How to save money on household bills

Are you tired of paying too much for your household bills? Do you feel like you’re constantly struggling to keep up with all of your monthly expenses? Well, you’re not alone. Many people struggle to keep up with the rising costs of living, but there are ways to save money on your bills.

By making a few simple changes, you can save hundreds of dollars a year on your household bills. From your electricity bill to your water bill, there are plenty of ways to cut costs without sacrificing comfort or convenience. In this article, we’ll share some ideas to help you save money on your household bills.

How to save money on your electric bill

One of the biggest contributors to high household bills is your electricity costs. To save money on electricity, start by making small changes to your daily habits. Turn off lights and unplug electronics when they’re not in use; use energy-efficient settings on your washing machine and dishwasher; and switch to energy-efficient light bulbs.

There’s also no harm in shopping around for a better price. There are plenty of electricity companies out there, and the chances are that one of them may be able to offer a better deal depending on your situation.

How to save money on your gas bill

A way to save money on your gas bill is to properly insulate your home. Check for any drafts or leaks around windows and doors and seal them up with weather stripping or caulking. You can also add insulation to your attic and walls to keep the heat in during the winter and out during the summer.

Additionally, you can save money on your energy bill by performing consistent maintenance checks on your heating system. Regularly changing air filters and scheduling yearly maintenance checks can ensure that your system is running efficiently and not wasting energy. You can also consider cutting down on your utility bills by upgrading to a more energy-efficient system. This would, of course, be likely to require a high upfront cost; but hey, sometimes you’ve got to spend money to make money.

How to save money on groceries

One of the most consistent ways we’ve found to save money on grocery bills is to do your grocery shopping online. Shopping online allows you to easily compare prices and take advantage of deals and discounts. You can also create a shopping list and stick to it, avoiding impulse buys and unnecessary items.

You can also either pay a small fee for delivery (sometimes free if your bill is high enough) or you can choose pickup, skip the queue and get all your groceries at your nearest store.

There are plenty of benefits of online grocery shopping. 16, in fact.

How to save money on your mortgage

Mortgage payments have been on every home owner’s mind lately, especially with all of the interest rate rises and the mortgage cliff with many mortgages’ fixed rate periods coming to an end. This means that now may well be the best time to look at refinancing your mortgage.

Refinancing your mortgage means taking out a new loan to pay off your existing mortgage. This can result in a lower interest rate, which can save you hundreds of dollars, if not thousands of dollars, in monthly repayments over the life of your loan. Our in-house MyBudget Loans team has saved our clients an average of around $7,000 per year by refinancing their mortgages through our trusted third-party lenders.

And if you’re looking to save further over the long run, consider making extra monthly payments where possible. For example, using our home loan repayment calculator, if you were to consistently pay an additional $100 per month on a $400,000 mortgage at 5.09% p.a. over 30 years, you would save a total of $42,729 on interest, as well as cutting two years and 10 months worth of mortgage repayments off the life of your loan.

How to save money on your phone bill

One of the biggest household bills that many people face is their phone bill. Fortunately, these monthly payments can also be cut down with enough planning. One option is to consider a family plan, which allows multiple people to share a single plan and split the cost.

Another option is to bundle your phone plan with other services, such as internet or streaming services, which may result in a discounted rate. Additionally, some providers offer special deals or promotions for new customers, so it can be worth shopping around and comparing different options. By taking these steps, you can potentially save money on your monthly bills.

How to save money on your insurances

You may also be able to save money by looking into your insurance policies. It may be time to shop around and consider your needs to ensure you’re not paying for anything unnecessary.

Comparison websites can be a great tool to help you find the best deals for home, content, and health insurance. By doing your research, you may be able to find better rates or discounts that can help you save money in the long run.

Another way to reduce your home insurance premium could be to increase the excess, which is the fixed amount you pay towards a claim. And if you have a lot of emergency savings to fall back on, you could also reduce the insurable amount of your contents. Just make sure you have enough savings in your emergency fund to cover any potential losses.

And lastly, some insurers offer discounts if you pay annually instead of monthly repayments. While a lump sum may be hard for your budget to swallow, if you are in a position to do so, it may save you some money down the line.

How to save money on other household bills

Sometimes saving money on household expenses simply takes a review of your budget and bank statements in order to identify any areas where you can cut back. One way to do this is by removing any unnecessary expenses or services that you no longer require, such as unused streaming services. Another way is to cut down on any unnecessary discretionary spending, such as your day-to-day spending and look for cheaper prices on items when shopping around.

How often should you compare your bills?

The answer to this question varies depending on the type of bill. For example, you may only need to compare your car insurance once a year, but you may want to check your energy bills much more regularly to ensure you’re getting the best deal in relation to your energy usage.

Why comparing bills is important for your finances

Comparing bills between your current retailer and others within the energy market, is important for your finances because it allows you to identify any expenses you may be spending way more than you need to. It can also help to weed out any unnecessary expenses, which is why reviewing your budget is a healthy habit to develop.

You may find that your utility bills (e.g. electricity rates or gas supply) have increased significantly. By regularly comparing your bills, you can catch these issues early and take action to resolve them. Additionally, doing this can help you find better deals and save money in the long run. It’s recommended to compare your bills at least once every three months to stay on top of your expenses.

What to consider when comparing bills

Comparing bills is an important financial habit that can help you save money. However, it’s not just about comparing prices and settling on the lowest number. There are several factors you may need to consider when comparing bills to ensure you’re getting the best deal for your money.

Price

The first factor to consider is quite obvious, and that’s price. With energy bill prices rising rapidly and putting a great strain on Australians’ budgets, ensuring that you’re able to save money where possible can make a world of difference.

There are also other factors here, especially with the price of electricity. To save on your electric bills, be sure to check things like the energy ratings via the star ratings to ensure they’re energy efficient when buying new appliances. The higher the star rating, the better, so getting an energy efficient air conditioner or clothes washer with a high star rating can certainly help in those sweltering summer months. I certainly can’t handle the summer without good air conditioning!

Energy-efficient appliances allow you to reduce your electricity costs on your electricity plans, so whether you switch energy retailers or not for a cheaper plan, you’ll still be saving in the long run from time to time with a higher star rating on clothes washers. Saving a cents per day adds up to dollars per week, and then dozens of dollars per month, etc.

Billing cycle

When comparing your bills, perhaps the next thing you may want to consider is the billing cycle. For example, you may be paying for your car insurance monthly and then you find a better deal; however, it requires you to pay annually.

While you may be able to save money in the long run, you don’t want to create a shortfall in the budget’s short-term, which may result in other late payments on other month-to-month expenses and credit card debt that could have you paying fees or even affecting your credit score.

Service quality

Of course, you want to ensure that you’re getting the best bang for your buck, but you also don’t want to sacrifice too much of the bang just to save a couple bucks. Cheaper energy plans may not be better, but on the other hand, a premium price may not equal a premium service. Be sure to compare prices by getting quotes on electricity costs, but also check reviews so that you’re getting a good value for your money.

You certainly don’t want to compromise internet quality; you’ll need that to be able to read all of our wonderful articles.

Hidden costs and fees

Before you sign any contract to switch your services to a new energy provider, make sure you check for all possible hidden costs, exit fees and service charges. If a price or sentence has an asterisk next to it, that means there’s more to it and may be in fine writing on the bottom somewhere. Be clever, do the maths, and if a deal sounds too good to be true, you may want to trust your instinct.

No bill is exempt from being reviewed

We’ve only spoken about your mid-range bills so far, but what about some of your larger expenses? For example, mortgage or rent, electricity bills, gas bills, hot water systems, internet, phone and insurance.

The average new mortgage as of January 2023 was $624,000 according to the Australian Bureau of Statistics (ABS). And with the rising interest rates introduced by the Reserve Bank of Australia (RBA), the average variable rate is 6.84% p.a. Using our home loan repayment calculator, you’d be accruing a total of $846,475 in interest repayments over the length of a 30 year loan.

By reducing your mortgage interest rate by just 0.5% per year on such a loan, the monthly payment goes down by $206. The savings over 30 years add up to a whopping $74,152. That’s a wonderfully positive impact on your financial situation!

Did you know that MyBudget Loans has saved over 100 of our clients over $500,000 on their mortgages by negotiating lower interest rates and repayments in the last two years?

How to streamline your bill comparison process

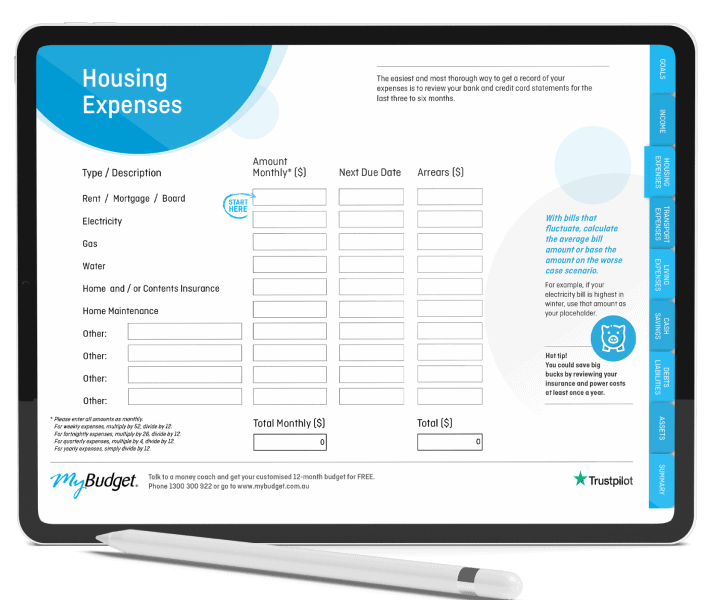

Review your budget

By having a budget that spans a 12-month period, you’ll receive some much needed clarity about where you are financially. With this mapped out, you’ll be able to have full visibility over where your money is going and, more importantly, areas where you may be able to save.

Keep your receipts

Gone are the days where we had a dedicated drawer full of paper paid bills and receipts. Tracking your transactions is easier than ever now that everything is digital, so be sure to keep track of all of your payments so that you can notice any anomalies in future bills.

Don’t fall victim to ‘loyalty tax’

House and contents insurance is one expense in particular where annual comparison shopping can result in big savings. You may even be able to save money while staying with the same insurer. It may also come down to convenience, especially when your billing periods are routinely deducted via direct debit, it becomes a case of out of sight, out of mind.

Insurers are nice people but notorious for bill creep or “loyalty tax.” That’s where annual price increases result in existing customers paying more than new customers for the same service. It often happens with insurance, phone, internet, your current energy plan, and other bills that renew annually.

Look for other money saving opportunities

If you are careful with your money, you are very likely mindful of your daily spending habits. You might, for example, keep your food costs down by meal planning or setting yourself a budget for clothes shopping. When you bundle those habits together, you can save literally thousands of dollars a year.

Bringing your lunch to work can save upwards of $2500 annually. Making your daily espresso at home could put $1500 back in your wallet. And cutting your grocery bill by just $20 a week could mean an extra $1000 for a holiday at the end of the year.

Use our checklist

Much like a writer, perhaps the most daunting part of the process is the blank page. Where do I start? How do I organise all of the different prices and quotes from every energy provider I contact? Well, you can rest easy by downloading our handy get a better deal checklist.

It’s a simple but effective way to make sure you’re comparing the key household energy bills that have the biggest impact on your hip pocket.

How can MyBudget help me with my household bills?

The best way to start saving money is to know where your money is going. MyBudget has helped over 130,000 Australians live their lives free from money worries, all with the power of budgeting. We break all of your expenses down into an easy and automated plan, and the clarity provides a great way to see where you can save money. We’ve helped Australians pay off credit card debt, improve their spending habits and reach their financial goals with effective savings plans.

To learn more, give us a call on 1300 300 922 or enquire online today.

Ready to find out more?

Call 1300 300 922 or get started today