I’ve lost my job, what do I do now?

It’s a question we hope you never need to ask, but it’s more common than you’d expect: “I’ve lost my job… what do I do now?!”. If you’re struggling to know what to do when you’re made redundant, you’ve come to the right place.

How to survive losing your job

The first thought you might have when you’re in this situation is usually along the lines of “I’ve lost my job, but I need money to pay bills”. So what should you do?

1. Explore your options

On the one hand, it’s never good to be out of work. On the other hand, Australia’s welfare benefit net is strong and there are multiple forms of financial assistance on offer.

Plus, any energy spent panicking how to survive after losing your job will be better channelled into planning. Even though you may not be able to anticipate every unknown, making a financial plan will help you prepare for most eventualities. More on that in steps 3 and 4.

2. Contact Centrelink to find out your government benefit entitlements

Centrelink can be time-consuming and initially mind-boggling in its complexity, but the effort is worth it. Fortunately, most of it can be done from home via the MyGov web portal.

This article provides a step-by-step guide to applying for Centrelink benefits.

Be prepared to put aside a chunk of time to work through the process. So, take some deep breaths, make a coffee and settle in. Once you’ve gathered and submitted all the appropriate documents, you can then make a claim.

After submitting your claim, you wait (given the current circumstances, we’re unable to estimate how long). Centrelink will let you know if your claim has been approved, what your payment amount will be, your fortnightly payment dates, any backdated payments, and other details.

3. Work out your essential living expenses

Once you’ve gone through the initial shock of “I’ve lost my job, what do I do”, you need to start getting practical.

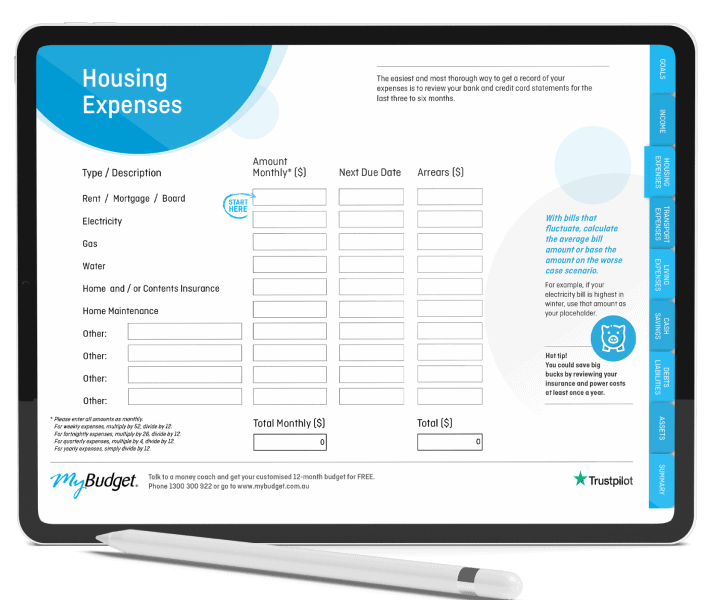

Print off or pull up your last three or four months of credit card and bank statements – six months is even better. On the first pass, highlight and add up all of your fortnightly essential living expenses, plus your cost of housing and keeping your car on the road. This is integral when planning how to survive losing your job.

In other words:

- Groceries

- Petrol or other transport

- Medicines and medical visits

- Power and utilities

- Rent or mortgage

- Insurance premiums

- Registration

- Any other essential expenses in your budget (e.g. pet medications or vital equipment hire.)

In budgeting-speak, these are your required expenses – the amount of money you need to live and keep a roof over your head and a car on the road.

Is money going to be tight? Does it leave no room for, say, car or home repairs or buying extra groceries?

4. Work out your non-essential expenses

If you’re concerned about how to survive after losing your job, cutting down on non-essential spending is crucial. On the second pass of your credit card and bank statements, highlight and add up how much you’re spending every fortnight on everything else. To get a fortnightly figure (in keeping with Centrelink payments), you’ll need to average the total.

In budgeting-speak, these are your discretionary expenses – the amount of money you spend on things you don’t really need. This is your opportunity to reduce your costs by cutting non-essential expenses out of your budget. Remember, it’s not forever—just while you get back on your feet.

It might be helpful to organise your required expenses into two lists:

- Things you don’t need and are happy to live without

- Things you don’t need and you’d really like to keep. For instance, nobody needs Disney+, but it sure comes in handy for keeping kids entertained!

Need help creating a budget and planning your expenses? Download our free budget template here.

5. Talk to your lenders and creditors

Now that you’ve created a budget, you’ll have a clearer picture of your bills and spending habits. If you think you’re going to have trouble meeting your regular financial obligations, such as rent, mortgage or bills, now is the time to act early.

At MyBudget, we talk to our clients’ creditors for them and to get payment arrangements in place so they don’t pay late fees or incur unnecessary interest charges.

Likewise, you can do the same – contact your lenders and creditors sooner rather than later to explain your situation. Speak to them honestly and tell them you’ve lost your job and need money to pay bills. Most creditors want to help, especially if you have a good payment history and you stick to your payment plans.

6. Prioritise your bills

Not all bills are equal and, when money is tight, your expenses need to be prioritised accordingly. Your top priority should be to have money in your pocket for essential living expenses. Rent or mortgage repayments, plus keeping the lights on, need to be included in your essential living expenses.

If you’re a tenant, where possible, we recommend trying to maintain a positive relationship with your landlord. Keep them updated about your situation and use your budget to work out what sort of payments will be affordable.

(You can see now why the budget you created in steps 3 and 4 is key for knowing how to survive losing your job.)

7. Talk to your bank or lender

If you’re reading this article as a mortgage holder who still has their job, it’s definitely worth getting a home loan health check. With the official interest rate so low, one of the ways we’ve freed up cash for a number of MyBudget clients is by helping them to refinance their mortgages or consolidate debts.

Our MyBudget Loans team has been saving clients around $400 a month compared with their previous repayments.

8. Get free help

That’s why helping people to navigate through their transition from one job to another is one of the most important services we can offer at MyBudget.

You don’t have to be a MyBudget client to benefit. We’re also providing free phone consultations for everyone. You’re under no pressure to join and the budget plan we create for you is yours to keep.

These aren’t the sort of tips and advice you’d find if you just searched “What to do when you’re made redundant”; this is important and personalised guidance.

If you wish, we can manage your budget for you – in which case, we’ll do all the legwork – or you’re welcome to take your budget and manage it yourself. It’s all about having a deep, detailed understanding of your financial position and feeling prepared for whatever comes your way.

9. Lastly, what NOT to do

Avoid keeping up your usual spending habits if it means paying for your lifestyle on credit cards. Likewise, don’t eat up your savings too quickly. It’s better to reduce your spending to live within your means.

Avoid ‘Buy now pay later’ schemes, like Afterpay, and other commitments that may become unaffordable if you lose your job or income. Don’t put your head in the sand. Talk to your creditors sooner rather than later if paying your bills is going to be difficult.

Don’t be afraid to ask for help. enquire about what you’re eligible for after redundancy, reach out to Centrelink, book a free budget appointment with MyBudget or whatever else is going to help. And to repeat step 1: Don’t panic – for every financial problem there’s a solution, including learning how to survive losing your job.

We’ll get through this together!

Hopefully after reading this article, instead of thinking “I’ve lost my job, what do I do now?”, you feel empowered but also realistic about your next steps. For more pragmatic money management tips like this, subscribe to the MyBudget Blog and follow us on Facebook.

Or why not start today? To book your free phone appointment contact MyBudget on 1300 300 922 or enquire online. The customised budget we design for you is yours to keep.

Ready to find out more?

Call 1300 300 922 or get started today