How much does it cost to start up a business in Australia?

Starting a business can be an exciting and rewarding experience, but it can also be costly. Many people dream of becoming their own boss, but they may not know what is involved and how to start up a business in Australia.

The cost of starting a business in Australia can vary greatly depending on the type of business you want to start, where you want to start it, and the resources you have available. It is important to have a clear understanding of these costs before you start your business so you can plan accordingly and avoid any surprises along the way.

In this article, we will explore the different costs associated with starting a business in Australia, and also provide some ways on how to keep your average costs down while still launching a successful business.

Determine the business you want to start

Before you can answer whether you can afford the start-up costs for a business, you first need a clear idea of your vision for your business. What product or service do you want to offer? Some start-ups cost more to set up than others and can range from side hustles to businesses where you need to consider hiring staff.

Business start-up costs vary wildly depending on the industry and nature of your business: obviously, a bricks and mortar shop selling a range of products will have significantly different start-up costs than an online store drop-shipping t-shirts. Nowadays, anyone can start a business with nothing but a laptop and an internet connection, so the business type you’re looking to start can dictate your costs immensely.

Something else to consider is what do you want to achieve financially in the short term and long term? It’s important to be realistic here, especially in the short term. Creating a business plan will help you be strategic and differentiate between your essential and optional business start-up costs.

How much does it cost to start a business?

If you’re hoping to build a side hustle plan to keep your day job, it’s possible to start a small business with minimal start-up costs – it’s all about priorities, keeping your end-goal in mind, and building the foundations for a financially viable small business.

Of course, if you’re going into business with other people, it’s important that everyone’s transparent about their financial situation and goals and that there’s an agreement in place about who’s responsible for what when it comes to business start-up costs.

Here are some starter questions to help you work out if you can afford the common startup costs for a business:

How much money do you need to maintain your lifestyle and personal financial obligations?

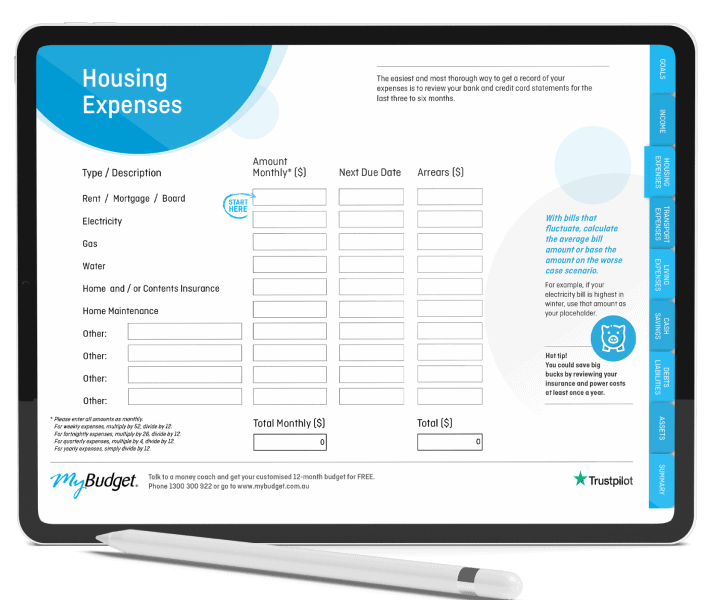

Make sure you’ve created a comprehensive personal budget, don’t just guess this one! We’ve created a comprehensive personal budget template if you need help getting started.

What is your current financial situation?

Are you already in debt, or do you have significant assets (cash or shares) that could be leveraged to start your business? Is your credit report healthy enough that a lender would consider you for a business loan? Some small businesses can be started without a loan, credit card or outside investments of course, but depending on the industry, it may be an unavoidable undertaking. But if you can avoid the extra expense in the form of loan repayments, all the better!

Do you have enough money saved for your personal expenses AND an emergency fund?

If your business is one you’d be starting in lieu of other employment, you want savings to cover your personal expenses (or your share of them) for at least six months, and ideally for a year. Bear in mind that it can take a while for a new small business to get off the ground and become profitable, so you can’t rely on making a regular salary straight away. It’s always a good idea to have a separate emergency fund put aside for unexpected events (vet bills/flooded house/medical expenses, etc).

Are you ready to go full-time in your business?

If you don’t have that money saved yet, a budget will give you a benchmark monthly savings goal to aim for. We’ve got lots of tips for how you can boost your savings on our blog. Or, one of our personal budgeting experts can help you customise a budget to save for your entrepreneurial goals.

Another factor to consider before going full-time with your business is whether you have a solid business plan in place. It’s important to have a clear understanding of your business model and how you plan to make a profit (perhaps not right away, but in the long-run). You may also want to seek advice from professional services, such as a business mentor or consultant to ensure your plan is comprehensive and realistic.

Initial costs to consider

Businesses don’t just pop up overnight. They take months (if not years) of planning depending on the scope of the business, and there are some initial costs to consider to ensure you’re starting off on the right track.

Business registration and licensing fees

One of the first costs to consider is the business registration and licensing fees. The average cost of registration varies depending on the type of business structure you choose (such as sole trader, partnership, or company) and the state or territory in which you’re registering. The Australian government’s Business Registration Service allows you to follow the steps to apply for an ABN and register your business, and these costs can differ greatly depending on the type of business you are willing to register for. In addition to registration fees, there may be ongoing licensing fees for certain industries or professions. It’s important to research and budget for these costs before starting your business.

There are also the additional business registration expenses that you may not initially think about, such as trademarks/patents, domain names/email hosting, membership fees, franchise fees (or even the business purchase price!).

Equipment and supplies

Another cost to consider when starting a business is equipment and supplies. Depending on your industry, you may need to purchase equipment such as computers, tools, or machinery. You may also need to budget for office supplies, such as paper, pens, and printer ink. It’s important to shop around and compare prices to ensure you’re getting the best deal, and buy in bulk where possible. Don’t forget to also factor in the cost of maintenance and repairs for any equipment you purchase.

Office or retail space rental costs

Office or retail space rental costs can also be a significant ongoing expense for new businesses. The cost of rent will vary depending on the location, size, and type of space you need. It’s important to consider the accessibility of the location and whether it’s convenient for customers and employees. You may also need to factor in additional costs such as utility costs, internet, and insurance. Consider negotiating with landlords for a lower rent or exploring shared office spaces to save money. It’s important to budget for rent and factor it into your overall business plan to ensure profitability.

Many businesses start off small, some to the point where you’d be working from home until you can justify the expense. It’s important to weigh up whether certain monthly costs are necessary depending on where your business is in its lifecycle, as well as doing your research to keep costs low, but we’ll get to that.

Depending on the sort of business you’re starting, you may also need insurance for building and contents, vehicle, workers compensation, business assets, and importantly, public, professional and product liability.

Marketing and advertising expenses

When it comes to marketing and advertising expenses, it’s important to have a budget in place. This can include costs for social media advertising, Google AdWords, print advertisements, and more. It’s recommended to start small, especially when you’re just starting out and money is scarce, and test different marketing strategies to see what works best for your business.

You can also consider using free marketing tools such as social media platforms and email marketing to keep costs low and get your online presence under way. It’s important to track your expenses and adjust your budget accordingly to ensure you’re getting the best return on investment.

Employee wages and benefits

When it comes to hiring employees, it’s important to factor in the cost of wages and benefits. In addition to a fair wage, you’ll also need to consider additional costs such as superannuation contributions, workers’ compensation insurance, and any other benefits you may offer such as paid time off or health insurance. It’s important to budget for these expenses and ensure that you can afford to hire and maintain staff.

Depending on the scope of your business, whether you need to hire employees would differ greatly. But hiring staff is not a decision to be taken lightly as your employees rely on the income in order to fund their own lives, so having a long-term hiring strategy is crucial to the scope and growth of your business’ success. Contracting freelancers or contractors can help to minimise the risk, especially in the early days of your business lifecycle.

Legal and accounting fees

When it comes to legal and accounting fees, it’s important to budget for the ongoing costs of compliance and advice. This includes registering your business, obtaining necessary licences, and paying for ongoing legal and accounting advice on bookkeeping and tax deductions. You’ll also need this for drawing up contracts when you liaise and work with clients so that you’re operating fairly in the eyes of the law.

It’s also recommended that you work with a qualified accountant and lawyer to ensure that your business is set up correctly and remains compliant with all relevant laws and regulations. These are variable costs as they tend to vary depending on the type of business you have and the level of support you require.

Taxes and insurance

When it comes to taxes, there are several types that businesses in Australia may be subject to. These include income tax, goods and services tax (GST), and payroll tax. It’s important to understand your tax obligations and ensure that you are paying the correct amount.

If this is your first foray into being self-employed, remember you’ll need to pay your own superannuation, and put money aside for tax and potentially register for GST. Don’t make the mistake of thinking that all money coming into your business is profit for you to spend.

Additionally, businesses may also need to consider insurance, such as public liability insurance or worker’s compensation insurance, which can vary in cost depending on the industry and size of the business. It’s important to factor in these costs when budgeting for your business start-up.

Additional costs to keep in mind

While you might not be able to do a full cash flow projection for your business, you can anticipate the additional ongoing expenses you’ll have in your first year.

Consider the rent, internet, phone, utility costs and tech costs you’ll have (including accounting and other software subscriptions), as well as ongoing variable expenses for fresh stock/raw materials. Your operating costs aren’t going to go away just because you haven’t built up a steady flow of customers yet, particularly if you need to have perishable or seasonal stock. (Do your research on what the cost of your utilities may be rather than making a guess, as business electricity tends to be more expensive than residential.)

Unexpected expenses

Not everything in life goes according to plan, and starting and building a business is a complicated endeavour. Unexpected expenses are likely to pop up, especially in the world of business. Keeping some wriggle room in your business budget could help to mitigate these risks and setting up and maintaining an emergency fund to have for ad hoc one-time expenses could save many headaches in the future.

Tips for reducing start-up costs

If the reality of the start-up costs for a business have surprised you, don’t worry, we have good news too! There are so many ways you can minimise your business startup costs. Here’s our top tips:

Start small

Can you start your business as a small side hustle and keep your day job (or go part-time) while you test the viability and interest in your business offering? If you’re starting an online business shop, how about starting a small range of products that will minimise your production costs. Slowly but surely reducing your day job hours as your business profit increases will ensure that you’ll never go hungry on your journey. Just remember that the tortoise beat the hare by going slow and steady all those years ago.

Choose your location carefully

Rather than taking out a lease on an office, could you work from home or in a co-working space? Not only is this cheaper than renting (plus membership often includes internet and basic office furniture, which will significantly cut down your operating costs), you won’t have to commit to anything long-term.

If you’re planning to open a bricks & mortar business, be smart about the location. It may be appealing to be in the heart of the city, but consider whether you can find your customers elsewhere, such as in an up-and-coming suburb. Rent will probably be cheaper, and your business can (hopefully) grow as the neighbourhood does!

Many shopping centres and even councils offer pop-up shop options for a cheaper way to test your business idea and see how it resonates with your target audience before you commit to a lease.

Look for business grants

Did you know that councils, state and even the federal government offer grants for new businesses? Do your research and reach out to your local business associations for advice, as you may be eligible for assistance. A good place to start is this business grants and programs finder.

Be ruthless about what’s essential

Yes, it’s very tempting to want all the bells and whistles for your new business. Branding and customer experience is very important, but things like fancy office supplies and a designer desk, not so much. Yes, certain business expenses might be tax deductible, but if you’re spending unnecessarily, that’s probably not a smart business move.

Importantly, make sure you keep track of all your expenses and stay on top of your accounting from the very beginning. You won’t be able to make claims if you didn’t keep your receipts, and those costs can quickly add up. If you’re not confident with the financial side of running a business, make sure you find yourself a good bookkeeper and accountant.

Doing things yourself

From your shop fitout to your marketing cost, there’s a lot of ways to keep your expenses low with some DIY. Canva is a great tool for creating professional marketing assets with templates for everything from social media to business cards to newsletters/brochures. Social media is a low-cost way to start building an audience for your business. Get yourself a cheap ring light and start sharing valuable content (and your enthusiasm!) with the world. If your new premises is a bit tired, head down to Bunnings and pick up some paint and recruit some friends to help you out rather than paying a professional – if your landlord allows it.

Starting a business is possible, even on a tight budget

If you want to start a business, start saving for it. Our expert team can help you understand your personal finances and even create a customised personal budget template for you, so that you can afford the start-up costs of a business sooner. While we can’t budget for business expenses, we can assist in helping you save for your dream business and keeping your personal finances in check, so contact us today to take the first step towards making your entrepreneurial dreams a reality.

We hope you’re feeling more confident about how to start a small business in Australia and all the business startup expenses involved. For more helpful advice like this, subscribe to our newsletter for budgeting tips, career advice and everything you need to know about healthy money management habits.

Ready to find out more?

Call 1300 300 922 or get started today