How to save money: 21 practical ways to save faster

Do you want to start saving? Boost your savings account? Achieve your financial goals faster? Here are 21 practical ways on how to save money (and none of them involve using tea bags twice!).

Why savings is important

What are you saving for? Most people are saving for something. Perhaps yours is a big goal (holiday, house deposit, renovations, retirement) or a small one (concert ticket, date night, a special gift). Either way, saving money is one of the basic foundations of financial fitness. It’s how you get from where you are today to the financial goals of your future.

Savings also provide an important safety net. An emergency fund is a soft place to land if an unexpected bill pops up or, say, a pandemic puts millions out of people out of work. Without cash in the bank, the alternative is to lean on your credit card or the good nature of family and friends.

Lastly, savings translate into more life choices. Money in the bank may not buy happiness, but it will give you options. The alternative – living week to week – translates into fewer life choices. This is how people get stuck in jobs, relationships or living situations they don’t like. They have the desire to change, but no financial means to make it happen.

Why saving can be hard

We’ve established that saving is how you:

- Achieve your financial goals

- Protect yourself from ‘what ifs’

- Increase your financial options in life

That’s all well and good but saving is hard! Sometimes, it’s impossible to make ends meet, let alone find spare cash.

If you find saving difficult and are unsure how to save money, you’re certainly not alone! More than a quarter of Australians have less than $1000 in the bank and 13% have less than $100. In the event of a financial crisis, 63% of people said they would struggle to raise $3,000 (ME Bank Household Financial Comfort survey).

Flat wage growth coupled with inflation (the cost of goods and services going up) has pushed up the cost of living in Australia. It’s not just discretionary expenses that are stretching Aussie wallets – it’s the rising price of essentials. Over the last 15 years, bills you can’t avoid (e.g. housing, health, transport and power) have been going up while incomes have stayed around the same.

MONEY MINDSET TIP

Don’t hope for things to get better and continue scratching your head around how to save money. Instead, create a practical savings plan that builds up your savings over time.

- Stop paying credit card interest on your dreams – save for financial goals

- Stop relying on family or friends to lend you money – build up your emergency fund

- Don’t get trapped in a life you don’t love – savings give you flexibility and freedom.

Practical ways on how to save money

Do you want to get serious about saving? Great! Believe it or not, the saving adventure you’re about to embark on is not only important, it might even be fun! That’s because saving is not just about setting aside money—it’s a set of habits that can grow into a total money management system.

You’ll be pleased to know that most of the practical tips below on how to save money require only small tweaks to your current lifestyle. But they represent little changes that can have a big impact as you increasingly embrace mindful money habits.

Of course, you don’t need to adopt every single tip. Choose those that are the biggest opportunities for you. Open your mind and give them your best, most determined shot because the effort is worth it. This is how you unlock all sorts of exciting life opportunities—travel and holidays, a home of your own, a comfortable retirement, or whatever a great life looks like for you.

Get clear about your savings goals

Before we think about how to save money, perhaps we should be asking ourselves why we want to save money. What is the destination and why is it important to you? Getting clear about your saving goals is the first step towards achieving them. So take a few minutes now to think about what you want to save for. What does your ideal life look like? What are your long-term goals? And the short-term?

FURTHER READING: 5 ways to visualise your financial goals and achieve them faster

Do an overview of your spending habits

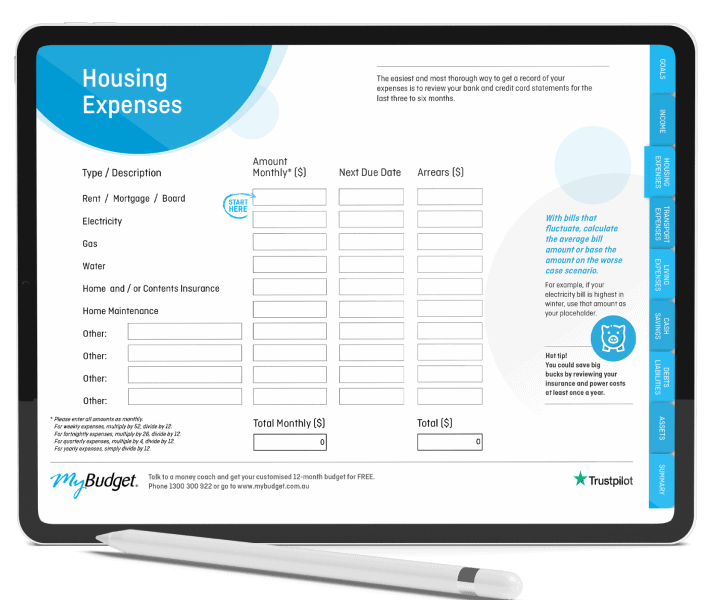

Do you know exactly how much money you spend on groceries? How about eating out? Alcohol? Hobbies and gadgets? Subscriptions? Don’t worry—half of people admit they don’t know their mortgage interest amount. To get an idea of your spending habits, print the last six months of statements for your credit card and bank accounts. Go through them with a highlighter and do some rough sums. What spending habits stand out for you? Where is your money going? What little changes could you make? Keep these statements safe because they’ll come in handy when you get to tip #21.

Make a weekly meal plan

The average Australian household spends around $140 a week or $6,720 a year on groceries. If you were to cut your grocery budget by just $10 a week and put that money in a savings account, you would have $520 at the end of the year. Cut $20 a week and you’ll save more than $1000. The best way to trim your supermarket spending is by meal planning. Meal planning involves thinking ahead about what you’ll make for meals and snacks for the whole week. You then create your shopping list. To save even more, create your meal plan around supermarket specials.

Do online grocery shopping

While we’re talking about grocery shopping, let’s mention impulse buying. Supermarkets are designed to trigger impulsive spending urges. The best way to avoid these urges is to avoid the shops. That’s why we love online grocery shopping. We consider the delivery fee a good investment. As well as avoiding the temptation of chips, biscuits and other triggers, seeing your cart total add up in the corner of the screen makes it easy to stay on budget.

FURTHER READING: Impulse buying: why we love unplanned spending and how to stop it

Buy in bulk

Savvy shoppers avoid paying full price. When they see a non-perishable item on sale, they buy two or three and set them aside for the future. The key here, of course, is to only buy items you need. Think: laundry detergent, dish soap, body wash, shampoo, cleaning products, tinned and dry foods. Chat with your local butcher about bulk meat deals.

Keep quick meals in the freezer

On top of grocery costs, the average household spends nearly $86 a week on eating out. That’s the equivalent of $4,468 a year and a significant proportion is takeaway food. If you’re in the habit of buying food on the run, the antidote is preparation. For example, keep a selection of quick, easy to prepare meals in the freezer. If you know you’re going to be late some nights or too tired to cook, you can pop a freezer meal in the microwave instead of buying takeaway.

Bring your lunch to work

Cooking a little extra for dinner is a great way to make sure you have leftovers for lunch the next day. As well as improving your diet, bringing your lunch to work can save $50+ a week or $2,500 a year—enough for a very nice holiday. If you’re not inspired by leftovers, invest in a Bento style lunchbox, sandwich bags, a soup thermos or include microwave lunches in your weekly meal plan.

Learn to make espresso coffee

As Aussies, we love our coffee. Three-quarters of us drink coffee every day and 28% have three cups. With the average latte costing $4.16, you can see how quickly a coffee addiction can add up. One barista-made daily latte would set you back $1500 a year. By comparison, stove-top Moka pots make excellent espresso (starting at $10) and Aldi’s $4.30 Lazzio coffee beans were rated the best in Australia.

Party like it’s not 1999

At MyBudget, we’re all about putting the “fun” in funds. Pubbing, clubbing, going to concerts, catching up with friends and letting your hair down are all aspects of being active and social. But do you spend too much on partying? Is it costing you your other goals? After a few drinks, it can be easy to overspend, especially if you’re paying on card or tapping your phone. One trick is to leave your cards at home and carry cash for going out. When the cash is gone, it’s time to go home. The other trick is to politely decline some invitations. It’s ok to say “I won’t be able to come this time. I’m saving my money for [insert goal here.]”

Energy-proof your home

The average Australian household spends a whopping 40% of their energy consumption on heating and cooling. So, it’s worth going to the effort of energy-proofing your home. As with budgeting, it’s not one big change that will make the difference. It’s a host of small power-saving tips that can add up to big savings over the year.

Cancel subscriptions

Ten dollars a month here, $5 there. App subscriptions and memberships can quickly add up. Even just cutting a $10 month from your subscription bill will grow your savings by $120 a year.

Get a better deal on your bills

Are you paying too much for insurance, phone or power? These are expenses where you can potentially save hundreds with just a few short phone calls. And how about your mortgage? A meagre 0.5% drop in your home loan interest rate could save $100 a month ($1200 a year) and $38,000 over the life of the average mortgage. Use this checklist to make sure you’re getting the best deal on your bills.

FURTHER READING: Slash your household bills by getting a better deal

Buy your phone outright

Speaking of phone bills, we crunched the numbers and worked out that a BYOD (bring your own device) mobile phone and data plan could save you around $1200 every three years. Our calculations assume that you enter into a BYOD plan with a fully paid off phone and that you replace it with a new handset every three years. The key is to make sure you set aside the first $1000 of savings to put towards a new phone when you eventually need it.

Sell things you don’t need

Your emergency savings fund could be hiding in your cupboards and garage. How? In the form of stuff you don’t need or use. Here is an opportunity to declutter your home and boost your savings at the same time. Consider hosting a garage sale or listing your unwanted items on Facebook Marketplace or Gumtree.

Unsubscribe from emails

Is your inbox overflowing with sales emails? As well as trying to grab a share of your wallet, all those emails take up time and add to your mental load. Free yourself from the distraction and temptation. Unsubscribe, unsubscribe, unsubscribe.

Slash your debt

It’s really hard to start saving money if you’re grappling with debt. This is especially true if you have high interest debt, such as credit cards or personal loans. Should you pay off your debts before you start saving? The answer is generally, yes. The spare cash you free up from these tips should first be used to pay down your debts as quickly as possible.

Stop using your credit card

It’s also difficult to start saving if you’re carrying a credit card balance. Breaking a credit card habit requires taking control of your spending habits, which might mean tightening your belt for a while. But think of how good it will feel to channel the money you were spending on credit card payments into your savings.

Save any lump sum payments

Are you expecting a tax refund? How about a sales bonus? Birthday money? This is a great way for how to save money and it’s quick way to boost your savings to earmark any lump sum payments for building up your savings. The average tax refund is $2300, which is a tidy sum to set aside for rainy days.

Open a dedicated savings account

This might sound obvious, but one of the keys to becoming a good saver is to have a savings account. Instead, a lot of people muddle all their money together in a single account. This makes it hard to tell how much of the balance is for future bills, and how much is for spending and saving. Most banks will allow you to open a no-fee, cardless savings account online. Cardless is a great way to make sure your savings are hard to access. The only exception to this rule is for people who have a mortgage offset account. You should keep your savings in your home loan offset account or mortgage redraw facility to reduce your mortgage balance.

How to save money as a MyBudget client?

- Money coming into your MyBudget account is automatically allocated in expense streams, such as holiday savings, living expenses, mortgage and rent, and so on

- Money for your living expenses is transferred to your personal bank account. Your other bills are paid directly from your budget, so you don’t have to worry about a thing

- Adding a bill, moving money or making a change to your budget is easy. With the MyBudget mobile app, all of our tools are at your fingertips. And our caring money coaches are only ever a phone call or email away

- You sit back and relax knowing your bills are paid on time and your savings are growing!

Automate your savings

Once you’ve got a dedicated savings account, you can automate your savings. Ask your payroll administrator to deposit a proportion of your pay into your savings account. Alternatively, set up an automatic transfer between your own accounts. Ideally, the transfer should occur on your payday, before the money has a chance to hit your pocket. At MyBudget, this is all taken care of for you.

Make your money go further with a budget

If you want to get serious about saving, you need a budget. A budget is a financial plan that shows how you are going to use your money to achieve your financial goals. You can use the statements you printed at #2 to create your own budget. Better yet, get a fully-customised budget made for you by a MyBudget money expert. It’s absolutely free, there’s no obligation to join and you’re guaranteed to discover how to save money with your financial situation.

The worry-free way to manage your money

Want to learn more about how to save money more efficiently? Whatever your money goals, there is a MyBudget solution to help you reach them

Ready to find out more?

Call 1300 300 922 or get started today