How to clean your credit report and repair your credit score

Have you been turned down for a loan and thought, “How can I fix my credit score?” Your credit report plays a huge role in financial approvals, and if it’s looking a bit rough, it might be time for a clean-up. Here’s how to fix a bad credit report, improve your credit score, and get your finances back on track.

What is a credit report, and what is a credit score?

Think of your credit report like your financial report card, while your credit score is the grade. In Australia, credit scores range from zero to 1,000 or 1,200, depending on the credit reporting agency. Lenders use it to gauge your financial reliability and assess credit risk.

A ‘good’ credit score can land you lower interest rates and better loan terms. A ‘bad’ score? Expect higher rates, limited borrowing power, and fewer lender options. So, that little number? It’s a big deal.

What does a credit report include?

- Your personal details (name, date of birth, address, and driver’s licence number)

- How many times you’ve applied for credit (credit checks)

- The type and amount of credit you hold (personal loans, credit card debt, secured loans)

- Your repayment history (including any defaults, late payments, or judgments)

- Any court judgements or financial issues (fraud, bankruptcy, debt collectors)

- Information collected by Equifax, Experian, and illion, each of which may have slightly different data, depending on which lenders report to them.

Where can you check your credit report for free?

You can access a free copy of your credit report every three months from Australia’s three major credit reporting agencies:

Since each agency collects slightly different data, it’s worth checking all three to get a complete picture of your credit history.

You can also get your score for free from online providers like Finder, Wisr, and Canstar.

Who are Equifax, Experian and illion, and what’s the difference?

Equifax, Experian, and illion are Australia’s three major credit bureaus, but they differ in how they collect, analyse, and present data, leading to variations in your credit score. Here are the score variations from each agency:

- Equifax: from 0 (low) to 1200 (best)

- Experian: from 0 (low) to 1000 (best)

- illion: from 0 (low) to 1000 (best).

Why are scores different across credit reporting agencies?

Each credit bureau calculates credit scores differently, weighing factors like payment history and credit utilisation uniquely. Plus, lenders aren’t required to report to all three, so your credit file may vary between agencies.

How is a credit score calculated?

Your credit score is based on several key factors:

- Payment history: late or missed payments drag your score down

- Credit utilisation: using too much of your available credit can hurt your score

- Length of credit history: a long, well-managed credit history helps

- Types of credit: a mix of secured loans, unsecured loans, credit cards, and overdrafts can be beneficial

- Public records and credit inquiries: too many credit applications in a short time is a red flag.

Here’s an example of how Equifax categorises scores:

- Below average (0-459) high risk of negative credit events

- Average (460-660) moderate risk

- Good (661-734) lower risk

- Very good (735-852) very low risk

- Excellent (853-1200) almost no risk.

A higher score means better chances of loan approvals and lower interest rates.

What is the real cost of a bad credit score?

According to 9News Australia, applying for an unsecured loan with ANZ bank with a poor credit score would mean a rate of 19.99%, whereas an excellent credit score for the same loan could land you a 7.49% rate. With other lenders like Latitude, the difference can be even greater, up to 20%.

What is a default, and how does it affect your credit score?

A default is recorded when you fail to pay a debt of $150 or more that is overdue by 60+ days. Defaults can stay on your report for five to seven years, making it harder to get credit.

How to clean your credit report and improve your credit score

Can you remove a default from your credit report?

You can only remove a default from your credit report if it was listed in error. If you think a default is incorrect, take these steps:

- Contact the creditor to dispute it

- If unresolved, lodge a complaint with the credit reporting agency

- If necessary, escalate to the Australian Financial Complaints Authority (AFCA).

Can credit repair companies clean your credit report?

You might see companies promising to ‘wipe’ bad marks from your credit report, for a hefty fee. The truth? If a default or missed payment is legitimate, it stays on your report.

How can you improve your credit score (without paying for ‘credit repair’)?

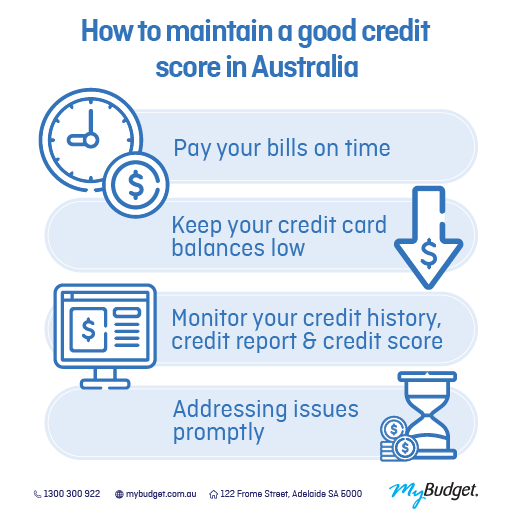

Fixing your credit score isn’t about quick tricks, it’s about building good financial habits. Here’s what you can do:

- Pay your bills and loans on time: set up automatic payments to avoid missing due dates

- Reduce your credit card limits: a lower limit improves your credit utilisation

- Avoid applying for multiple loans at once: too many inquiries can lower your score

- Build a positive credit history: recent good behaviour matters more than past mistakes.

Struggling with late payments or credit card debt? A budget is the best tool for improving your credit score

A solid personal budget helps you stay on top of bills, avoid debt, and improve your financial situation. When you’re in control of your finances, you’re less likely to miss payments or rack up high interest credit card balances, both of which impact your credit score.

Need help getting a budget started? Download our free Personal Budget Template.

How can MyBudget help you clean your credit report?

At MyBudget, we take the stress out of money management with a 12-month personalised budget plan that’s tailored to your unique financial situation. If you need a more customised approach to managing your debts and improving your credit score, we can help by:

- Ensuring your bills are paid on time

- Helping reduce debt faster

- Building your long-term financial security

We can even liaise with your creditors, so no more creditor calls or scrambling to cover unexpected costs, just an organised, stress-free approach to managing your finances.

Did you know, most MyBudget clients pay off their unsecured debts in under three years! With over 130,000 Australians helped, MyBudget has been a trusted financial solution for over 25 years.

Ready to boost your credit score?

Call 1300 300 922 today to chat with one of our awesome MyBudget team members or enquire online for a free, no-obligation consultation tailored just for you.