’t heavy anymore. I made the decision, which was the best decision I’ve ever made, was to say, yes, please help me. I needed to change. My whole life was a disaster.”

Just because it’s tough now, doesn’t mean it always needs to be. Going from drowning under a mountain of debt and addiction to building savings with newfound extra cash and working toward a brand new career path, Valerie hopes that her story of building a positive relationship with money can inspire others that are in a similar financial position to do the same.

To get started and take charge of your own financial future, MyBudget has helped over 130,000 Australians live their lives free from money worries. This has been from managing credit card debt with a debt repayment plan, to simply helping to make a more sustainable financial situation with a comprehensive household budget. We’ve improved many Australians’ credit scores by helping them paying off their personal loans with a range of debt relief options, and we can help you too. Be sure to give us a call on 1300 300 922 or enquire online today.