How do couples manage their money? Building joint finances to transform your financial future

MyBudget clients often say that money was a hot topic for arguments before they added structure to their joint finances. How couples manage their money means working together as a team and making sure you’re both on the same page. Each couple is unique – not every couple combine finances – and to keep that spark alive, everyone has their own love language. Keeping that spark alive in a relationship with date nights, active listening and compromise is crucial. Throw joint finances into the mix and it can make you question how couples manage their money and how they manage to build a thriving financial future together.

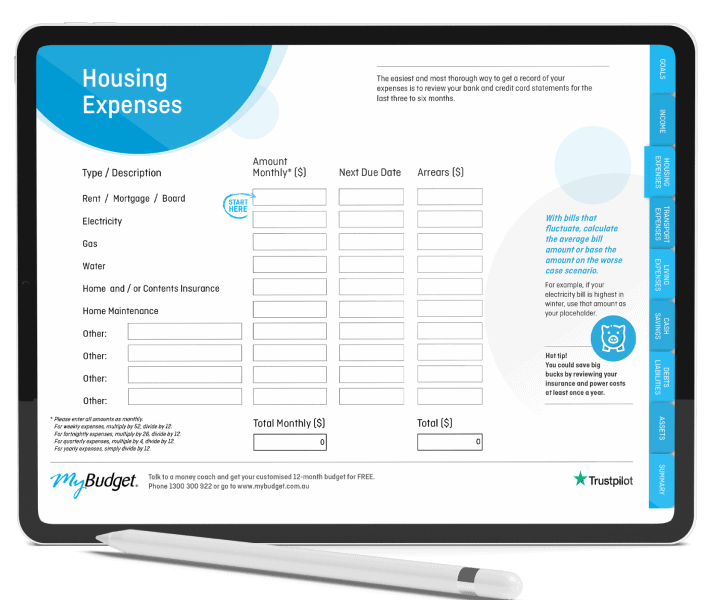

How to create a budget as a couple?

To combine finances with your partner requires complete and total honesty. Nothing can be left out as a budget isn’t a budget if it’s not honest. This is a scary (but necessary) first step as it means making yourself vulnerable.

Once you’re able to rip off that bandaid, you’ll need to make a list together which includes your joint expenses and any expected individual ones:

- Income

- Required expenses (rent/mortgage, car loan, insurances, etc.)

- Credit cards and debts

- Financial obligations (child support, supporting a relative, etc.)

- Living expenses

- Personal individual expenses (clothes, hair cuts, etc.)

Everyone is different when it comes to money, so it’s important to come into this conversation with understanding and an open mind.

It’s also important to consider that one partner may not earn as much as the other, so how do you share the load as a team? When you’re looking to combine finances together, one may find themselves paying a larger share than the other. This may be for a variety of reasons, whether that be if one of you is studying or is a stay-at-home parent. In any case, you’ll both need to ensure that you’re working toward the same goals (more on that later) and be sure to keep those communication lines open with each other.

Having your own individually allocated spending money can help to maintain that independence that joint finances can take away. These allowances are good for things like lunches at work, coffees and any hobbies/personal interests each partner may have. Remember, all work and no play makes Jack a dull boy.

Should couples have joint bank accounts?

Having joint finances with your partner may not be right for you, and that’s okay. This may be due to income differences, financial obligations or one partner having a poor credit rating. When opening a joint account (or applying for a joint loan) together, you’ll both become equally responsible for the repayments and be equally impacted if payments begin to run behind. Make sure you’ve carefully considered these consequences if your partner’s strength isn’t money management.

When couples don’t have joint bank accounts, part of the challenge can be who pays for what. “Whose turn is it to pay for lunch?”, “What’s my share of the electricity bill?” and “Did you pay the rent this week?”. These questions may ring some triggering bells from your relationship and a feeling of obligation (or guilt) can certainly result in things becoming a little one-sided.

Tips for how couples manage their money

- Setting up a shared account for bills, necessities and direct debits

- Establish a spending limit rule

- Play to each other’s strengths

- Create a budget (our personal favourite)

Some couples have multiple accounts for various uses. These can be a shared account for joint household bills, separate individual accounts for personal spending allowances and then a joint savings account for future goals. It may take some tweaking to find a system that works for both of you but don’t give up, Rome wasn’t built in a day and neither was your joint budget.

Setting up your financial future as a couple

Thinking about your financial future together and establishing goals is the best part of how couples manage their money. Goals may be as a couple or individual and it’s important to factor in both.

Financial goals for couples

- Getting out of debt

- Getting married

- Starting a family

- Buying a house

- Going on holidays

- Retirement savings

Individual financial goals

- Study

- Career development

- Indulgent purchases

- Medical procedure

- Car repair

However, these dreams don’t come true overnight; for one, it requires an honest (and fun) conversation with your partner about where you both hope to be in the future, both financially and personally.

Once this has been established, you can begin to formulate a budget that not only gets you out of debt but also turns your dreams into a reality. You both work hard for your money, so let it work hard for you.

When should I talk to my partner about money?

Finding the right moment to discuss money with your partner can be difficult to gauge, especially if you’re concerned about your financial compatibility. You don’t want to leave it too long where it becomes the elephant in every room but bringing it up too early may also be a little forward.

Finding the right time can vary but it’s important to be honest with yourself and to first and foremost know what you want. Being upfront about your financial goals can help to gauge your financial compatibility with your partner and can ensure you’re both on the same page.

So how do couples manage their money? The answer is honest communication and planning, whilst remembering that everyone has their own responsibilities and priorities. Planning out your financial future can be a daunting task but that’s where MyBudget can help.

If you’re still unsure about how couples manage their money and want to look at creating a budget that helps you combine finances and create a plan, pay off your debts and works towards reaching your future goals, then enquire online to have a free consultation with our team.

Ready to find out more?

Call 1300 300 922 or get started today