Closing the gap: women and superannuation

Despite the strides forward women have made in the last decade, the superannuation gender gap means that women are still retiring with significantly less super than men. But the relationship between women and superannuation doesn’t have to be this way. There are ways to boost your super—and future self—without busting your budget.

It’s time to think about women and superannuation. Before you let out a collective groan, it’s okay, we get it. With 101 other issues competing for your time and resources (the mortgage, the car, your kids’ education, what to cook for dinner tonight), thinking about how to boost your super and saving for retirement can be easy to push off.

Home ownership is a big asset for women, and superannuation typically follows. Super is also the safety net that will define your standard of living in retirement. Quite literally, it could be the difference between living in comfort or in poverty. That’s why you should boost your super now. Not when retirement is suddenly a few years away.

What’s the superannuation gender gap?

You’ve probably heard of the gender pay gap—the phenomenon that women typically earn less for doing the same job as men. While the gender pay gap is slowly closing, its legacy is the superannuation gender gap. Women are retiring with significantly lower super balances than men.

Why? Because super contributions made by your employer are calculated as a percentage of your salary. The consequence is that when you earn less pay, you earn less super. When you earn less super, you have less money to live on during retirement.

But that’s just the start of the problem. The superannuation gender gap is further magnified by the fact that women are more likely to work in lower-paying jobs than men. Think childcare, aged care, admin work, nursing, teaching, and so on.

Women are also more likely to have broken work patterns and to engage in flexible, part-time work so they can juggle unpaid duties, such as caring for kids and older family members. All-in-all, in the race towards a comfortable retirement, women face some steep hurdles. The result? The average super balance per age group is lower for women than men.

Then came the ‘pink recession’

Unfortunately, 2020 was a year of further financial setbacks for women. Dubbed the ‘pink recession’, the Covid-19 pandemic was particularly damaging for women and superannuation.

Job losses and cuts in working hours disproportionately affected women during the pandemic. In large part, this is because women are over-represented in the health, hospitality and retail sectors.

Women were also more likely than men to empty out their super through the government’s superannuation access scheme. The scheme, which gave people early access to their retirement savings, was a lifeline for many. But it also means that a lot of people’s super accounts have taken a leap backwards.

How big is the superannuation gender gap?

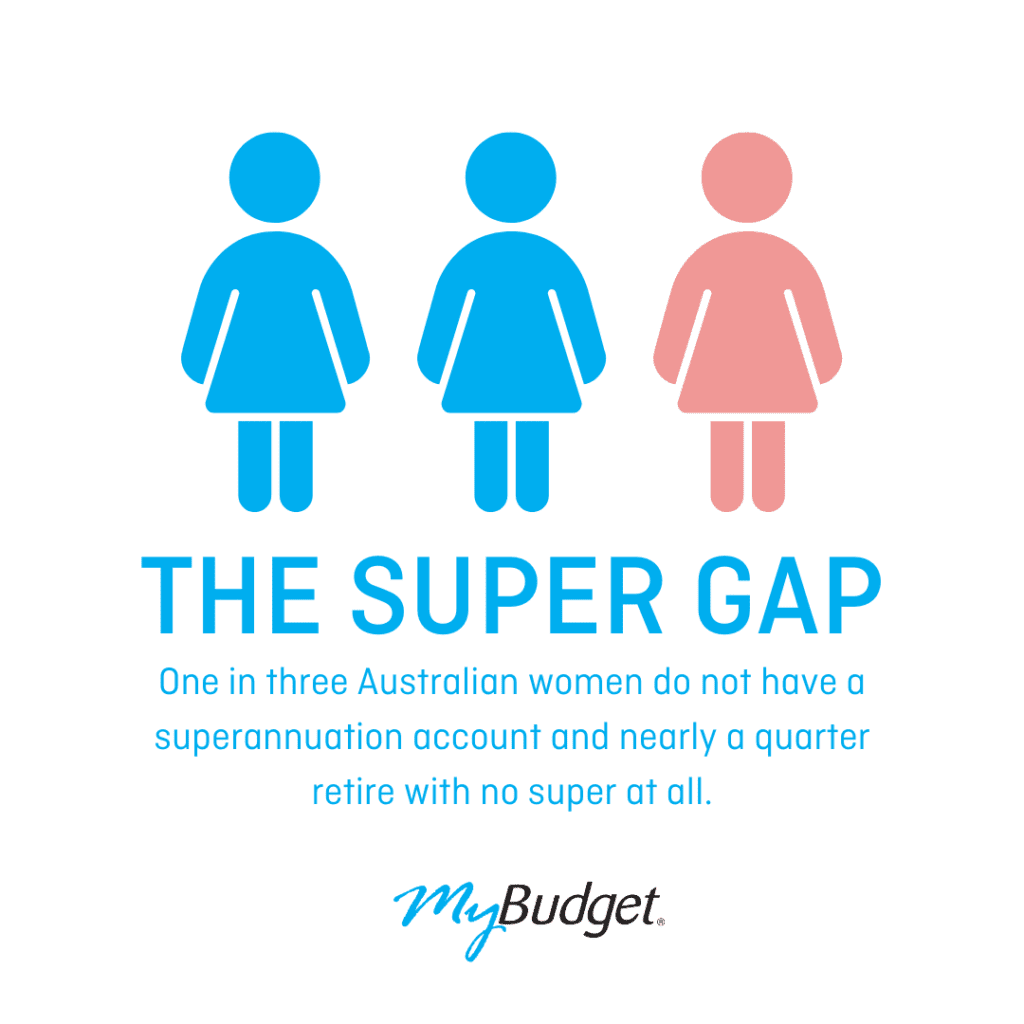

According to the Association of Superannuation Funds of Australia (ASFA), in 2019, one in three women did not have a super account and around one-quarter of women retired with no super at all.

Of those that did have super, women aged between 60-64 retired with a median balance of $122,848, compared to $154,453 for men. Both men and women retiring in 2019 fell well short of $545,000. This is the average super balance per age group needed for a comfortable retirement according to the ASFA.

As this latest crop of retirees have only benefitted from compulsory super for part of their working lives, it’s useful to look at the average super balance per age for men and women of different generations. This provides a clearer picture of how far behind women really are.

Australian Taxation Office (ATO) figures show that average super balances in 2018-19 were $162,275 for men and $128,068 for women. That’s a 27% gap.

Plan for retirement and boost your super

So far, we’ve focused on the doom and the gloom—the uphill battle women face to fulfil the dream of sipping margaritas on a tropical beach (or whatever your retirement hopes may be!)

But, thankfully, all is not lost. Now’s the right time to close the superannuation gender gap and boost your super by following these steps:

1. Get intimate with your super

If you get to know your super now, it’ll be less like having a blind date when retirement finally arrives! The first step is to find your account details, log in and check your current balance. You can see how this compares to the average super balance per age of other women (and men) here.

Now check that your employer is making regular contributions – at least once a quarter – and that they’re contributing the right amount. Employer contributions should be at least 9.5% of your ‘ordinary time earnings,’ though some employers pay more.

During your working years, your super is invested on your behalf to earn more money. You can choose how it’s invested. Find out which investment option you’re in and check how it has performed over the past one, three and five years.

Super Ratings compares more than 100 funds every year and allows you to compare three-year earnings across a range of investment options.

While you’re at it, look at how much you’re paying in fees and for insurance cover. Both costs can eat into your balance. According to Super Ratings, the top 10 low-fee funds charged their members from $238 to $395 per annum based on a $50K balance.

If you’re concerned that your fees are too high or investment returns too low, speak to your super fund, accountant or financial planner about your options. It’s your right to change funds if you wish to.

2. Tuck and roll

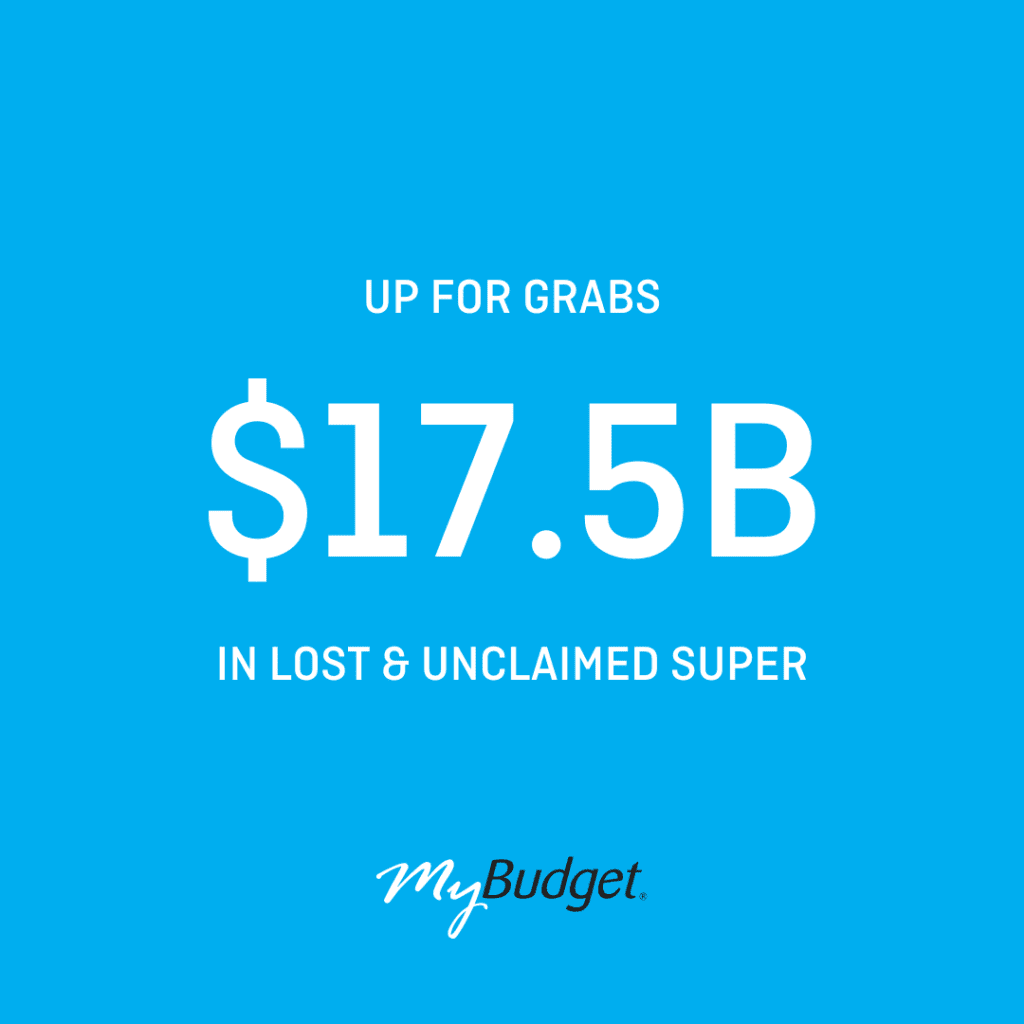

If you’ve ever changed jobs, you might have multiple super accounts. A quick way to boost your super is to consolidate your accounts into one. This will avoid paying duplicate account fees.

Rolling multiple super balances together is quick and easy and your super fund can help.

Finally, do a lost super search through the ATO. It’s possible you’ve got super from previous jobs you’ve forgotten about – bonus! Once you locate any lost super, roll it into your current fund and boost your super in an instant.

3. Embrace small changes to grow and boost your super

Now that you’re acquainted with your super, it’s time to make it grow. The most straightforward approach is to make voluntary contributions into your super account. By voluntary, we mean above and beyond what your employer is contributing. Because we’re women and superannuation works against us, contributing more works to level the playing field.

To work out if you can afford to make extra super payments, create a personal or household budget. If you don’t have a budget already, download MyBudget’s free budget template to get started.

If your budget shows that money is tight, don’t be discouraged. Even just adding an extra $10 a week to your super can make a difference to your retirement outlook. To see just how much, use the ‘Small Change Big Savings Calculator’.

4. Decide how you want to contribute to boost your super

There are a couple of different ways to make voluntary superannuation contributions. The first is called salary sacrifice. With salary sacrificing, you ask your employer to pay some of your before-tax salary into your super, usually on a regular basis, such as every pay.

For many people, salary sacrificing is a double bonus. It means you can boost your super while lowering your taxable income. But make sure you get advice from an accountant or tax professional to understand how it would work in your situation. If salary sacrificing is something you want to do, your payroll department can help you set it up.

If you’re not in a position to salary sacrifice, another option is to boost your super using your tax refund, work bonus or an inheritance. You can make a one-off, before-tax personal contribution to your super and then claim a tax deduction. This can also reduce your taxable income. Again, you should seek advice about your specific situation from an accountant or tax professional.

5. Get your spouse to chip in

They say ‘a man is not a financial plan,’ but super might be the exception. If you’re earning less than $40,000 a year or not working, your spouse can boost your super by contributing after-tax money into your super and receive a tax break for doing so. This is a particularly important way to combat the superannuation gender gap if you’re a primary carer and taking time away from work to look after children.

If you earn over $40,000 a year, your spouse can still make contributions to your super, but they won’t receive a tax break. See the ATO website for updated details on spouse contributions.

6. Boost your super with a little help from Canberra

At the time of research, if you earn less than $53,564 before-tax and put some after-tax money into your super, the government will make co-contributions up to a maximum of $500 per annum. The amount of your co-contribution entitlement will depend on your income and how much you put into your super.

You don’t need to apply for the super co-contribution. When you lodge your tax return, the ATO will work out if you’re eligible and pay it into your super account automatically.

7. Keep your eye on the horizon

Women and superannuation are top of mind at the moment. Super funds and consumer groups are reported to be lobbying the government to allow joint super funds for married couples. The idea behind this is to help overcome the superannuation gender gap.

Other proposed measures include removing the $450 per month minimum earning threshold for the employer super guarantee. It’s estimated that around 350,000 people earn no super because of this rule and that more than half are women.

Discover the worry-free way to manage your money and boost your super while you’re at it. If you’re worried about the superannuation gender gap affecting your finances, let’s chat.

Ready to find out more?

Call 1300 300 922 or get started today

About the writer

Michelle Bowes

Michelle Bowes is an experienced business journalist and personal finance writer based in Sydney. As a mum of three growing and very busy kids (and one growing and not so busy cat), she knows all about the daily juggle and understands the challenges Australian families face in managing their household budgets in the face of the ever-rising cost of living.