What is responsible lending?

What happens when a lender or other credit provider approves a loan that results in financial hardship for you? It may be a breach of responsible lending laws. So, what is responsible lending? Continue reading as our client advocacy team explains responsible lending laws and how we’ve saved clients more than $100,000 over the last six months.

MyBudget client and full-time student Claire (not her real name) applied for a credit card with a $3,500 limit through a major bank. Over the course of the next three years, her limit was increased on five occasions, eventually reaching $28,000.

By the time Claire contacted MyBudget, the card was in arrears beyond the $28,000 limit and she could not afford the minimum monthly repayments.

Download your free 6 Steps to Eliminate Credit Card Debt eBook.

After reviewing Claire’s budget, MyBudget’s client advocacy team identified a potential issue with her bank’s responsible lending rules. We contacted Claire to discuss our observations and raised the possibility of lodging a responsible lending dispute on her behalf.

We’ll learn more about Claire’s situation in a moment, but let’s first define what is responsible lending.

What is responsible lending?

Responsible lending laws are designed to protect consumers from loans and other credit contracts that don’t suit their situation.

The rule forms part of Chapter 3 of the ‘National Consumer Credit Protection Act 2009.’ It requires that lenders and other credit providers must not enter into a credit contract, suggest a credit contract or assist a consumer to apply for credit if it’s unsuitable for them.

This forms the basis for banks’ responsible lending rules. In layperson terms, it says that lenders and creditor providers can’t offer you credit they know you can’t afford.

How do responsible lending laws work?

Lenders are required to keep up with responsible lending changes and assess the suitability of their credit products for your situation. This means taking into account a variety of factors, including:

- How much your earn

- Your assets

- Existing debts

- Your living situation

- Your employment situation

- Fixed and variable expenses

- If any other people are financially dependent on you (eg. partner and kids)

- Potential changes to your financial situation

When it comes to assessing all of the above, lenders can’t just take your word for it. They are obliged to verify your income and other details.

When you apply for a loan, that’s why the lender requests copies of your most recent payslips and other documents. They may also use your bank and credit card statements to verify your expenses and any liabilities, such as Afterpay or rent-to-buy accounts.

While this can feel intrusive, it’s the lender’s way of assessing whether the loan or credit product they provide is likely to cause you financial hardship now or, to the best of their assessment, in the future.

What is a responsible lending breach?

Responsible lending breaches can play out in different ways. You could, for example, have difficulty making your repayments from the beginning. You might have already been in financial hardship when you got the loan or you were lent more money than you could reasonably repay.

Alternatively, your loan could change and become unsuitable over time. This is what happened to our client Claire.

Over the space of three years, her bank offered her consecutive credit card limit increases that ballooned her limit from $3,500 to $28,000. During the same period, Claire’s income changed very little. So if you search on Google for ‘What is responsible lending’, that definitely isn’t it!

What is a responsible lending dispute?

Under responsible lending laws and rules, consumers have a right to dispute the creditor’s lending decision or to request information about how the lender assessed their credit application. If unsatisfied with the lender’s response, the consumer can also escalate the dispute to the Australian Financial Complaints Authority (AFCA).

In Claire’s case, we first gathered details about her financial history with the creditor. Secondly, we requested information from the creditor. Then, based on our investigations, we determined that the creditor had not acted responsibly. This meant her banks’ responsible lending criteria wasn’t being met.

We drafted and lodged a responsible lending dispute on Claire’s behalf. In our dispute, we requested that Claire be refunded all interest, fees and charges previously incurred and that all future interest, fees and charges be waived.

How was the responsible lending dispute resolved for Claire?

After negotiations to resolve the dispute with Claire’s creditor were unsuccessful, our client advocacy team escalated the dispute to AFCA.

After months of back-and-forth and several unsatisfactory offers from the creditor, we were finally able to achieve the outcome Claire was seeking.

The creditor agreed to a goodwill payment of $8,400 towards Claire’s credit card balance. They also agreed to waive all future interest, fees and charges, and allowed Claire to repay her outstanding balance at a more affordable rate.

Claire was extremely happy with the outcome. When combined with Claire’s budgeting strategy, it means she will pay off the credit card two years sooner than she originally budgeted for.

There are other causes of financial hardship

It is important to acknowledge that the majority of creditors do lend responsibly. Financial hardship is more often caused by factors outside of the lender’s control. The borrower, for instance, may experience a sudden job loss or illness that stops them from working.

The coronavirus pandemic and the massive job losses it triggered is an extreme example of how a borrower’s situation can suddenly change. In response, banks and other creditors introduced a raft of financial assistance measures.

As with the responsible lending rules, financial hardship provisions also fall under the National Consumer Credit Protection Act. Lenders and creditors are obliged to assess and understand financial hardship grounds and their impact on borrowers, and to offer appropriate contract changes.

Responsible lending is only part of the picture

MyBudget is foremostly renowned for designing customised budget solutions that help people affordably repay their debts and save faster.

To achieve these outcomes, our clients’ success is founded on an automated system that provides detailed day-to-day and long-range visibility, plus the caring support of our money coaches.

All of this rolls up to a system that gives every dollar a job and keeps budgets on track.

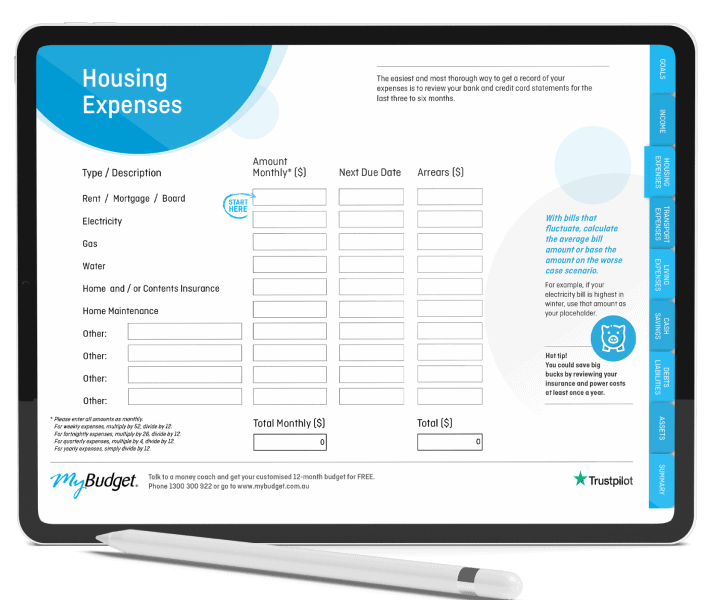

Download your free Budget Template and Workbook.

Our advocacy team has saved clients $100,000 in the last six months alone

In the background, we also have our client advocacy team who specialise in understanding and applying responsible lending laws and rules. When we see that a client is experiencing financial hardship as a result of a responsible lending breach, our client advocacy team steps in to help.

The process can involve:

- Requesting information from both you and the creditor(s)

- Lodging a responsible lending dispute on your behalf, if appropriate

- Escalating the dispute to AFCA, if required

- Managing the dispute from start to finish

Over the last six months alone, MyBudget has directly advocated for 10 clients and achieved total savings of over $100,000.

If you’d like to know more about responsible lending laws or want us to review your situation, contact MyBudget today on 1300 300 922 or enquire online to find out more. Your consultation is free, there’s no obligation to proceed and we’ll create a customised budget plan that’s yours to keep.

Ready to find out more?

Call 1300 300 922 or get started today